FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

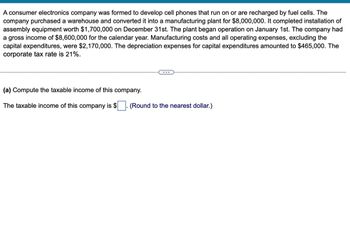

Transcribed Image Text:A consumer electronics company was formed to develop cell phones that run on or are recharged by fuel cells. The

company purchased a warehouse and converted it into a manufacturing plant for $8,000,000. It completed installation of

assembly equipment worth $1,700,000 on December 31st. The plant began operation on January 1st. The company had

a gross income of $8,600,000 for the calendar year. Manufacturing costs and all operating expenses, excluding the

capital expenditures, were $2,170,000. The depreciation expenses for capital expenditures amounted to $465,000. The

corporate tax rate is 21%.

(a) Compute the taxable income of this company.

The taxable income of this company is $

(Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The controller for Nina Group reviewed the following large transactions this month for the company: ● Purchase of a forklift to use in the warehouse: $32,000 (8-year life, depreciated on a straight-line basis, recorded monthly). ● Purchase of materials for use in the production of wheelbarrows (the company’s primary product): $114,000 (all was used in production this month, and all units produced were sold). ● Recognized payroll costs for this month’s production, office, and administrative employees: $45,000 (one-third for each category). ● Investment in mutual funds (with excess cash): $65,000. What dollar amount from these transactions would be recorded as an expense this month? What dollar amount would still be listed as an asset at the end of the month?arrow_forwardLavoie Corporation acquired new equipment at a cost of $100,000 plus 7% provincial sales tax and 5% GST. (GST is a recoverable tax.) The company paid $1,700 to transport the equipment to its plant. The site where the equipment was to be placed was not yet ready and Lavoie Corporation spent another $500 for one month's storage costs. When installed, $300 in labour and $200 in materials were used to adjust and calibrate the machine to the company's exact specifications. The units produced in the trial runs were subsequently sold to employees for $400. During the first two months of production, the equipment was used at only 50% of its capacity. Labour costs of $3,000 and material costs of $2,000 were incurred in this production, while the units sold generated $5,500 of sales. Lavoie paid an engineering consulting firm $11,000 for its services in recommending the specific equipment to purchase and for help during the calibration phase. Borrowing costs of $800 were incurred because of the…arrow_forwardMorris Associates bought a machine for $82,000 cash. The estimated useful life was five years and the estimated residual value was $7,000. Assume that the estimated useful life in productive units is 171,000. Units actually produced were 45,600 in year 1 and 51,300 in year 2. Required: 1. Determine the appropriate amounts to complete the following schedule.arrow_forward

- Three different companies each purchased trucks on January 1, Year 1, for $74,000. Each truck was expected to last four years or 250,000 miles. Salvage value was estimated to be $6,000. All three trucks were driven 78,000 miles in Year 1, 55,000 miles in Year 2, 50,000 miles in Year 3, and 70,000 miles in Year 4. Each of the three companies earned $69,000 of cash revenue during each of the four years. Company A uses straight-line depreciation, company B uses double- declining-balance depreciation, and company C uses units-of- production depreciation. Answer each of the following questions. Ignore the effects of income taxes. Required a-1. Calculate the net income for Year 1. a-2. Which company will report the highest amount of net income for Year 1? b-1. Calculate the net income for Year 4. b-2. Which company will report the lowest amount of net income for Year 4? c-1. Calculate the book value on the December 31, Year 3, balance sheet. c-2. Which company will report the highest book…arrow_forwardNash Co, recently installed some new computer equipment. To prepare for the installation, Nash had some electrical work done in what was to become the server room, costing $20,600. The invoice price of the server equipment was $200,000. Three printers were also purchased at a cost of $1,900 each. The software for the system was an additional $46,200. The server equipment was believed to have a useful life of eight years, but due to the heavy anticipated usage, the printers were expected to have only a four-year useful life. The software to run the system was estimated to require a complete upgrade in five years to avoid obsolescence. Additionally, it cost $12.600 for delivery. All of the above costs were subject to a 6% non-refundable provincial sales tax. During the installation, a training course was conducted for the staff that would be using the new equipment, at a cost of $9,550. Assume that Nash follows IFRS, and that any allocation of common costs is done to the nearest 1%…arrow_forwardUniversity Car Wash purchased new soap dispensing equipment that cost $234,000 including installation. The company estimates that the equipment will have a residual value of $27,000. University Car Wash also estimates it will use the machine for six years or about 12,000 total hours. Actual use per year was as follows: Year Hours Used 1 2,800 2 1,900 3 2,000 4 2,000 5 1,800 6 1,500 3. Prepare a depreciation schedule for six years using the activity-based method. (Round your "Depreciation Rate" to 2 decimal places and use this amount in all subsequent calculations.)arrow_forward

