Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

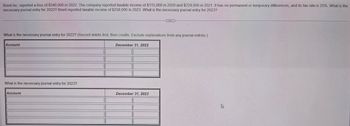

Transcribed Image Text:Brent Inc. reported a loss of $540,000 in 2022. The company reported taxable income of $115,000 in 2020 and $229,000 in 2021. It has no permanent or temporary differences, and its tax rate is 25%. What is the

necessary journal entry for 2022? Brent reported taxable income of $258,000 in 2023. What is the necessary journal entry for 2023?

What is the necessary journal entry for 2022? (Record debits first, then credits. Exclude explanations from any journal entries.)

Account

What is the necessary journal entry for 2023?

Account

December 31, 2022

December 31, 2023

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Brooks Company reported a prior period adjustment of 512,000 in pretax financial "income" and taxable income for 2020. The prior period adjustment was the result of an error in calculating bad debt expense for 2019. The current tax rate is 30%, and no change in the tax rate has been enacted for future years. When the company applies intraperiod income tax allocation, the prior period adjustment will be shown on the: a. income statement at 12,000 b. income statement at 8,400 (net of 3,600 income taxes) c. retained earnings statement at 12,000 d. retained earnings statement at 8,400 (net of 3,600 income taxes)arrow_forwardBackus Inc. reported a loss of $500,000 in 2022. The company reported taxable income of $125,000 in 2020 and $230,000 in 2021. It has no permanent or temporary differences, and its tax rate is 35%. What is the necessary journal entry for 2022? Backus reported taxable income of $250,000 in 2023. What is the necessary journal entry for 2023? What is the necessary journal entry for 2022? (Record debits first, then credits. Exclude explanations from any journal entries.) Account December 31, 2022arrow_forwardViolet Corporation reported a loss in 2022 of $610,000 and carried back the loss to the extent allowed. The company reported taxable income of $215,000 in 2020 and $245,000 in 2021. It has no permanent or temporary differences and its tax rate is 30%.Violet reported taxable income of $345,000 in 2023. What is the necessary journal entry for 2023? Group of answer choices Income Tax Expense 183,000 Income Tax Payable 138,000 Deferred Tax Asset 45,000 Income Tax Expense 103,500 Income Tax Payable 58,500 Deferred Tax Asset 45,000 Income Tax Refund Receivable 138,000 Deferred Tax Asset 45,000 Income Tax Benefit 183,000 Income Tax Refund Receivable 58,500 Deferred Tax Asset 45,000 Income Tax Benefit 103,500arrow_forward

- I need the answer as soon as possiblearrow_forwardPrepare the income statement for 2023, beginning with the line "income before income taxes.arrow_forwardSkysong Inc. reports the following pretax income (loss) for both financial reporting purposes and tax purposes. Year Pretax Income (loss) Tax Rate 2018 123,300 17% 2019 113,000 17% 2020 (282,000) 19% 2021 303,000 19% Prepare the journal entries for 2020 and 2021, assuming that based on the weight of available evidence, it is more likely than not that one-fourth of the benefits of the loss carryforward will not be realized.arrow_forward

- .) Krondor Co. reported book income of $10,359,000 for the year ended December 31, 2022, its first year of operations. Their tax account reported that their taxable income for the year was $9,323,000. If the change in amounts was caused by a temporary difference that will reverse in 2023, and if Krondor Co. tax rate is 30% in 2022 and 35% in 2023, what should the company report as either a deferred tax asset or liability for 2022? (1 ?' O $310,800 deferred tax asset O $362,600 deferred tax liability $362,600 deferred tax asset O $310,800 deferred tax liabilityarrow_forwardTamarisk Inc. had pretax financial income of $139,400 in 2025. Included in the computation of that amount is insurance expense of $4,400 which is not deductible for tax purposes. In addition, depreciation for tax purposes exceeds accounting depreciation by $10,000. Prepare Tamarisk's journal entry to record 2025 taxes, assuming a tax rate of 30%. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Creditarrow_forwardXYZ Company reported the following pretax income (loss) and related tax rates during the years 2016-2021. Year Pretax Income (loss) Tax rate 2016 $75,000 30% 2017 150,000 30% 2018 240,000 40% 2019 (540,000) 48% 2020 210,000 40% 2021 300,000 42% Prepare the journal entries for the years 2019 and 2020 to record income taxes and the tax effects of the loss. Assume that XYZ elects the carryback provision where possible and it is probable that it will realize benefits of any loss carryforward. Prepare the portion of the income statement that presents your answer in part (a) for the year ended 2019.arrow_forward

- XYZ Company reported the following pretax income (loss) and related tax rates during the years 2016-2021. Year Pretax Income (loss) Таx rate 2016 $75,000 30% 2017 150,000 30% 2018 240,000 40% 2019 (540,000) 48% 2020 210,000 40% 2021 300,000 42% a. Prepare the journal entries for the years 2019 and 2020 to record income taxes and the tax effects of the loss. Assume that XYZ elects the carryback provision where possible and it is probable that it will realize benefits of any loss carryforward. b. Prepare the portion of the income statement that presents your answer in part (a) for the year ended 2019.arrow_forwardWhat is the income tax payable for 2020? (Apply the pre-CREATE law rulings)arrow_forward1. What is the income tax payable for 2020? (Apply the pre-CREATE law rulings)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning