CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

general accounting question

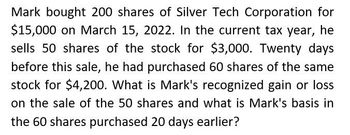

Transcribed Image Text:Mark bought 200 shares of Silver Tech Corporation for

$15,000 on March 15, 2022. In the current tax year, he

sells 50 shares of the stock for $3,000. Twenty days

before this sale, he had purchased 60 shares of the same

stock for $4,200. What is Mark's recognized gain or loss

on the sale of the 50 shares and what is Mark's basis in

the 60 shares purchased 20 days earlier?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT