EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Calculate the firm's price earnings ratio on these accounting question?

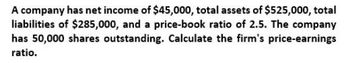

Transcribed Image Text:A company has net income of $45,000, total assets of $525,000, total

liabilities of $285,000, and a price-book ratio of 2.5. The company

has 50,000 shares outstanding. Calculate the firm's price-earnings

ratio.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Renew Company has an earnings per share (EPS) of $3.50, a value per share of $35, and a market value of $36. Calculate the price/earnings (P/E) ratio.arrow_forwardSanedrin Company has an earnings per share (EPS) of $4.50, a value per share of $45 and a market value of $38. Calculate the price/earnings ratio (P/E).arrow_forwardGeneral accountingarrow_forward

- A firm has $160,000 shares of stock outstanding sales of $1.94 million , net income of $126,400 a price earnings ratio of 21.3 and a book value per share of $7.92. What is the market to book ratio?arrow_forwardAccounting. What is the firm's price earning ratio?arrow_forwardOn the balance sheet of Bearcat Inc., you notice "Common Stock ($0.10 par)" of $248,655, "Capital Surplus" of $282,621, and "Retained Earnings" of $210,534. If Bearcat Inc. has Sales of $292,6836 and a profit margin of 30.52%, what is the price/earnings (P/E) ratio of the firm if their stock is currently selling for $21.94 per share? O None of these options are correct 67.18 54.97 240.97 61.07 DISCLarrow_forward

- You find the following financial information about a company: net working capital = $1,071; fixed assets $7,297; total assets = $11,686; and long-term debt = $4,381. What is the company's total equity? Multiple Choice $3,987 $8,539 $4,389 $6,457 $9,387arrow_forwardA company had a market price of $27.50 per share, earnings per share of $1.25, and dividends per share of $0.40. Its price-earnings ratio equals: 22.0. 93.8. 32.0. 3.3. 3.1.arrow_forwardA company reports earnings per share on common stock of $2.00 when the market price of per share of common stock is $50.000. What is the company’s price-earnings ratio?arrow_forward

- A firm has the following accounts; sales = $1,190,000, cost of goods sold = $876,000, depreciation expense = $130,000, addition to retained earnings = $43,000. The firm's dividends per share = $1.05, tax rate = 21%, and number of shares outstanding = 19,000. What is the firm's times interest earned ratio? O 1.76 1.52 11.41 O 1.42arrow_forwardNeed help with this accounting questionarrow_forwardLassiter Industries has annual sales of $220,000 with 12,000 shares of stock outstanding. The firm has a profit margin of 6 percent and a price-sales ratio of 1.20. What is the firm's price-earnings ratio? e B omarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT