Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

?? Financial accounting question

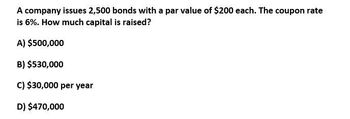

Transcribed Image Text:A company issues 2,500 bonds with a par value of $200 each. The coupon rate

is 6%. How much capital is raised?

A) $500,000

B) $530,000

C) $30,000 per year

D) $470,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- How much capital is raised?arrow_forwardD&G Enterprises issues bonds with a $1,000 face value that make coupon payments of $30 every 3 months. What is the coupon rate? A) 0.30% B) 3.00% C) 9.00% D) 12.00% E) 30.00%arrow_forwardA company has issued 10-year bonds, with a face value of $1,000,000 in 1,000 dollar units. Interest at 16% is paid quarterly. If an investor desires to earn 20% nominal interest on $100,000 worth of these bonds, what would be the selling price have to be?arrow_forward

- ABC Company will issue $5,100,000 in 8%, 10-year bonds when the market rate of interest is 10%. Interest is paid semiannually. Required: Determine how much cash ABC Company will realize from the bond issue. Note: Use tables, Excel, or a financial calculator. Round your intermediate calculations to the nearest whole dollar. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Bond issue pricearrow_forwardCG Forest and Paper LTD. raises capital; by selling 5,000,000 worth of debt with flotation xost equal to 3% of its par value. If the debt matures in 15 years and has coupon rate of 6% (paid annually).What is the bond's YTMSubject: Financial Accountingarrow_forwardA company issued 10%, 10-year bonds with a face amount of $100 million. The market yield for bonds of similar risk and maturity is 6%. Interest is paid semiannually. At what price did the bonds sell? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar. Use tables, Excel, or a financial calculator.(FV of $1. PV of $1. FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) Price of bondsarrow_forward

- 1) HMK Enterprises would like to raise $10.0 million to invest in capital expenditures. The company plans to issue five-year $1,000 bonds with a face value of and a coupon rate of 6.58% (annual payments). 6 The following table summarizes the yield to maturity for five-year (annual-payment) coupon corporate bonds of various ratings: Rating AAA AA A BBB BB YTM 6.13% 6.36% 6.52% 6.94% 7.55% Assuming the bonds will be rated AA, what will be the price of the bonds?arrow_forwardWhat is the coupon rate on this financial accounting question?arrow_forwardGeneral Accountingarrow_forward

- The nominal rate of return is $1,000. % earned by an investor in a bond that was purchased for $904, has an annual coupon of 9%, and was sold at the end of the year for $1031? Assume the face value of the bond isarrow_forwardA company has issued 10-year bonds, with a face value of $1,000,000, in $1,000 units. Interestat 16% is paid quarterly. If an investor desires to earn 20% nominal interest (compoundedquarterly) on $100,000 worth of these bonds, what would the purchase price have to be?arrow_forward3. Assume you purchased a bond for $9,186. The bond pays $300 interest every six months. You sell the bond after 18 months for $10,000. Calculate the following: a. Income. b. Capital gain (or loss). c. Total return in dollars and as a percentage of the original investment. Review Only Click the icon to see the Worked Solution. a. The current income is $ (Round to the nearest dollar.) b. The capital gain (or loss) is $ (Enter a loss as a negative number and round to the nearest dollar.) c. The total return in dollars is $ (Round to the nearest dollar.) The total return as a percentage of the original investment is %. (Enter as a percentage and round to two decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT