EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Solve this question Financial accounting

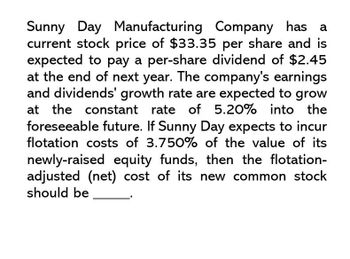

Transcribed Image Text:Sunny Day Manufacturing Company has a

current stock price of $33.35 per share and is

expected to pay a per-share dividend of $2.45

at the end of next year. The company's earnings

and dividends' growth rate are expected to grow

at the constant rate of 5.20% into the

foreseeable future. If Sunny Day expects to incur

flotation costs of 3.750% of the value of its

newly-raised equity funds, then the flotation-

adjusted (net) cost of its new common stock

should be

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 1. Sunny Day Manufacturing Company has a current stock price of $22.35 per share, and is expected to pay a per-share dividend of $1.36 at the end of the year. The company’s earnings’ and dividends’ growth rate are expected to grow at the constant rate of 9.40% into the foreseeable future. If Sunny Day expects to incur flotation costs of 5.00% of the value of its newly-raised equity funds, then the flotation-adjusted (net) cost of its new common stock (rounded to two decimal places) should be _______ . 15.81% 15.49% 13.44% 12.65%arrow_forwardThe stock of Nogro Corporation is currently selling for $16 per share. Earnings per share in the coming year are expected to be $4 The company has a policy of paying out 40% of its earnings each year in dividends. The rest es retained and invested in projects that earn a 25% rate of return per year. This situation is expected to continue indefinitely Required: a. Assuming the current market price of the stock reflects its intrinsic value as computed using the constant-growth DDM, what rate of return do Nogro's investors require? (Do not round intermediate calculations.) Rate of retur Return to question Answer is complete and correct. 250% b. By how much does its value exceed what it would be if all earnings were paid as dividends and nothing was reinvested?arrow_forwardStacker Weight Loss currently pays an annual year-end dividend of $1.40 per share. It plans to increase this dividend by 5.0 % next year and maintain it at the new level for the foreseeable future. If the required return on this firm's stock is 15 % what is the value of Stacker's stock?arrow_forward

- DFB, Inc. expects earnings next year of $5.99 per share, and it plans to pay a $4.36 dividend to shareholders (assume that is one year from now). DFB will retain $1.63 per share of its earnings to reinvest in new projects that have an expected return of 14.8% per year. Suppose DFB will maintain the same dividend payout rate, retention rate, and return on new investments in the future and will not change its number of outstanding shares. Assume next dividend is due in one year. a. What growth rate of earnings would you forecast for DFB? b. If DFB's equity cost of capital is 12.6%, what price would you estimate for DFB stock today? c. Suppose instead that DFB paid a dividend of $5.36 per share at the end of this year and retained only $0.63 per share in earnings. That is, it chose to pay a higher dividend instead of reinvesting in as many new projects. If DFB maintains this higher payout rate in the future, what stock price would you estimate for the firm now? Should DFB raise its…arrow_forwardDFB, Inc. expects earnings next year of $4.73 per share, and it plans to pay a $3.09 dividend to shareholders (assume that is one year from now). DFB will retain $1.64 per share of its earnings to reinvest in new projects that have an expected return of 15.4% per year. Suppose DFB will maintain the same dividend payout rate, retention rate, and return on new investments in the future and will not change its number of outstanding shares. Assume next dividend is due in one year. a. What growth rate of earnings would you forecast for DFB? b. If DFB's equity cost of capital is 12.6%, what price would you estimate for DFB stock today? c. Suppose instead that DFB paid a dividend of $4.09 per share at the end of this year and retained only $0.64 per share in earnings. That is, it chose to pay a higher dividend instead of reinvesting in as many new projects. If DFB maintains this higher payout rate in the future, what stock price would you estimate for the firm now? Should DFB raise its…arrow_forwardDFB, Inc. expects earnings next year of $5.87 per share, and it plans to pay a $3.39 dividend to shareholders (assume that is one year from now). DFB will retain $2.48 per share of its earnings to reinvest in new projects that have an expected return of 15.5% per year. Suppose DFB will maintain the same dividend payout rate, retention rate, and return on new investments in the future and will not change its number of outstanding shares. Assume next dividend is due in one year. a. What growth rate of earnings would you forecast for DFB? b. If DFB's equity cost of capital is 11.9%, what price would you estimate for DFB stock today? c. Suppose instead that DFB paid a dividend of $4.39 per share at the end of this year and retained only $1.48 per share in earnings. That is, it chose to pay a higher dividend instead of reinvesting in as many new projects. If DFB maintains this higher payout rate in the future, what stock price would you estimate for the firm now? Should DFB raise its…arrow_forward

