Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Do fast answer of this accounting questions

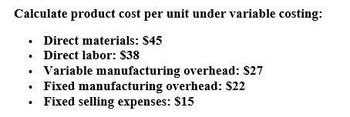

Transcribed Image Text:Calculate product cost per unit under variable costing:

⚫ Direct materials: $45

Direct labor: $38

⚫ Variable manufacturing overhead: $27

⚫ Fixed manufacturing overhead: $22

. Fixed selling expenses: $15

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Given the following information, determine the product cost of one unit: Direct Materials = $60; Direct labor = $10; Apply Overhead based on $2 per Direct Labor hour; Direct labor hours is 4 hours per unit. a. $70 per unit b. $80 per unit c. $78 per unit d. $85 per unit Contribution margin is sales less: a. Fixed overhead and fixed selling and administrative expenses b. Variable Cost of goods sold and variable selling & administrative expenses c. Variable selling and administrative expemses and Fixed selling and administrative expenses d. variable cost of goods sold An investment generates an operating income of $100,000, and the average operating assets are $400,000. What is the return on the investment? a. 100% b. 75% c. 25% d. 20%arrow_forwardThe following variable production costs apply to goods made by Fanning Manufacturing Corporation: Item Materials Labor Variable overhead Total Required Determine the total variable production cost, assuming that Fanning makes 10,000, 20,000, or 30,000 units. Units Produced Cost per Unit $10.00 2.50 0.75 $13.25 Total variable cost 10,000 20,000 30,000arrow_forwardHi expart Provide solutionarrow_forward

- Urmilabenarrow_forwardnarubhaiarrow_forwardGiven the following data, calculate product cost per unit under absorption costing. Direct labor RM 18 per unit Direct materials RM 12 per unit Overhead Total variable overhead RM 31,000 Total fixed overhead RM 101,000 Expected units to be produced 51,000 units Multiple Choice a.30.00 per unit b.30.61 per unit c.31.98 per unit d.32.59 per unit e.33.00 per unitarrow_forward

- The following variable production costs apply to goods made by Baird Manufacturing Corporation: Item Materials Labor Variable overhead Total Units Produced Cost per Unit $15.00 Total variable cost Required Determine the total variable production cost, assuming that Baird makes 11,000, 21,000, or 31,000 units. 5.50 0.75 $21.25 11,000 Check my work 21,000 31,000arrow_forwardDirect material $0.10, Direct laber is $0.25, Variable Overhead is $0.10, Fixed overhead is $0.40 what is the fixed costs per unit, the total cost per unit, and gross margin if 1,600,000 units were produced?arrow_forwardrmn.1arrow_forward

- Net income under variable costing is P 30,000. Data shows: the total manufacturing cost per unit is P 20; total variable cost per unit is P 15 per unit and variable period cost is P 3 per unit. Beginning and ending inventories are 1,000 units and 1,500 units, respectively. What is the income under absorption costing?arrow_forwardSubject. General Account. questionsarrow_forwardB. Find the cost of a product Different costs are presented below Direct materials $ 5.00 per unit Indirect materials $ 2.00 per unit Direct labor $ 10.00 per hour Indirect labor $ 3.00 per hour Other variable indirect costs $ 6.00 per hour Other fixed indirect costs $ 10.00 per unit Commissions to sellers $ 4.00 per unit Variable administrative costs $ 6.00 per unit Fixed Administrative Costs $ 10.00 per unit 2. Determine the Sales Price if the company expects to earn 140% on cost (Markup of 140 on cost). .arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub