College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

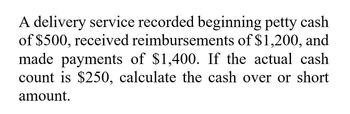

Transcribed Image Text:A delivery service recorded beginning petty cash

of $500, received reimbursements of $1,200, and

made payments of $1,400. If the actual cash

count is $250, calculate the cash over or short

amount.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Cash Over Or short amount?arrow_forwardWhile examining cash receipts information, the accounting department determined the following information: opening cash balance $177, cash on hand $1,328.37, and cash sales per register tape $1,166.57. Prepare the required journal entry based upon the cash count sheet. (Round answers to 2 decimal places, e.g. 52.75. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Cash 1151.37 Cash Over and Short 15.2 Accounts Receivable 1166.57arrow_forwardWhile examining cash receipts information, the accounting department determined the following information: opening cash balance $178, cash on hand $1,016.25, and cash sales per register tape $853.27. Prepare the required journal entry based upon the cash count sheet. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 2 decimal places, eg. 52.75.) Account Titles and Explanation Debit Creditarrow_forward

- While examining cash receipts information, the accounting department determined the following information: cash on hand $1,125.74 and cash sales per register tape $988.62. Prepare the required journal entry. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to 2 decimal places, e.g. 52.75.) Account Titles and Explanation Debit Creditarrow_forwardThe following is the description of cash disbursements system of Two symbols limites: Upon receipt of the documents from accounts payable department, the cash disbursements clerk filesthe documents until their payment due date. On the due date, the clerk prepares a cheque for theinvoiced amount, which is sent to the treasurer who signs it and mails back to the supplier.The cash disbursement clerk then updates the cheque register, accounts payable ledger, and accountspayable control account from the clerk’s terminal. Finally, the clerk files the invoice and copy ofpurchase order, receiving report, cheque in the department.Required:Describe the internal control weakness in Two Symbols’ cash disbursements system and discuss therisk associated with the weakness.arrow_forwardThe actual cash received from cash sales was $32,443, and the amount indicated by the cash register total was $32,473. Journalize the entry to record the cash receipts and cash sales. If an amount box does not require an entry, leave it blank. blank Account Debit Credit blankarrow_forward

- A $180 petty cash fund has cash of $15 and receipts of $180. Which of the following would be part of the journal entry to replenish the account? Select the correct answer. a-debit to Cash for $15 b-credit to Cash Short and Over for $15 c-credit to Petty Cash for $180 d-credit to Cash for $180arrow_forwardThe following is the description of cash disbursements system of Two Symbols Limited: Upon receipt of the documents from accounts payable department, the cash disbursements clerk files the documents until their payment due date. On the due date, the clerk prepares a cheque for the invoiced amount, which is sent to the treasurer who signs it and mails back to the supplier. The cash disbursement clerk then updates the cheque register, accounts payable ledger, and accountspayable control account from the clerk’s terminal. Finally, the clerk files the invoice and copy ofpurchase order, receiving report, cheque in the department. Required:Describe the internal control weakness in Two Symbols’ cash disbursements system and discuss therisk associated with the weakness.arrow_forwardThe following is the description of cash disbursements system of Two Symbols Limited:Upon receipt of the documents from accounts payable department, the cash disbursements clerk files the documents until their payment due date. On the due date, the clerk prepares a cheque for the invoiced amount, which is sent to the treasurer who signs it and mails back to the supplier.The cash disbursement clerk then updates the cheque register, accounts payable ledger, and accounts payable control account from the clerk’s terminal. Finally, the clerk files the invoice and copy of purchase order, receiving report, cheque in the department. Question 01 Describe the internal control weakness in Two Symbols’ cash disbursements system and discuss the risk associated with the weakness.arrow_forward

- the following is the discription of cash disbursements system of Two symbols limited: upon receipt of the documents from accounts payable department, the cash disbursements clerk files the documents until their payment due date, on the due date the clerk prepares a cheque for the invoiced amount, which is sent to the treasurer who signs it and mails back to the supplier. the cash disbursement clerk then updates the cheque register, accounts payable ledger and accounts payable control account from the clerk's terminal. finally the clerk files the invoice and copy of purchase order, receiving report, cheque in the department required: describe the internal control weekness in Two symbols cash disbursement system and discuss the risk associated with the weekness.arrow_forwardA $144 petty cash fund has cash of $24 and receipts of $109. The journal entry to replenish the account would include a Oa. credit to Petty Cash for $109. Ob. credit to Cash for $144. Oc. debit to Cash for $24. Od. debit to Cash Short and Over for $11. Previous Nextarrow_forwardA $180 petty cash fund has cash of $20 and receipts of $146. Which of the following would be part of the journal entry to replenish the account? Select the correct answer. credit to Cash for $180 debit to Cash for $20 debit to Cash Short and Over for $14 credit to Petty Cash for $146arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage