Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Need help with this accounting questions

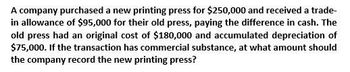

Transcribed Image Text:A company purchased a new printing press for $250,000 and received a trade-

in allowance of $95,000 for their old press, paying the difference in cash. The

old press had an original cost of $180,000 and accumulated depreciation of

$75,000. If the transaction has commercial substance, at what amount should

the company record the new printing press?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Kindly help me with accounting questionsarrow_forwardWhat amount should the company record the new cooling system for this financial accounting question?arrow_forwardWillis Company trades in a printing press for a newer model. The cost of the old printing press was $62,000, and accumulated depreciation up to the date of the trade - in is $46,000. The company also pays $45,000 cash for the newer printing press. The fair market value of the newer printing press is $70,000. The journal entry to acquire the new printing press will required a debit to Printing Press for: A. $45,000 B. $108,000. C. $70,000. D. $62,000arrow_forward

- Cliff Company traded in an old truck for a new one. The old truck had a cost of $300,000 and accumulated depreciation of $60,000. The new truck had an invoice price of $311,000. Huffington was given a $237,000 trade-in allowance on the old truck, which meant they paid $74,000 in addition to the old truck to acquire the new truck. If this transaction has commercial substance, what is the recorded value of the new truck? Multiple Choice $240,000 $300,000 $74,000 $311,000 $314,000arrow_forwardHunter Sailing Company exchanged an old sailboat for a new one. The old sailboat had a cost of $210,000 and accumulated depreciation of $105,000. The new sailboat had an invoice price of $230,000. Hunter received a trade in allowance of $115,000 on the old sailboat, which meant the company paid $115,000 in addition to the old sailboat to acquire the new sailboat. If this transaction has commercial substance, what amount of gain or loss should be recorded on this exchange? Multiple Choice $0 gain or loss $10,000 gain $10,000 loss $105,000 loss $115,000 gainarrow_forwardArca Salvage purchased equipment for $10,000. Arca recorded total depreciation of $8,000 on the equipment. Assume that Arca exchanged the old equipment for new equipment, paying $4,000 cash. The fair market value of the new equipment is $5,000. Journalize Arca's exchange of equipment. Assume this exchange has commercial substance. Let's begin by calculating the gain or loss on the exchange of equipment. (Enter a loss with a minus sign or parentheses.) Market value of assets received Less: Book value of asset exchanged Cash paid Gain or (Loss)arrow_forward

- Caleb Company owns a machine that had cost $46,000 with accumulated depreciation of $20,200. Caleb exchanges the machine for a newer model that has a market value of $56,000. Record the exchange assuming Caleb paid $31,800 cash and the exchange has commercial substance. Record the exchange assuming Caleb paid $23,800 cash and the exchange has commercial substance.arrow_forwardWhat is the depreciable base of the machine on this accounting question?arrow_forwardConnors Corporation acquired manufacturing equipment for use in its assembly line. Below are four independent situations relating to the acquisition of the equipment. What journal entry is required for each situation ? The equipment was purchased on account for $25,000. Credit terms were 2/10, n/30. Payment was made within the discount period and the company records the purchases of equipment net of discounts. Connors gave the seller a noninterest-bearing note. The note required payment of $27,000 one year from date of purchase. The fair value of the equipment is not determinable. An interest rate of 10% properly reflects the time value of money in this situation. Connors traded in old equipment that had a book value of $6,000 (original cost of $14,000 and accumulated depreciation of $8,000) and paid cash of $22,000. The old equipment had a fair value of $2,500 on the date of the exchange. The exchange has commercial substance. Connors issued 1,000 shares of its no-par common stock…arrow_forward

- A company purchased a machine valued at $70,000. It traded in an old (similar) machine for a $9, 400 trade-in allowance, meaning the company paid $60, 600 cash with the trade-in. The old machine cost $48,000 and had accumulated depreciation of $39,600. For tax purposes, the new machine should be recorded at $. ( Do not input a comma or cents.)arrow_forwardPlease given answerarrow_forwardOn August 1, Gold Company exchanged a machine for a similar machine owned by Cowboy Company and also received $7,000 cash from Cowboy Company. Gold's machine had an original cost of $80,000, accumulated depreciation to date of $14,500, and a fair market value of $60,000. Cowboy’s machine had an original cost of $95,000 and a book value of $45,000 and a fair value of $53,000.Required:a. Prepare the necessary journal entry by Gold Company to record this transaction.b. Prepare the necessary journal entry by Cowboy Company to record this transaction.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College