Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Give me answer

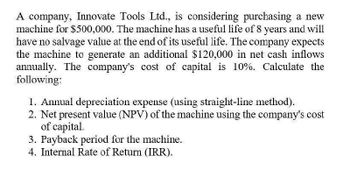

Transcribed Image Text:A company, Innovate Tools Ltd., is considering purchasing a new

machine for $500,000. The machine has a useful life of 8 years and will

have no salvage value at the end of its useful life. The company expects

the machine to generate an additional $120,000 in net cash inflows

annually. The company's cost of capital is 10%. Calculate the

following:

1. Annual depreciation expense (using straight-line method).

2. Net present value (NPV) of the machine using the company's cost

of capital.

3. Payback period for the machine.

4. Internal Rate of Return (IRR).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- The Scampini Supplies Company recently purchased a new delivery truck. The new truck cost $22,500, and it is expected to generate net after-tax operating cash flows, including depreciation, of $6,250 per year. The truck has a 5-year expected life. The expected salvage values after tax adjustments for the truck are given here. The company’s cost of capital is 10%. Should the firm operate the truck until the end of its 5-year physical life? If not, then what is its optimal economic life? Would the introduction of salvage values, in addition to operating cash flows, ever reduce the expected NPV and/or IRR of a project?arrow_forwardTaos Productions bought a piece of equipment for $79,860 that will last for 5 years. The equipment will generate net operating cash flows of $20,000 per year and will have no salvage value at the end of its life. What is the internal rate of return?arrow_forwardCinemar Productions bought a piece of equipment for $55,898 that will last for 5 years. The equipment will generate net operating cash flows of $14,000 per year and will have no salvage value at the end of its life. What is the internal rate of return?arrow_forward

- Gallant Sports s considering the purchase of a new rock-climbing facility. The company estimates that the construction will require an initial outlay of $350,000. Other cash flows are estimated as follows: Assuming the company limits its analysis to four years due to economic uncertainties, determine the net present value of the rock-climbing facility. Should the company develop the facility if the required rate of return is 6%?arrow_forwardA company, Innovate Tools Ltd., is considering purchasing a new machine for $500,000. The machine has a useful life of 8 years and will have no salvage value at the end of its useful life. The company expects the machine to generate an additional $120,000 in net cash inflows annually. The company's cost of capital is 10%. Calculate the following: 1. Annual depreciation expense (using straight-line method). 2. Net present value (NPV) of the machine using the company's cost of capital. 3. Payback period for the machine. 4. Internal Rate of Return (IRR).arrow_forwardProvidearrow_forward

- Help mearrow_forwardis planning to acquire a new machine at a total cost of P360,000. The estimated life of the machine is 6 years with no salvage value. The straight-line method of depreciation will be used. NUBD estimates that the annual cash flow from operations, before income taxes, from using this machine amounts to P90,000. Assume that NUBD’s cost of capital is 8% and the income tax rate is 40%. (Use 3 decimal places for the PV factors)What would be the net present value?arrow_forwardBartlett Car Wash Co. is considering the purchase of a new facility. It would allow Bartlett to increase its net income by $113,216 per year. Other information about this proposed project follows: Initial investment $ 524,150 Useful life 10 years Salvage value $ 55,000 Assume straight line depreciation method is used. Required: 1. Calculate the accounting rate of return for Bartlett. (Round your percentage answer to 2 decimal places.) 2. Calculate the payback period for Bartlett. (Round your answer to 2 decimal places.)arrow_forward

- ← Daily Enterprises is purchasing a $10.5 million machine. It will cost $55,000 to transport and install the machine. The machine has a depreciable life of five years and will have no salvage value. If Daily uses straight-line depreciation, what are the depreciation expenses associated with this machine? The yearly depreciation expenses are $. (Round to the nearest dollar.)arrow_forwardBartlett Car Wash Company is considering the purchase of a new facility. It would allow Bartlett to increase its net income by $106,439 per year. Other information about this proposed project follows: Initial investment $ 514,200 Useful life 10 years Salvage value $ 45,000 Assume straight line depreciation method is used. Required: 1. Calculate the accounting rate of return for Bartlett. Note: Round your percentage answer to 2 decimal places. 2. Calculate the payback period for Bartlett. Note: Round your answer to 2 decimal places. 1. Accounting Rate of Return 2. Payback Period % yearsarrow_forward2arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College