FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:Title: Depreciation Calculation Schedule

Instructions:

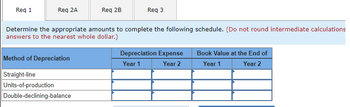

Determine the appropriate amounts to complete the following schedule. (Do not round intermediate calculations, round your final answers to the nearest whole dollar.)

| Method of Depreciation | Depreciation Expense | Book Value at the End of |

|----------------------------|----------------------|--------------------------|

| | Year 1 | Year 2 | Year 1 | Year 2 |

| Straight-line | | | | |

| Units-of-production | | | | |

| Double-declining-balance | | | | |

This table is designed to compare different methods of calculating depreciation expenses and the book value of an asset over time (across Year 1 and Year 2). The methods covered are Straight-line, Units-of-production, and Double-declining-balance.

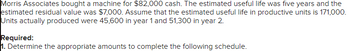

Transcribed Image Text:**Scenario:**

Morris Associates purchased a machine for $82,000 cash. The estimated useful life of the machine is five years, with an estimated residual value of $7,000. The estimated useful life in productive units is 171,000. In practice, the machine produced 45,600 units in year 1 and 51,300 units in year 2.

**Task:**

1. Determine the depreciation amounts to complete the following schedule based on the available data.

This exercise is designed to apply concepts of depreciation, focusing on the units of production method. Consider the cost, estimated useful life, residual value, and actual production to calculate the appropriate depreciation expense for each year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume Plain Ice Cream Company, Incorporated, in Ithaca, NY, bought a new ice cream production kit (pasteurizer/homogenizer, cooler, aging vat, freezer, and filling machine) at the beginning of the year at a cost of $22,000. The estimated useful life was four years, and the residual value was $2,000. Assume that the estimated productive life of the machine was 10,000 hours. Actual annua usage was 4,000 hours in Year 1; 3,000 hours in Year 2; 2,000 hours in Year 3; and 1,000 hours in Year 4. Required: 1. Complete a separate depreciation schedule for each of the alternative methods. a. Straight-line. b. Units-of-production. c. Double-declining-balance. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Year At acquisition 1 2 3 4 Req 1C Complete a depreciation schedule using the straight-line method. Depreciation Accumulated Expense Depreciation Net Book Valuearrow_forwardA machine was purchased at an original cost of P3,250,114 with a salvage value of P386.985. The machine is expected to perform for 365,281 hours and can produce total units of 574,125. The machine has the following outputs: First year: H-20.243 hours O-45,754 units Second year: H-19,854 hours 0-41,658 units Third year: H-19.895 hours 0-42.036 units Fourth year H-17.856 hours O-36.025 units Determine the following: A)Book value at the end of four years using Service-Output Method. B.)Total depreciation at the end of 2nd year using Working-Hours Method. C.)Book value at the end of three years using Working-Hours Method. (Please provide detailed solution not in excel, thank you)arrow_forwardAssume Plain Ice Cream Company, Incorporated, in Ithaca, NY, bought a new ice cream production kit (pasteurizer/homogenizer, cooler, aging vat, freezer, and filling machine) at the beginning of the year at a cost of $24,000. The estimated useful life was four years, and the residual value was $2,580. Assume that the estimated productive life of the machine was 10,200 hours. Actual annual usage was 4,080 hours in Year 1; 3,060 hours in Year 2; 2,040 hours in Year 3; and 1,020 hours in Year 4. Required: 1. Complete a separate depreciation schedule for each of the alternative methods. a. Straight-line. b. Units-of-production. c. Double-declining-balance. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 1C Complete a depreciation schedule using the units-of-production method. Note: Use two decimal places for the per unit output factor. Do not round intermediate calculations. Year Depreciation Expense At acquisition 1 2 3 4 Accumulated Depreciation Net…arrow_forward

