Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

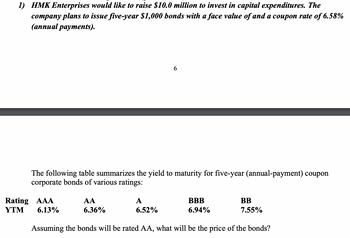

Transcribed Image Text:1) HMK Enterprises would like to raise $10.0 million to invest in capital expenditures. The

company plans to issue five-year $1,000 bonds with a face value of and a coupon rate of 6.58%

(annual payments).

6

The following table summarizes the yield to maturity for five-year (annual-payment) coupon

corporate bonds of various ratings:

Rating AAA

AA

A

BBB

BB

YTM 6.13%

6.36%

6.52%

6.94%

7.55%

Assuming the bonds will be rated AA, what will be the price of the bonds?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Review the Bond Table below; all bonds have semi-annual payments. Security. Coupon Rate Face Value 0.00% $1,000 4.50% 5.00% 1-yr Treasury 5-yr Treasury 10-yr Treasury 5-yr Corporate (rated A) 10-year Corporate 8.40% (rated BBB) Multiple Choice O 4.80% O If a company wanted to issue a new Corporate Bond (10 years, A rating) for full price, what coupon rate would it have to offer? 6.90% 6.50% 7.75% 7.50% $1,000 $1,000 $1,000 None of the above $1,000 Price $ 965.90 $991.18 $976.94 $912.46 $1,044.66arrow_forwardSebastian Corporation issued 30-year $50 million of face value bonds that have a coupon rate of 6% paid annually. The bonds were issued at 102. Given this information, calculate the yield to maturity. Multiple Choice 5.65% 5.85% 5.55% 5.75% 5.95% Show me all the calculation steps and formulas if necessaryarrow_forwardMCQ: Legacy Inc. recently issued bonds that mature in 10 years. They have a par value of $1,000 and annual coupon of 6%. The current market interest rate is 8.5%. Assume that the bonds can be recalled at end of year 5 at $1,250. What will be the price of bonds? Select one: a. 833.82 b. 1067.75 c. 1130.95 d. 835.97 e. 582.73arrow_forward

- Monster Inc. issues $100,000 face value, 6% semiannual coupon bonds maturing in 10 years. The market initially prices these bonds to yield 8% compounded semiannually. What is the issue price of these bonds? Select one: a. $81,902 b. $78,066 c. $87,506 d. $108,784 e. $86,410arrow_forwardA company is going to undertake an issue of $100 million of high yield bonds, with a maturity of 5 years. The bonds are rated BB. The coupon on the bonds is 5%, paid semi-annually. The underwriter is charging a commission of 2%. What is the effective yield on the bonds, from the company's point of view? Group of answer choices 5.46 % 7.00% 5.75% 2.73%arrow_forward5. A securities firm has provided the balance sheet below. Assets ($ millions) $ 34 Liabilities and Equity ($ millions) Short-term funding Cash $ 27 Debt securities 175 Bonds 300 Equity securities 400 Debentures 197 Other assets 12 Equity 97 Total Assets $ 621 Total Liabilities and Equity $ 621 The debt securities have an annual 7.25% coupon rate, 22 years to maturity and a yield to maturity of 6.75%. The market value of the equity securities and the other assets is equal to their book value. The firm has 500,000 shares outstanding and the price per share is $35.67. a. Calculate the firm's aggregate indebtedness to net capital ratio. b. Calculate the firm's highly liquid assets to total liabilities ratio. Based on the firm's ratios from a and b, is it in compliance with Rule 15C 3-1? Why or why not? C.arrow_forward

- Assume that Western Asset Management Company LLC (WAMC) has $10,000 par value zero-coupon bonds outstanding. WAMC bonds are currently trading at $5,500 with 8 years to maturity. WAMC tax bracket is 35%. Calculate the cost of debt for WAMC (System will not accept percentage (%) sign, therefore write your answer upto four decimals).arrow_forwardPlease help me. Thankyou.arrow_forwardSchallheim Corporation’s outstanding bonds have a $1,000 par value, a 7 percent semiannual coupon, 16 years to maturity, and an 8.5 percent yield to maturity (YTM). What is the bond’s price? a. $870.11 b. $871.37 c. $1,000.00 d. $914.20 e. $455.00arrow_forward

- Macro Corporation issued 50-year $80 million of face value bonds that have a coupon rate of 6% paid semi-annually. The bonds were issued at 97. Given this information, calculate the yield to maturity. Multiple Choice 6.30% 6.00% 6.20% 6.10% 6.40% Show all the calculation process and formulas if necessaryarrow_forwardK (Related to Checkpoint 9.2 and Checkpoint 9.3) (Bond valuation relationships) The 13-year, $1,000 par value bonds of Waco Industries pay 7 percent interest annually. The market price of the bond is $855, and the market's required yield to maturity on a comparable-risk bond is 10 percent. a. Compute the bond's yield to maturity. b. Determine the value of the bond to you given the market's required yield to maturity on a comparable-risk bond. c. Should you purchase the bond? a. What is your yield to maturity on the Waco bonds given the current market price of the bonds? % (Round to two decimal places.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education