Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Hello tutor please given correct answer general Accounting

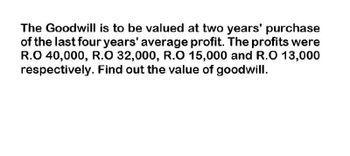

Transcribed Image Text:The Goodwill is to be valued at two years' purchase

of the last four years' average profit. The profits were

R.O 40,000, R.O 32,000, R.O 15,000 and R.O 13,000

respectively. Find out the value of goodwill.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- An asset costs $19,000. At a depreciation rate of 20 percent, calculate its book value using declining-balance method. a. After one year b. After two years c. After six years a. The book value after one year is $ . (Round to the nearest dollar as needed.)arrow_forwardConsider an asset with a cost basis of $10,000 that has been depreciated using 100% bonus depreciation. What is the gain or loss if the asset is disposed of after 5 years of operation for (a) $7000, (b) $0, and (c) a cost of $2000?arrow_forwardThe following present value factors are provided for use in this problem. Periods Present Value of $1 at 8% Present Value of an Annuity of $1 at 8% 1 0.9259 0.9259 2 0.8573 1.7833 3 0.7938 2.5771 4 0.7350 3.3121 Xavier Company wants to purchase an asset for $37,000 with a four-year life and a $1,000 salvage value. Xavier requires an 8% return on investment. The expected year - end net cash flows are $12,000 in each of the four years. What is the machine's net present value (round to the nearest whole dollar)?arrow_forward

- Consider an asset with upfront cost of $12,210. The cost associated with it during the first year of operation is $6,526. The cost associated with it during the second year of operation is $10,861. With an interest rate of 0.03, what is a levelized cost payment payable at the end of years 1 and 2, which has the same present value as the actual cost stream at the end of period 0. The annuity formula for an interest rate of 0.03 and t payments is given by (1+i)* 1-(1+i) t =arrow_forwardThe MACRS depreciation allowances on 3-year property are 33.33%, 44.45%, 14.81%, and 7.41%, respectively. What is the amount of the depreciation for Years 1, 2, and 3 for a 3-year property with an initial cost of $64,000?arrow_forwardIf the EBIT for the year is $5000, depreciation is $1000 and the tax rate is 20%. Further CA on Dec. 31st were $1500 and the CL were $700. On Jan. 1st the CA were $1000 and the CL were $800. The value of Future Assets on Dec.31st was $3000 and on Jan.1st was $5000. Find the CFA.arrow_forward

- An asset with a purchase price of $501,013 falls in the 3-year MACRS asset class. The asset will be sold at the end of a three year project for $180,745. What is the book value of the asset at the end of the project? Round your answer to the nearest dollar. Year Depreciable Allowance 1 33% 2 45 3 15 4 7arrow_forwardIf an asset book-depreciates by the DDB method over a 10-year period, how long will it take to reach its salvage value if the estimated salvage is 20% of the first cost? Remember, assets can continue to depreciate after they have reached their salvage value.arrow_forwardA company purchases an asset for P10,000.00 and plans to keep it for 20 years. If the salvage value is zero at the end of the 20th year, what is the depreciation in the third year? Use the sum of the years digit method.arrow_forward

- An asset is purchased for Php50,000. The salvage value in 25 years is Php100,00. What are the depreciation in the first three years using straight line method?arrow_forwardReferring to PA7 where Kenzie Company purchased a 3-D printer for $450,000, consider how the purchase of the printer impacts not only depreciation expense each year but also the assets book value. What amount will be recorded as depreciation expense each year, and what will the book value be at the end of each year after depreciation is recorded?arrow_forwardA truck was purchased for $58,000 and depreciates $6560 per year. Suppose that the vehicle is depreciated so that it holds 60% of its value from the previous year. Write an exponential function of the form =yV0bt , where V0 is the initial value and t is the number of years after purchase.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT