FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

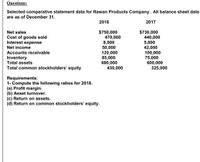

Transcribed Image Text:Questions:

Selected comparative statement data for Rawan Products Company. All balance sheet data

are as of December 31.

2018

2017

$750,000

470,000

8,000

50,000

120,000

85,000

680,000

430,000

$730,000

440,000

5,000

42,000

100,000

75,000

600,000

325,000

Net sales

Cost of goods sold

Interest expense

Net income

Accounts receivable

Inventory

Total assets

Total common stockholders' equity

Requirements:

1- Compute the following ratios for 2018.

(a) Profit margin.

(b) Asset turnover.

(c) Return on assets.

(d) Return on common stockholders' equity.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Comparative financial statement data for Flounder Corp. and Blue Spruce Corp., two competitors, appear below. All balance sheet data are as of December 31, 2017. Flounder Corp. Blue Spruce Corp. 2017 2017 Net sales $1,908,000 $657,200 Cost of goods sold 1,245,500 360,400 Operating expenses 299,980 103,880 Interest expense 9,540 4,028 Income tax expense 90,100 38,160 Current assets 444,000 199,036 Plant assets (net) 563,920 148,112 Current liabilities 70,305 35,739 Long-term liabilities 115,010 43,125 Net cash provided by operating activities 146,280 38,160 Capital expenditures 95,400 21,200 Dividends paid on common stock 38,160 15,900 Weighted-average number of shares outstanding 80,000 50,000 (a)Compute the net income and earnings per share for each company for 2017. (Round Earnings per share to 2 decimal places, e.g. $2.78.) Net Income Earnings per share Flounder Corp. $…arrow_forwardFind for Armstrong Company and Blair Company : Liquidity Ratio (a) Current Ratio Market tests (b) Price/earnings ratio (c) Divident yield ratio (%)arrow_forwardSuppose selected comparative statement data for the giant bookseller Barnes & Noble are presented here. All balance sheet data are as of the end of the fiscal year (in millions). 2020 2019 Net sales $5,150 $5,100 Cost of goods sold 3,400 3,901 Net income 75 151 Accounts receivable 75 104 Inventory 1,250 1,350 Total assets 2,950 3,150 Total common stockholders’ equity 890 1,121 Compute the following ratios for 2020. (Round asset turnover to 2 decimal places, e.g 1.83 and all other answers to 1 decimal place, e.g. 1.8 or 2.5%) (a) Profit margin enter percentages rounded to 1 decimal place ? % (b) Asset turnover enter Asset turnover in times rounded to 2 decimal places ? times (c) Return on assets enter percentages rounded to 1 decimal place ? % (d) Return on common stockholders’ equity enter percentages rounded to 1 decimal place ? % (e) Gross profit…arrow_forward

- Use the Ulta annual report to calculate profit margin, total debt ratio, and cash ratio for the year ending in 2021.arrow_forwardSuppose selected comparative statement data for the giant bookseller Barnes & Noble are as follows. All balance sheet data are as of the end of the fiscal year (in millions). Net sales Cost of goods sold Net income Accounts receivable Inventory Total assets Total common stockholders' equity 2022 $4,750.0 3.300.3 85.3 75.1 1,150.0 2,850.0 900.2 2021 $5,500.6 3,700.6 110.1 102.2 1.250.0 3,250.1 1.120.7arrow_forwardUsing these data from the comparative balance sheets of Bonita Company, perform a vertical analysis. Accounts receivable (net) Inventory Total assets (Round percentages to 1 decimal place, e.g. 12.1%.) Accounts receivable (net) Inventory Total assets Amount $435.960 December 31, 2022 December 31, 2021 $422,800 720.720 2.520,000 $435.960 December 31, 2022 720.720 2,520.000 Percentage 624,400 2,800,000 Amount $422,800 624,400 2.800,000 December 31, 2021 Percentage % 8arrow_forward

- Need help ASAP :(arrow_forwardExcerpts from Andre Company's December 31, 2024 and 2023, financial statements are presented below: Accounts receivable Inventory Net sales Cost of goods sold Current liabilities Interest-bearing debt Total stockholders' equity Net income What is the debt to equity ratio for 2024? Note: Round your answer to one decimal place. Multiple Choice 41.9% 41.7% 2024 2023 $ 44,000 $44,000 34,000 45,000 195,000 196,000 117,000 116,000 86,000 68,000 103,000 114,000 246,000 234,000 38,000 33,000arrow_forwardAnalysis and Interpretation of ProfitabilityBalance sheets and income statements for 3M Company follow. 3M COMPANY Consolidated Statements of Income For Years ended December 31 ($ millions) 2018 2017 Net sales $32,765 $31,657 Operating expenses Cost of sales 16,682 16,055 Selling, general and administrative expenses 7,602 6,626 Research, development and related expenses 1,821 1,870 Gain on sale of businesses (547) (586) Total operating expenses 25,558 23,965 Operating income 7,207 7,692 Other expense, net* 207 144 Income before income taxes 7,000 7,548 Provision for income taxes 1,637 2,679 Net income including noncontrolling interest 5,363 4,869 Less: Net income attributable to noncontrolling interest 14 11 Net income attributable to 3M $ 5,349 $ 4,858 *Interest expense, gross $350 million in 2018 and $322 million in 2017. 3M COMPANY Consolidated Balance Sheets At December 31 ($ millions, except per share amount) 2018 2017…arrow_forward

- Analysis and Interpretation of ProfitabilityBalance sheets and income statements for Costco Wholesale Corporation follow. Costco Wholesale Corporation Consolidated Statements of Earnings For Fiscal Years Ended ($ millions) September 2, 2018 Total revenue $141,576 Operating expenses Merchandise costs 123,152 Selling, general and administrative 13,876 Preopening expenses 68 Operating Income 4,480 Other income (expense) Interest expense 159 Interest income and other, net (121) Income before income taxes 4,442 Provision for income taxes 1,263 Net income including noncontrolling interests 3,179 Net income attributable to noncontrolling interests (45) Net income attributable to Costco $3,134 Costco Wholesale Corporation Consolidated Balance Sheets ($ millions, except par value and share data) September 2, 2018 September 3, 2017 Current assets Cash and cash equivalents $6,055 $4,546 Short-term investments 1,204 1,233…arrow_forwardSelected hypothetical comparative statement data for the giant bookseller Barnes & Noble are presented here. All balance sheet data are as of the end of the fiscal year (in millions). Net sales Cost of goods sold Net income Accounts receivable (net) Inventory Total assets Total common stockholders' equity a. b. C. d. e. Profit margin Asset turnover Return on assets 2025 $5,050.3 Gross profit rate 3,700.7 65.1 65.0 1.250.1 Compute the following ratios for 2025. (Round asset turnover to 2 decimal places, e.g 1.83 and all other answers to 1 decimal place, e.g. 1.8 or 2.5%) 2,950.1 940.6 Return on common stockholders' equity 2024 $5,800.9 3,200.1 190.9 106.6 1,350.1 3,250.1 1,100.5 % times % % %arrow_forward- What are the firm’s current ratios for 2018 and 2019?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education