CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Financial Accounting

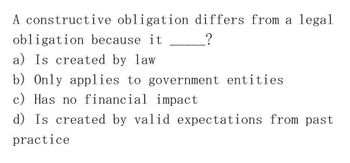

Transcribed Image Text:A constructive obligation differs from a legal

obligation because it

a) Is created by law.

_?

b) Only applies to government entities

c) Has no financial impact

d) Is created by valid expectations from past.

practice

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In explaining the meaning of obligation in the definition of a liability, the Conceptual Framework states: A. That an obligation is a duty or responsibility that an entity has no practical ability to avoid B. Than an obligation can arise from a duty or responsibility conditional on a future action that the entity itself may take, if the entity has no practical ability to avoid taking that action C. That an obligation can arise from an entity's customary practices, published policies or specific statements, if the entity has no practical ability to avoid those practices, policies or statements D. All of the abovearrow_forwardWhich of the following is not a criterion that must be met for an item to be classified as a liability? A certain cash payment will occur in the future. A sacrifice will require the entity’s assets or services. There is a probable future sacrifice. There is a present obligation that results from a past transaction.arrow_forwardFor a liability to be recognised within the financial statements, it needs to be reasonably apparent that an obligation to an ____________exists. Select one alternative: legal obligation external party another party counter partyarrow_forward

- In accordance with AASB 9, the recognition of a financial asset or financial liability will be influenced by considerations as to whether there is a contractual right to exchange financial assets or financial liabilities with another entity under conditions that are potentially favourable, or potentially unfavourable, to the entity. Explain what this requirement means.arrow_forwardWhich of the following is not considered a permanent difference? Select one: a. Interest received on government obligations. b. Fines resulting from violating the law. c . Percentage depletion of natural resources. d. Stock-based compensation expense.arrow_forwardWith reference to IAS 37, identify the correct statements from the following: I. A contingent asset should be disclosed by note if an inflow of economic benefits is probable. II. Contingent assets must not be recognised in financial statements unless an inflow of economic benefits is virtually certain to arise. III. No disclosure of a contingent liability is required if the possibility of a transfer of economic benefits arising is remote. a- I, II and III b- I and II only c- II and III only d- I and III onlyarrow_forward

- 4. Entity A issues an instrument that is re-purchasable by delivering cash or another financial asset. However, Entity A's and financial liability remain unaltered. delivo 1ssues an instrument that is re-purchasable byarrow_forwardA note secured by a deed of trust provides for an automatic action of the laws known as a.a strict foreclosure. b.equitable rights. c.a power of sale. d.a statutory right.arrow_forwardThe term "provision" as it is used in IAS 37, is most closely related to what term in U.S. GAAP? O Contingent liability, where the outflow of resources is "remote." Contingent liability, where the outflow of resources is "probable." O Current liability, where the outflow is difficult to measure. Reserve for bad debt, where the amount recoverable is "uncertain."arrow_forward

- I. In case of conflict between revenue regulation and the provisions of NIRC, the former shall prevail. II. NIRC is a special law, thus in case of conflict with civil code, then the latter shall prevail. o Both are true o Both are false o Only I is true o Only II is truearrow_forwardUnder PFRS 15, which of the following factors indicates that the revenue from contracts with customers is recognized from the moment the entity satisfies the performance obligation at a point in time? When the entity has transferred physical possession of the asset to the customer. When the customer simultaneously receives and consumes all the benefits provided by the entity as the entity performs. When the entity’s performance does not create an asset with an alternative use to the entity and the entity has an enforceable right to payment for performance completed to date. When the entity’s performance creates or enhances an asset that the customer controls as the asset is created.arrow_forwardTRUE OR FALSE 1. PFRS 4 SUPERSEDES PFRS17 2.PFRS 17 APPLIES TO REINSURANCE CONTRACTS3.INCOME SERVICE IS RECOGNIZED IN OTHER COMPREHENSIVE INCOME4. PFRS17 APPLIES TO INVESTMENT CONTRACTS WITH DISCRETIONARY FEATURES REGARDLESS IF THE ENTITY ALSO ISSUES INSRANCE CONRACS OR NIarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...

Accounting

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:South-Western College Pub