- LTX Ltd expects earnings this year of $$5.275.27 per share, and it plans to pay a $$3.413.41 dividend to shareholders. LTX will retain $$1.861.86 per share of its earnings to reinvest in new projects which have an expected return of 16.516.5% per year. Suppose LTX will maintain the same dividend payout rate, retention rate and return on new investments in the future and will not change its number of outstanding shares. (a) LTX's growth rate of earnings is %(Round your answer to four decimal places) (b) If LTX's equity cost of capital is 12.912.9%, then LTX's share price will be $$(Round your answer to the nearest cent) (c) If LTX paid a dividend of $$4.134.13 per share this year and retained only $$1.141.14 per share in earnings. That is, it chose to pay a higher dividend instead of reinvesting its profits in as many new projects as it was going to under its original plan. If LTX maintains this new, higher payout rate in the future, then LTX's share price would be $$.(Round…arrow_forwardDFB, Inc. expects earnings next year of $5.63 per share, and it plans to pay a $4.11 dividend to shareholders (assume that is one year from now). DFB will retain $1.52 per share of its earnings to reinvest in new projects that have an expected return of 14.8% per year. Suppose DFB will maintain the same dividend payout rate, retention rate, and return on new investments in the future and will not change its number of outstanding shares. Assume next dividend is due in one year. a. What growth rate of earnings would you forecast for DFB? b. If DFB's equity cost of capital is 12.5%, what price would you estimate for DFB stock today? c. Suppose instead that DFB paid a dividend of $5.11 per share at the end of this year and retained only $0.52 per share in earnings. That is, it chose to pay a higher dividend instead of reinvesting in as many new projects. If DFB maintains this higher payout rate in the future, what stock price would you estimate for the firm now? Should DFB raise its…arrow_forwardDFB, Inc. expects earnings next year of $4.48 per share, and it plans to pay a $2.54 dividend to shareholders (assume that is one year from now). DFB will retain $1.94 per share of its earnings to reinvest in new projects that have an expected return of 15.7% per year. Suppose DFB will maintain the same dividend payout rate, retention rate, and return on new investments in the future and will not change its number of outstanding shares. Assume next dividend is due in one year. a. What growth rate of earnings would you forecast for DFB? b. If DFB's equity cost of capital is 11.8%, what price would you estimate for DFB stock today? c. Suppose instead that DFB paid a dividend of $3.54 per share at the end of this year and retained only $0.94 per share in earnings. That is, it chose to pay a higher dividend instead of reinvesti in as many new projects. If DFB maintains this higher payout rate in the future, what stock price would you estimate for the firm now? Should DFB raise its…arrow_forward

- DFB, Inc. expects earnings next year of $5.00 per share, and it plans to pay a $3.00 dividend to shareholders (assume that is one year from now). DFB will retain $2.00 per share of its earnings to reinvest in new projects that have an expected return of 15.0% per year. Suppose DFB will maintain the same dividend payout rate, retention rate, and return on new investments in the future and will not change its number of outstanding shares. Assume next dividend is due in one year. a. What growth rate of earnings would you forecast for DFB? b. If DFB's equity cost of capital is 12.0%, what price would you estimate for DFB stock today? c. Suppose instead that DFB paid a dividend of $4.00 per share at the end of this year and retained only $1.00 per share in earnings. That is, it chose to pay a higher dividend instead of reinvesting in as many new projects. If DFB maintains this higher payout rate in the future, what stock price would you estimate for the firm now? Should DFB raise its…arrow_forwardSidman Products’s common stock currently sells for $60.00 ashare. The firm is expected to earn $5.40 per share this year and to pay a year-end dividendof $3.60, and it finances only with common equity.a. If investors require a 9% return, what is the expected growth rate?b. If Sidman reinvests retained earnings in projects whose average return is equal tothe stock’s expected rate of return, what will be next year’s EPS?arrow_forwardDFB, Inc. expects earnings next year of $4.29 per share, and it plans to pay a $2.78 dividend to shareholders (assume that is one year from now). DFB will retain $1.51 per share of its earnings to reinvest in new projects that have an expected return of 14.3% per year. Suppose DFB will maintain the same dividend payout rate, retention rate, and return on new investments in the future and will not change its number of outstanding shares. Assume next dividend is due in one year. a. What growth rate of earnings would you forecast for DFB? b. If DFB's equity cost of capital is 11.7%, what price would you estimate for DFB stock today? c. Suppose instead that DFB paid a dividend of $3.78 per share at the end of this year and retained only $0.51 per share in earnings. That is, it chose to pay a higher dividend instead of reinvesting in as many new projects. If DFB maintains this higher payout rate in the future, what stock price would you estimate for the firm now? Should DFB raise its…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT