Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

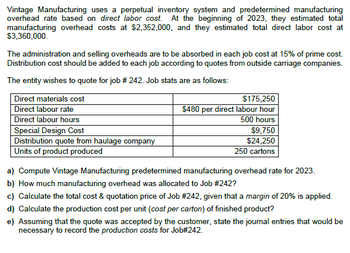

Transcribed Image Text:Vintage Manufacturing uses a perpetual inventory system and predetermined manufacturing

overhead rate based on direct labor cost. At the beginning of 2023, they estimated total

manufacturing overhead costs at $2,352,000, and they estimated total direct labor cost at

$3,360,000.

The administration and selling overheads are to be absorbed in each job cost at 15% of prime cost.

Distribution cost should be added to each job according to quotes from outside carriage companies.

The entity wishes to quote for job # 242. Job stats are as follows:

Direct materials cost

Direct labour rate

$175,250

$480 per direct labour hour

500 hours

Direct labour hours

Special Design Cost

Distribution quote from haulage company

Units of product produced

$9,750

$24,250

250 cartons

a) Compute Vintage Manufacturing predetermined manufacturing overhead rate for 2023.

b) How much manufacturing overhead was allocated to Job #242?

c) Calculate the total cost & quotation price of Job #242, given that a margin of 20% is applied.

d) Calculate the production cost per unit (cost per carton) of finished product?

e) Assuming that the quote was accepted by the customer, state the journal entries that would be

necessary to record the production costs for Job#242.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Bobcat uses a traditional cost system and estimates next years overhead will be $800.000, as driven by the estimated 25,000 direct labor hours. It manufactures three products and estimates the following costs: If the labor rate is $30 per hour, what is the per-unit cost of each product?arrow_forwardEverlast Manufacturing Company uses a predetermined manufacturing overhead rate based on a percentage of direct labor cost. At the beginning of 2020, they estimated total manufacturing overhead costs at $1,203,750, and they estimated total direct labor costs at $1,500,00o. The administration and selling overheads are to be absorbed in each job cost at 33%% of prime cost. Distribution cost should be added to each job according to quotes from outside carriage companies. The company wishes to quote for Job # B4000. Data for the job are as follows: Direct materials cost $159,500 Direct labour cost $240,000 Direct labour hours 400 hours Special Design Cost Distribution quote from haulage company $12,850 $17,900arrow_forwardEpsilon Manufacturing Company uses a predetermined manufacturing overhead rate based on a percentage of direct labor cost. At the beginning of 2018, they estimated total manufacturing overhead costs at $1,015,000, and they estimated total direct labor costs at $1,400,000. The administration and selling overheads are to be absorbed in each job cost at 15% of production cost. Distribution cost should be added to each job according to quotes from outside carriage companies.The company wishes to quote for job # W500. Data for the job are as follows:Direct materials cost $169,450Direct labour cost $230,000Direct labour hours 400 hoursSpecial Design Cost $12,300Distribution quote from haulage company $17,930Units of product produced 250 cratesIf predetermined Overhead rate is 72.50%. Calculate the total cost & quotation price of Job #W500, given that a margin of 25% is applied.arrow_forward

- Compute for the total Factory overhead rate of G Department, if the company uses the step method in allocating service department costs and distributes the cost of Department U first, Department V second and finally Department W. The producing departments uses the following bases: Department H, 100,000 direct labor hours; and Department G, 195,000 direct labor hours. The Madalilangko Ink Company prepared the following table for the year 2019: Production Service Departments Departments H G U V W Rent 250,000 770,000 15,000 14,500 7,000 Repairs 100,000 120,500 23,000 30,000…arrow_forwardWhat is the predetermined overhead allocation rate?arrow_forwardAaron, Inc. estimates direct labor costs and manufacturing overhead costs for the coming year to be $760,000 and $500,000, respectively. Aaron allocates overhead costs based on machine hours. The estimated total labor hours and machine hours for the coming year are 16,000 hours and 5,000 hours, respectively. What is the predetermined overhead allocation rate? (Round your answer to the nearest cent.) OA. $1.52 per labor hour OB. $100.00 per machine hour OC. $152.00 per machine hour O D. $31.25 per labor hourarrow_forward

- Aaron, Inc. estimates direct labor costs and manufacturing overhead costs for the coming year to be $770,000 and $500,000, respectively. Aaron allocates overhead costs based on machine hours. The estimated total labor hours and machine hours for the coming year are 17,000 hours and 5,000 hours, respectively. What is the predetermined overhead allocation rate? (Round your answer to the nearest cent.) A. $29.41 per labor hour B. $1.54 per labor hour C. $154.00 per machine hour D. $100.00 per machine hourarrow_forwardMichael Scott Paper Co. uses a predetermined overhead allocation rate to allocate overhead to individual jobs, based on the machine hours required.At the beginning of 2020, the company expected to incur the following:Michael Scott Paper Co.Beginning of 2020 Manufacturing overhead costs $1,001,910 Direct labor costs $1,512,800 Number of Machine hours to be used 73,400 At the end of 2020, the company had actually incurred:Michael Scott Paper Co.End of 2020 Direct labor costs $1,219,700 Depreciation on manufacturing plant equipment $596,400 Property taxes on plant $39,600 Sales Salaries $28,400 Delivery drivers wages $25,600 Plant janitor's wages $17,100 Number of Machine hours actually used 65,700 (Round your answers to two decimal places when needed and use rounded answers for all future calculations).1. Compute the predetermined overhead allocation rate. Total estimated overhead cost ? Total estimated quantity of the overhead allocation base =…arrow_forwardAnderson Manufacturing estimates direct labor costs and manufacturing overhead costs for the upcoming year to be $850,000 and $600,000, respectively. Anderson allocates overhead costs based on machine hours. The estimated total labor hours and machine hours for the coming year are 19,000 hours and 7,500 hours, respectively. What is the predetermined overhead allocation rate? (Round your answer to the nearest cent.)arrow_forward

- Aaron Company estimates direct labor costs and manufacturing overhead costs for the coming year to $900,000 and $700,000, respectively. Aaron allocates overhead costs based on labor hours. the estimated total labor hours and machine hours for the coming year are 16,000 hours and 10,000 hours, respectively., What's the predetermined overhead allocation rate?arrow_forwardCavy Company estimates that total factory overhead costs will be $1,039,500 for the year. Direct labor hours are estimated to be 110,000.arrow_forwardPrepare a schedule of cost of goods manufactured for the year ended June 30, 2021, clearly showing total manufacturing cost & total manufacturing costs to account for and Prepare an income statement for Regional Safety Supplies for the year ended June 30, 2021. List the non-manufacturing overheads in order of size starting with the largest. What is the selling price per mask if Regional Safety Supplies manufactured 1,850 masks for the period under review and uses a mark-up of 25% on cost?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning