Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Hi expert provide correct answer general accounting

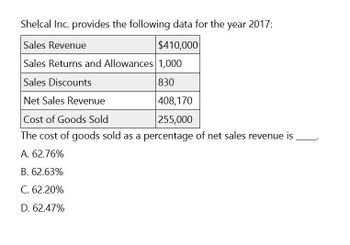

Transcribed Image Text:Shelcal Inc. provides the following data for the year 2017:

Sales Revenue

$410,000

Sales Returns and Allowances 1,000

Sales Discounts

Net Sales Revenue

830

408,170

255,000

Cost of Goods Sold

The cost of goods sold as a percentage of net sales revenue is

A. 62.76%

B. 62.63%

C. 62.20%

D. 62.47%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following information is available for Cooke Company for the current year: The gross margin is 40% of net sales. What is the cost of goods available for sale? a. 5840,000 b. 960,000 c. 1,200,000 d. 1,220,000arrow_forwardThe following is select account information for Sunrise Motors. Sales: $256,400; Sales Returns and Allowances: $34,890; COGS: $120,470; Sales Discounts: $44,760. Given this information, what is the Gross Profit Margin Ratio for Sunrise Motors? (Round to the nearest whole percentage.)arrow_forwardThe following is select account information for August Sundries. Sales: $850,360; Sales Returns and Allowances: $148,550; COGS: $300,840; Operating Expenses: $45,770; Sales Discounts: $231,820. If August Sundries uses a multi-step income statement format, what is their gross margin?arrow_forward

- A company shows the following balances: Sales Revenue $2962000Sales Returns and Allowances 402000Sales Discounts 60000Cost of Goods Sold 1350000 What is the gross profit rate? 46.0%58.0%54.0%66.0%arrow_forwardA company reported the following data for the year ending 2018: Description Amount Sales Sales discount Sales returns and allowances $400,000 $16,000 $13,000 $117,000 $153,000 |Cost of goods sold |Operating expense Income tax expense $23,750 Compute the amount of gross profit to be reported on the income statement. a. $101,000 b. $117,000 c. $254,000 d. $124,750 Answer O O O Oarrow_forwardcalculate the requirementsarrow_forward

- Perform a horizontal analysis for the entry "Gross Sales" shown on the income statement portion below. (Round percentages to one decimal place.) Increase/Decrease Revenue 2019 2018 Amount Percent Gross Sales $277,000 $200,100 $ % Less: Sales Returns and Allowances 14,200 12,400 Net Sales 262,800 187,700 Cost of Goods Sold Merchandise Inventory 31,900 33,800 Net Purchases 60,300 55,500 Goods Available for Sale 92,200 89,300 Less: Merchandise Inventory, Dec. 31 43,000 60,200 Cost of Goods Sold 49,200 29,100 Gross Margin 213,600 158,600arrow_forwardWhat is the times interest earned ratio on these accounting question?arrow_forwardA company reported the following data for the year ending 2018: Description Amount Sales $400,000 Sales discount $16,000 Sales returns and allowances $13.000 Cost of goods sold $117,000 Operating expense $153,000 Income tax expense $23,750 Compute the amount of net sales to be reported on the Income statement. $371,000 $397000 $384.000 $387.000arrow_forward

- Coleman, Inc. provides the following data from its Income Statement for 2018: Net Sales $ 560,000.00 Cost of Goods Sold $ (160,000.00) Gross Profit $ 400,000.00 Calculate the gross profit percentage. (round your answer to two decimal places) A 71.43% B 25.00% C 100.00% D 28.57%arrow_forwardCalculating the CCC from the Financial Statement The following data are taken from the financial statement: Annual Sales ( on Credit ) 1,216,666 Cost of Goods Sold 1,013,889 Average Inventory 250,000 Average Accounts Receivable 300,000 Average Accounts Payable 150,000 COMPUTE FOR THE FOLLOWING and interpret your answer: 1. DIO stands for Days Inventory Outstanding 89.99999014 DIO= (Ave. Inventory/Cost of Goods Sold)*365 =(250,000/1,013,889)*365 =89.99 or 90 days It takes the company approximately 90 days to turn inventory into sales 2. DSO stands for Days Sales Outstanding 90.00004932 DSO=(Ave. Accts. Receivables/Total Credit Sales)*365 =(300,000/1,216,666)*365 =90 days #NAME? 3. DPO stands for Days Payable Outstanding 53.99999408 DPO=(Ave. Accts. Payables/Cost of Goods Sold)*365 =(150,000/1,013,889)*365 =53.99 or 54 days It takes the company approximately 54 days to pay its invoices 4.CASH CONVERSION CYCLE 126.0000454 CCC= DIO + DSO - DPO = 90+90-54 = 126 It takes the company…arrow_forwardPlease find the following ratios for both year 2017 and year 2018 based on following data RATIO AT ROA L ROEarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College