FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

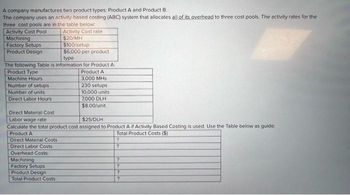

Transcribed Image Text:A company manufactures two product types: Product A and Product B.

The company uses an activity-based costing (ABC) system that allocates all of its overhead to three cost pools. The activity rates for the

three cost pools are in the table below:

Activity Cost rate

$20/MH

Activity Cost Pool

Machining

Factory Setups

Product Design

type

The following Table is information for Product A:

Product Type

Machine Hours

Number of setups

Number of units

Direct Labor Hours

$100/setup

$6,000 per product

Direct Material Costs

Direct Labor Costs

Overhead Costs:

Machining

Factory Setups

Product Design

Total Product Costs

Product A

3,000 MHs

230 setups

Direct Material Cost

Labor wage rate

$25/DLH

Calculate the total product cost assigned to Product A if Activity Based Costing is used. Use the Table below as guide:

Product A

Total Product Costs ($)

?

10,000 units

7,000 DLH

$8.00/unit

?

?

?

?

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Klumper Corporation Is a diversified manufacturer of Industrial goods. The company's activity-based costing system contalns the following stx activity cost pools and activity rates: Activity Cost Pool Supporting direct labor Machine processing Machine setups Production orders Activity Rates $8 per direct labor-hour $ 3 per machine-hour $ 35 per setup $ 160 per order $ 120 per shipment $ 875 per product Shipments Product sustaining Activity data have been supplied for the following two products: Total Expected Activity K425 M67 Number of units produced per year 2,000 50 200 Direct labor-hours 1,825 3,480 13 Machine-hours 40 Machine setups Production orders Shipments Product sustaining 2 13 2 26 2 Requlred: How much total overhead cost would be assigned to K425 and M67 using the activity-based costing system? Activity Cost Pool K425 M67 Supporting direct labor Machine processing Machine setups Production orders Shipments Product sustaining Total overhead cost 이 $arrow_forwardCarlise has identified the following information about its overhead activity pools and the two product lines: Activity Pools Materials handling Quality control Machine maintenance Cost Driver Number of moves Number of inspections Number of machine hours Cost Assigned to Pool Indoor Model $ 20,910 $ 85,120 $ 34,790 Materials Handling Quality Control Machine Maintenance Total Overhead Assigned Quantity or Amount Consumed by Quantity or Amount Consumed by Indoor Line Outdoor Line Required: 1. Suppose Carlise used a traditional costing system with machine hours as the cost driver. Determine the amount of overhead assigned to each product line. Complete this question by entering your answers in the tabs below. 2. Calculate the activity proportions for each activity pool in Carlise's ABC system. 3. Calculate the amount of overhead that Carlise will assign to the Indoor line if it uses an ABC system. 4. Determine the amount of overhead Carlise will assign to the Outdoor line if it uses an ABC…arrow_forwardMultiple Choice $9,907.97 $89,171.73 $5,173.02 $136.51arrow_forward

- Meester Corporation has an activity-based costing system with three activity cost pools--Machining, Order Filling, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are alloceted to three activity cost pools based on resource consumption, Data used in the first stage allocations follow Overhead costs: Equipment depreciation Supervisory expense $ 81,300 $ 2,200 Distribution of Resource Consumption Across Activity Cost Pools: Activity Cost Pools Machining Order Filling Other Equipment depreciation Supervisory expense 0.50 0.30 0. 20 e. 30 e.50 0.20 Mechining costs are assigned to products using machine-hours (MHs) and Order Filing costs are essigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity date for the companve o nroducts follaw You ae sren sharg Skop Share Activity MHs (Machining) Orders (Order Filling) Product Me 1,630 9,780 1,370…arrow_forwardDogarrow_forwardAssume a company manufactures only two products-14,000 units of Product G and 6,000 units of Product H. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to three cost pools. The following additional information is available for the company as a whole and for Products G and H: Activity Cost Pool Machining Machine setups Product design Activity Measure Machine-hours Number of setups Number of products Activity Measure Machine-hours Number of setups Number of products Product G Product H 9,000 50 1 6,000 150 1 Estimated Overhead Cost Expected Activity 15,000 MH 200 Setups $ 300,000 $ 150,000 $ 78,000 2 Products Using the ABC system, how much total overhead cost would be assigned from all of the activities to Product H?arrow_forward

- Please help me with show all calculation thankuarrow_forwardAn activity based costing system is used at Haldeman, SA to assign products overhead costs. First, the two overhead costs of Equipment depreciation and Water expense are allocated to three activity cost pools - Handling, Machining, and Other - based on resource consumption. The information used to perform these allocations is below: Overhead Costs: Equipment depreciation: $50,000 Water expense: $60,000 Distribution of Resource Consumption across Activity Cost Pools: Overhead Cost Activity Cost Pools Handling Machining Other Equipment depreciation 0.28 0.34 0.38 Water expense 0.32 0.22 0.46 The second stage of allocation is done by assigning the Handling costs to products on the basis of orders filled while products are assigned Machining costs based on machine hours. Costs assigned to the Other activity pool are not further assigned to products. Activity information for Haldeman's only two products is below: orders filled machine hours Product LS-157: 3,400 3,400…arrow_forwardThe following figure depicts the complete system that Office Inc. uses to estimate the total cost of each office desk and office chair that it produces. How many cost pools does Office Inc.'s 2-stage costing system use for Office Chair objects? A. 7 B. 0 C. 6 D. 5 E. 4 F. 2 G. 1 H. 3 I. 8arrow_forward

- TCM Company uses activity-based costing to determine products costs for external financial reports. The company has provided the following data concerning its activity-based costing system: Activity cost pools (and activity measures) Depreciation (allocated based on machine-hours) Batch setup (allocated based on # of set ups) General Factory (allocated based on direct labor hours) Estimated Overhead costs $67,500 273,700 204,000 Expected Activity (Allocation base) Product y Product x Activity Cost pool Depreciation Batch setup General factory The activity rate for the general factory activity cost pool is? Total 5000 m hours 4000 1000 7000 set ups 3000 4000 8000 dl hours 1000 7000arrow_forwardDierich Company uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity-based costing system: Costs: Manufacturing overhead $600,000 Selling and administrative expenses 220,000 Total $820,000 Distribution of Resource Consumption: Activity Cost Pools Order Size Customer Support Other Total Manufacturing overhead 15% 75% 10% 100% Selling and administrative expenses 60% 20% 20% 100% The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. You have been asked to complete the first-stage allocation of costs to the activity cost pools. How much cost, in total, would be allocated in the first-stage allocation to the Order Size activity cost pool? Multiple Choice $123,000 $222,000 $307,500 $492,000arrow_forwardFoam Products, Incorporated, makes foam seat cushions for the automotive and aerospace industries. The company's activity-based costing system has four activity cost pools, which are listed below, along with their activity measures and activity rates: Activity Cost Pool Supporting direct labor. Batch processing Order processing Customer service Activity Measure Number of direct labor-hours Number of batches Number of orders Number of customers Activity Rate $10 per direct labor-hour $90 per batch $286 per order $ 2,602 per customer The company just completed a single order from Interstate Trucking for 2,800 custom seat cushions. The order was produced in four batches. Each seat cushion required 0.3 direct labor-hours. The selling price was $141.10 per unit, the direct materials cost was $102 per unit, and the direct labor cost was $14.20 per unit. This was Interstate Trucking's only order during the year. Required: Calculate the customer margin on sales to Interstate Trucking for the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education