- (2). A machine costing $207,800 with a four-year life and an estimated $17,000 salvage value is installed in Luther Company’s factory on January 1. The factory manager estimates the machine will produce 477,000 units of product during its life. It actually produces the following units: 122,900 in Year 1, 122,900 in Year 2, 121,100 in Year 3, 120,100 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate—this difference was not predicted. Note: The machine cannot be depreciated below its estimated salvage value. Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. Note: Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar.arrow_forwardA machine costing $211,400 with a four-year life and an estimated $19,000 salvage value is installed in Luther Company's factory on January 1. The factory manager estimates the machine will produce 481,000 units of product during its life. It actually produces the following units: 123,200 in Year 1, 123,600 in Year 2, 121,400 in Year 3, 122,800 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate—this difference was not predicted. Note: The machine cannot be depreciated below its estimated salvage value. Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. Note: Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar. Complete this question by entering your answers in the tabs below. Straight Line Units of Production Year Year 1 Year 2 Year 3 Year 4 Total Compute depreciation for each year (and total depreciation…arrow_forwardIn June, Blackfly Ltd. received a $6,000 cash payment for work performed & billed the previous month. The company replanted a clear-cut area of northern Alberta for which it sent out an invoice for $20,000. At the beginning of the month the company had $1,000 of trees for planting. During the month the company purchased $2,000 more, and at the end of the month it was left with trees that had cost $1,000. The company's expenses were $1,000 in rent for its office and $3,000 in other expenses. Amortization on the truck and office equipment was calculated to be $1,500. The income tax rate is 10%. Net income for June was O$11,250 none of the listed answers are correct $15,500 $9,900 $10,800arrow_forward

- A machine costing $217,200 with a four-year life and an estimated $20,000 salvage value is installed in Luther Company’s factory on January 1. The factory manager estimates the machine will produce 493,000 units of product during its life. It actually produces the following units: 122,200 in Year 1, 124,100 in Year 2, 121,500 in Year 3, 135,200 in Year 4. The total number of units produced by the end of Year 4 exceeds the original estimate—this difference was not predicted. Note: The machine cannot be depreciated below its estimated salvage value. Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. (Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar.) A machine costing $217,200 with a four-year life and an estimated $20,000 salvage value is installed in Luther Company’s factory on January 1. The factory manager estimates the machine will produce…arrow_forwardJayarrow_forwardZachary Home Maintenance Company earned operating income of $6,565,300 on operating assets of $58,100,000 during Year 2. The Tree Cutting Division earned $1,191,970 on operating assets of $6,890,000. Zachary has offered the Tree Cutting Division $2,160,000 of additional operating assets. The manager of the Tree Cutting Division believes he could use the additional assets to generate operating income amounting to $440,640. Zachary has a desired return on investment (ROI) of 9.30 percent. Required a. Calculate the return on investment for Zachary, the Tree Cutting Division, and the additional investment opportunity. b. Calculate the residual income for Zachary, the Tree Cutting Division, and the additional investment opportunity.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education