FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

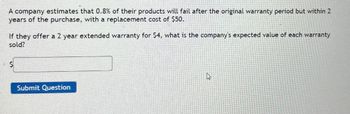

Transcribed Image Text:A company estimates that 0.8% of their products will fail after the original warranty period but within 2

years of the purchase, with a replacement cost of $50.

If they offer a 2 year extended warranty for $4, what is the company's expected value of each warranty

sold?

Submit Question

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You have a 35-year loan that is being paid in installments of 2,000 at the end of each year at an effective annual rate of 6%. Immediately after the 29th installment, the loan is renegotiated by keeping the period of the loan and the interest unchanged but the payments will change from now on to be 1700, 1700 + x, 1700 + 2x, . . . , 1700 + 5x. Find xarrow_forward4. The extended warranty on a $1,250 dishwasher is 18% of the purchase price and lasts for five years. What is the effective cost per year of the extended warranty?arrow_forwardA real estate broker decides to lease a car for 36 months. Suppose the annual interest rate is 7.8%, the negotiated price is $48,000, there is no trade-in, and the down payment is $3,000. Find the monthly lease payment (in dollars). Assume that the residual value is 48% of the MSRP of $51,800.arrow_forward

- A mortgage broker is offering a $279,000 30-year mortgage with a teaser rate. In the first two years of the mortgage, the borrower makes monthly payments on only a 4.5 percent APR interest rate. After the second year, the mortgage interest rate charged increases to 7.5 percent APR. What are the monthly payments in the first two years? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly payment What are the monthly payments after the second year? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly payment > 2 D TRENE VAR TVUNG S 2006- E - Earrow_forwardA holder of a 90-day bill with 40 days left to maturity and a face value of $ 100, 000 chooses to sell it into the market. If bills maturing in 40 days are currently yielding 1.75% per annum, what price will be obtained? (Assume there are 365 days in a year, and answers must be rounded to two decimal places) $ Please only use a plain number as your answer and don't insert a comma. For example, if you get 1000, please use 1000, and don't use 1,000.arrow_forwardA homeowner took out a 15-year fixed-rate mortgage of $140,000. The mortgage was taken out 7 years ago at a rate of 7.4 percent. If the homeowner refinances, the charges will be $1,000. What is the highest interest rate at which it would be beneficial to refinance the mortgage? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. APR %arrow_forward

- What is the effective yield to the lender through the date of prepayment on a $540,000 fixed rate mortgage loan fully amortizing over 30 years but paid off after 10 years if the stated annual interest rate is 6.50%, the lender charges 2.0% as an origination fee, $720 for an appraisal and $36 for a credit report and there is no prepayment penalty? -6.81% -6.71% -6.30% -6.50%arrow_forwardA mortgage broker is offering a $279,000 30-year mortgage with a teaser rate. In the first two years of the mortgage, the borrower makes monthly payments on only a 4.5 percent APR interest rate. After the second year, the mortgage interest rate charged increases to 7.5 percent APR. What are the monthly payments in the first two years? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly payment What are the monthly payments after the second year? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly paymentarrow_forwardA mortgage broker is offering a 30-year $192,900 mortgage with a teaser rate. In the first two years of the mortgage, the borrower makes monthly payments on only a 4.9 percent APR interest rate. After the second year, the mortgage interest rate charged increases to 7.9 percent APR. What are the monthly payments in the first two years? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly payment What are the monthly payments after the second year? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly paymentarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education