FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Don't use AI.

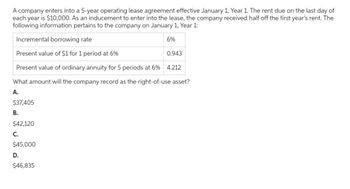

Transcribed Image Text:A company enters into a 5-year operating lease agreement effective January 1, Year 1. The rent due on the last day of

each year is $10,000. As an inducement to enter into the lease, the company received half off the first year's rent. The

following information pertains to the company on January 1, Year 1:

Incremental borrowing rate

6%

Present value of $1 for 1 period at 6%

0.943

Present value of ordinary annuity for 5 periods at 6% 4.212

What amount will the company record as the right-of-use asset?

A.

$37,405

B.

$42,120

C.

$45,000

D.

$46,835

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 1, Lessee Company leases equipment with a useful life of 5 years for a 3-year lease term. Payments of $52,000 are due at the beginning of each year. The incremental borrowing rate is 3%. The present value of the payments is $151,320. Which of the following is true? Lease expense at the end of the first year is $52,000. Amortization expense at the end of the first year is $151,320 divided by 3. The lease liability at the end of the first year is reduced by $52,000. The ROU asset at the end of the first year is $99,320.arrow_forwardGeneral Accountingarrow_forwardApplying New Lease Accounting Standards for Operating Leases On January 1 of the current year, CCH Corporation entered into the following lease contract. Based on the facts, CCH Corporation classifies the lease as an operating lease. Details of lease contract Leased asset Office space Lease term 5 years Annual lease payment $115,487 Upfront fees $10,000 Cost of debt capital 5% a. Determine the amount of the lease liability that CCH will add to its balance sheet at the inception of the lease. Amount of lease liability b. What amount will be added to the balance sheet as an asset? Amount added as an asset The rest of the questions are given in pictures below. please answer all parts correctly. i will upvote. thank you!!arrow_forward

- Recognize for year one ? General accountingarrow_forwardSubject :- Accountingarrow_forwardReporting a Finance Lease Pier10 Inc. entered into a five-year lease and recorded a right-of-use asset and lease liability of $88,000 on January 1. Pier10 Inc. was aware of the lessor's implicit rate of interest of 5%. The equipment under lease ha an estimated five-year useful life with no residual value. The first lease payment of $19,358 was due upon commencement of the lease. Show the balance sheet presentation on December 31, and the income statement presentation for the year ended December 31. Note: Round your answers to the nearest whole dollar.. Note: Do not use negative signs with your answers. Assets Balance Sheet Noncurrent assets: Right-of-Use Asset Liabilities Current liabilities: Lease Liability Noncurrent liabilities: Lease Liability Income Statement December 31 88,000 * 19,358 ✓ 0 % December 31 Expenses Interest Expense $ 3,432 ✔ Amortization Expense 17,600 ✓arrow_forward

- After the fourth year, the residual value was estimated at The lease provided for a transfer of title to the lessee at the and four year-end rental payments. The lease qualified as a Module4_Lease.pdf x of the asset was P7,994,000. Terms of the lease specify four-year life for the lease, an annual interest rate of 15% Ericson Company leased an asset to another entity. The coet 12 / 19 100% Problem 13-13 (IAA) direct financing lease.. The lease provided for a transfer of title to the lessee After the fourth year, the residual value was estimated P1,000,000. The PV of 1 at 15% for 4 periods is .572, and the PV of a ordinary annuity of 1 at 15% for 4 periods is 2.855. What is the annual rental payment? a. 2,000,000 b. 3,000,350 c. 2,800,000 d. 2,599,650arrow_forwardok nt ences A finance lease agreement calls for quarterly lease payments of $7,056 over a 10-year lease term, with the first payment on July 1, the beginning of the lease. The annual interest rate is 12%. Both the present value of the lease payments and the cost of the asset to the lessor are $168,000. Required: a. Prepare a partial amortization table up to the October 1 payment. b. What would be the amount of interest expense (revenue) the lessee (lessor) would record in conjunction with the second quarterly payment on October 1? Complete this question by entering your answers in the tabs below. Required A Required B Prepare a partial amortization table up to the October 1 payment. Note: Enter all amounts as positive values. Round your answers to the nearest whole dollar. Date July 1 July 1 October 1 Lease Payment Effective Interest Decrease in Outstanding balance balance Required B >arrow_forwardOn 1 January 20X1, Dynamic entered into a three year lease for a lorry. Lease payments are $10,000 per year for the first two years and $15,000 for the third year. All payments are due at the end of the year. The present value of the lease payments was $31,552, and Dynamic incurred initial direct costs of $3,000. Dynamic's rate of borrowing is 5%. Prepare extracts from Dynamic's financial statements in respect of the lease agreement for the year ended 31 December 20X1.arrow_forward

- Recording Sales-Type Lease, Purchase Option-Lessor Flint Company leased equipment to Land Company for a five-year period. Flint paid $112,716 for the equipment, which equals its current carrying value (with estimated useful life of five years). The lease commenced on January 1 of Year 1. Flint uses a target rate of return of 8% in all lease contracts. The first payment was received on January 1 of Year 1, and Flint's accounting periods end on December 31. The lease contract contains a purchase option stating that Land Company can purchase the equipment for $9,600 on January 1 of Year 6, at which time its residual value is estimated to be $15,600. It is reasonably certain that Land Company will exercise the purchase option at the end of the lease term. a. Compute the annual payment calculated by the lessor. • Note: Round answer to the nearest dollar. • Note: Do not use a negative sign with your answer. $ 26,139 Xarrow_forwardHelp with questions 14,15,16,17arrow_forwardLeases: Dowell leased the warehouses 1 year ago on December 31. The 5 year lease agreement called for Dowell to make quarterly lease payments of $2,398,303 payable each December 31, March 31, June 30 & September 30, with the first payment at the lease’s beginning. As a finance lease, Dowell had recorded the right-of-use asset and liability at $40 million, the present value of the lease payments at 8%. Dowell records amortization on a straight-line basis at the end of each fiscal year. Today, Dowell’s controller explained a proposal to sublease the underused warehouses to American Tankers Inc for the remaining 4 years of the lease term. American Tankers would be substituted as lessee under the original lease agreement. As the new lessee, it would become the primary obligor under the agreement, and Dowell would not be secondarily liable for fulfilling the obligations under the lease agreement. How would we need to account for this? After the first full year under the warehouse…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education