- i need the answer quicklyarrow_forwardOki Company pays $283,500 for equipment expected to last four years and have a $30,000 salvage value. Prepare journal entries to record the following costs related to the equipment. 1. Paid $20,250 cash for a new component that increased the equipment's productivity. 2. Paid $5,063 cash for minor repairs necessary to keep the equipment working well. 3. Paid $13,200 cash for significant repairs to increase the useful life of the equipment from four to seven years. View transaction list Journal entry worksheet > Record the betterment cost of $20,250 paid in cash. Note: Enter debits before credits. Debit Credit Transaction General Journal 1 MacBook Airarrow_forwardRequired information Use the following information for the Exercises below. [The following information applies to the questions displayed below.] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $47,500. The machine's useful life is estimated at 10 years, or 405,000 units of product, with a $7,000 salvage value. During its second year, the machine produces 34,500 units of product. Exercise 8-6 Double-declining-balance depreciation LO P1 Determine the machine's second-year depreciation using the double-declining-balance method. Double-declining-balance Depreciation es Annual Depreciation Expense Depreciation expense Choose Factors: Choose Factor(%) !! First year's depreciation Second year's depreciation %3Darrow_forward

- Please explain how to the methods below and only answer if you completely answer the question. Perdue Company purchased equipment on April 1 for $43,470. The equipment was expected to have a useful life of three years, or 7,020 operating hours, and a residual value of $1,350. The equipment was used for 1,300 hours during Year 1, 2,500 hours in Year 2, 2,100 hours in Year 3, and 1,120 hours in Year 4. Required: Determine the amount of depreciation expense for the years ended December 31, Year 1, Year 2, Year 3, and Year 4, by (a) the straight-line method, (b) the units-of-activity method, and (c) the double-declining-balance method.arrow_forwardRequlred Information Use the following information for the Exercises below. [The following information applies to the questions displayed below.] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $85,400. The machine's useful life is estimated at 20 years, or 402,000 units of product, with a $5.000 salvage value. During its second year, the machine produces 34,200 units of product. Exerclse 8-4 Stralght-Illne depreclation LO P1 Determine the machine's second-year depreciation and year end book value under the straight-line method. Straight-Line Depreciation Annual Depreciation Expense Choose Numerator: Choose Denominator: Depreciation expense Year 2 Depreciation Year end book value (Year 2)arrow_forwardAssume Plain Ice Cream Company, Incorporated, in Ithaca, NY, bought a new ice cream production kit (pasteurizer/homogenizer, cooler, aging vat, freezer, and filling machine) at the beginning of the year at a cost of $28,000. The estimated useful life was four years, and the residual value was $2,560. Assume that the estimated productive life of the machine was 10,600 hours. Actual annual usage was 4,240 hours in Year 1; 3,180 hours in Year 2; 2,120 hours in Year 3; and 1,060 hours in Year 4. Required: 1. Complete a separate depreciation schedule for each of the alternative methods. a. Straight-line. b. Units-of-production. c. Double-declining-balance. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 1C Complete a depreciation schedule using the straight-line method. Year Depreciation Expense At acquisition 1 2 3 Accumulated Depreciation Net Book Valuearrow_forward

- Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $83,600. The machine's useful life is estimated at 20 years, or 398,000 units of product, with a $4,000 salvage value. During its second year, the machine produces 33,800 units of product. Exercise 8-4 (Algo) Straight-line depreciation LO P1 Determine the machine's second-year depreciation and year end book value under the straight-line method. Straight-Line Depreciation Choose Numerator: / Annual Depreciation Expense Choose Denominator: = Depreciation expense Year 2 Depreciation Year end book value (Year 2) e to search O 68°F a 144 prt sc delete 96 & Y Karrow_forwardRequired information Use the following information for the Exercises below. [The following information applies to the questions displayed below.] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $45,900. The machine's useful life is estimated at 10 years, or 399,000 units of product, with a $6,000 salvage value. During its second year, the machine produces 33,900 units of product. Exercise 8-4 Straight-line depreciation LO P1 Determine the machine's second-year depreciation and year end book value under the straight-line method. Straight-Line Depreciation. Choose Numerator: / Year 2 Depreciation Year end book value (Year 2) Choose Denominator: = Annual Depreciation Expense Depreciation expense 0arrow_forwardsolve within 30 mins.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education