FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

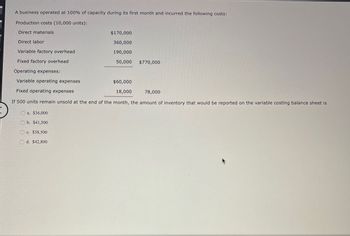

Transcribed Image Text:A business operated at 100% of capacity during its first month and incurred the following costs:

Production costs (10,000 units):

Direct materials

Direct labor

$170,000

360,000

Variable factory overhead

190,000

Fixed factory overhead

50,000

$770,000

Operating expenses:

Variable operating expenses

Fixed operating expenses

$60,000

18,000

78,000

If 500 units remain unsold at the end of the month, the amount of inventory that would be reported on the variable costing balance sheet is

a. $36,000

b. $41,500

c. $38,500

d. $42,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Jennifer R Us is currently operating at 100% capacity and incurred the following costs during the first month of operations: Units produced Direct labor Direct material Variable manufacturing overhead Fixed manufacturing overhead Variable operating expenses Fixed operating expenses 20100 O $47750. O $69951. O $58100. O $56000. $241200 179900 280500 102400 129700 50900 If the company has ending inventory of 1400 units for the month, how much inventory would be reported on the balance sheet using absorption costing?arrow_forwardA business operated at 100% of capacity during its first month, with the following results: Sales (112 units) $560,000 Production costs (140 units): Direct materials $70,000 Direct labor 17,500 Variable factory overhead 31,500 Fixed factory overhead 28,000 147,000 Operating expenses: Variable operating expenses $5,450 Fixed operating expenses 3,690 9,140 The amount of operating income that would be reported on the variable costing income statement is a. $559,860 b. $459,350 c. $427,660 d. $550,860arrow_forwardA business operated at 100% of capacity during its first month, with the following results: Sales (107 units) $502,900 Production costs (134 units): Direct materials $68,081 Direct labor 17,382 Variable factory overhead 30,419 Fixed factory overhead 28,972 144,854 Operating expenses: Variable operating expenses $5,613 Fixed operating expenses 4,372 9,985 What is the amount of the gross profit that would be reported on the absorption costing income statement?arrow_forward

- A business operated at 100% of capacity during its first month and incurred the following costs: Production costs (19,700 units): Direct materials $181,900 Direct labor 237,500 Variable factory overhead 254,900 Fixed factory overhead 93,200 $767,500 Operating expenses: Variable operating expenses $121,300 Fixed operating expenses 43,000 164,300 If 1,800 units remain unsold at the end of the month, the amount of inventory that would be reported on the absorption costing balance sheet is Oa. $61,611 Ob. $85,139 Oc. $72,694 Od. $70,128arrow_forwardWalsh Company manufactured 30,000 units during July. There were no units in inventory on July 1. Costs and expenses for July were as follows: Total Num Total Cost Number of Units Unit Cost Manufacturing costs: Variable $660,000 30,000 $22.00 Fixed 300,000 30,000 10.00 Total 960,000 Selling and administrative expenses: Variable $200,000 Fixed 160,000 Total. $360,000 If the company sells 25,000 units at $75 (units manufactured exceed units sold), prepare an income statement for July using: b. Variable costingarrow_forwardA business operated at 100% of capacity during its first month and incurred the following costs: Production costs (5,000 units): Direct materials Direct labor Variable factory overhead Fixed factory overhead Operating expenses: Variable operating expenses Fixed operating expenses $70,000 20,000 10,000 2,000 $17,000 1,000 $102,000 18,000 If 1,000 units remain unsold at the end of the month and sales total $150,000 for the month, the amount of manufacturing margin that would be reported on the absorption costing income statement is a. $54,000 b. $50,000 c. $70,000 d. not reportedarrow_forward

- On January 1 of the current year, Townsend Co. commenced operations. It operated its plant at 100% of capacity during January. The following data summarized the results for January: Units Production 50,000 Sales ($18 per unit) (42,000) Inventory, January 31 8,000 Manufacturing costs: Variable $575,000 Fixed 80,000 Total $655,000 Selling and administrative expenses: Variable $35,000 Fixed 10,500 Total $45,500 a. Prepare an income statement using absorption costing. Townsend Co. Absorption Costing Income Statement For the Month Ended January 31 Nextarrow_forwardA business operated at 100% of capacity during its first month and incurred the following costs: Production costs (19,800 units): Direct materials $177,000 Direct labor 227,000 Variable factory overhead 261,600 Fixed factory overhead 100,400 $766,000 Operating expenses: Variable operating expenses $132,300 Fixed operating expenses 42,700 175,000 If 1,800 units remain unsold at the end of the month, the amount of inventory that would be reported on the variable costing balance sheet is a. $60,498 b. $72,536 Oc. $69,636 O d. $85,545arrow_forwardA business operated at 100% of capacity during its first month and incurred the following costs: Production costs (17,100 units): Direct materials $183,100 Direct labor 227,700 Variable factory overhead 246,200 Fixed factory overhead 104,700 $761,700 Operating expenses: Variable operating expenses $122,200 Fixed operating expenses 49,300 171,500 If 1,600 units remain unsold at the end of the month and sales total $1,079,000 for the month, what would be the amount of income from operations reported on the absorption costing income statement? a.$216,975 b.$71,270 c.$207,274 d.$61,474arrow_forward

- A business operated at 100% of capacity during its first month and incurred the following costs: Production costs (19,200 units): Direct materials Direct labor Variable factory overhead Fixed factory overhead Operating expenses: Variable operating expenses $174,500 232,600 249,000 104,200 $760,300 $134,700 43,300 Fixed operating expenses 178,000 If 1,700 units remain unsold at the end of the month, the amount of inventory that would be reported on the variable costing balance sheet is O a. $67,318 O b. $70,019 O c. $58,089 O d. $83,079arrow_forwardA business operated at 100% of capacity during its first month and incurred the following costs: Production costs (17,100 units): Direct materials $184,100 Direct labor 222,200 Variable factory overhead 241,500 Fixed factory overhead 104,400 $752,200 Operating expenses: Variable operating expenses $126,900 Fixed operating expenses 46,600 173,500 If 1,700 units remain unsold at the end of the month, the amount of inventory that would be reported on the variable costing balance sheet is:arrow_forwardRecords at Hal’s Accounting Services show the following costs for year 1. Direct materials and supplies $ 40,000 Employee costs 2,900,000 Total overhead 1,300,000 Production was 25,000 billable hours. Fixed overhead was $700,000. Assuming no change in billable hours in year 2, direct materials and supplies costs are expected to increase by 10 percent. Direct labor costs are expected to increase by 5 percent. Variable overhead per billable hour is expected to remain the same, but fixed overhead is expected to increase by 5 percent. b. Determine the total costs per billable hour for year 1 and year 2.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education