FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

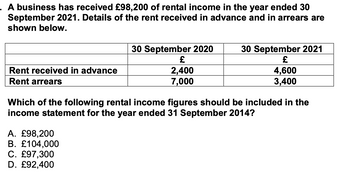

Transcribed Image Text:. A business has received £98,200 of rental income in the year ended 30

September 2021. Details of the rent received in advance and in arrears are

shown below.

Rent received in advance

Rent arrears

30 September 2020

£

2,400

7,000

A. £98,200

B. £104,000

C. £97,300

D. £92,400

30 September 2021

£

4,600

3,400

Which of the following rental income figures should be included in the

income statement for the year ended 31 September 2014?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assuming Sunny-D Cafe has a tax rate of 30 percent, calculate sales for the firm given the following financial information: net income of $37,900; interest expense of $11,500; depreciation expense of $14,200; and costs of $80,900. Points: 1 A. $144,500 B. $154,143 C. $160,743 D. $165,114 E. Remember to breathearrow_forward2021 2020 2019 2018 2017 Sales Cost of goods sold Accounts receivable $ 479,191 246,837 23,289 $ 315,257 $ 247,260 $ 167,634 $ 120,600 162,481 18,379 129,153 16,888 87,443 9,807 61,506 8,249 Compute trend percents for the above accounts, using 2017 as the base year. For each of the three acco situation as revealed by the trend percents appears to be favorable or unfavorable. 2021: 2020: 2019: 2018: 2017: Trend Percent for Net Sales: Numerator: 1 Denominator: 1 1 Is the trend percent for Net Sales favorable or unfavorable? 2021: 2020: 2019: 2018: 2017: Trend Percent for Cost of Goods Sold: Numerator: Denominator: 1 1 1 Is the trend percent for Cost of Goods Sold favorable or unfavorable? 2021: 2020: 2019: 2018: 2017: Trend Percent for Accounts Receivable: Numerator: Denominator: Is the trend percent for Accounts Receivable favorable or unfavorable? = Trend percent % 9900 = % = % = % % Trend percent % % % % % 11 Trend percent = % % % = % %arrow_forwardThe components of income before tax were: Years ended December 31 ($ millions) 2018 U.S. Non-U.S. Total 2017 2016 $12,283 $10,626 $5,925 482 492 437 $12,765 $11,118 $6,362 Income tax expense/(benefit) consisted of the following: Years ended December 31 ($ millions) Current tax expense U.S. federal 2017 2016 Non-U.S. U.S. State Total current $1,967 $1,340 $1,253 $169 $149 $133 97 23 15 Deferred tax expense U.S. federal $2,233 $1,512 $1,401 $224 $(598) $(1,096) Non-U.S. $(4) $3 $(4) U.S. State 5 (6) (44) Total deferred $(1,095) $221 $(646)arrow_forward

- CALCULATE THE EBITDA For the year ended December 31, Notes 2020 2019 Revenue ₱ 10,775,731.00 ₱ 11,334,976.00 Cost of Sales 7,175,540.00 7,552,700.00 Gross profit 3,600,191.00 3,782,276.00 General and Administrative expenses 3,278,202.00 3,417,740.00 Finance Cost Or Interest Expense 48,000.00 16,000.00 Net Income before Tax 273,989.00 348,536.00 Provision for Income Tax 82,197.00 104,561.00 NET INCOME AFTER TAX ₱ 191,792.00 ₱ 243,975.00 (See Notes to Financial Statement)arrow_forwardNet Sales COGS Depreciation EBIT Interest Taxable Income Taxes Net Income 2019 Income Statement Dividends Additions to Retained Earnings 147 647.74 3,456 1,895 235 1,326 320 1,006 211.26 794.74arrow_forwardWhat is the Net Effective Rent using the following data? Five year gross step up lease with expense stops Gross rents Yr. 1 = $23.00, increasing 3% each year beginning Yr. 2 Operating Expense Yr. 1 $12.00, increasing 2% each year beginning Yr. 2 %3! Expense Stop at $12.00 Round to two decimals for the rents. O $12.77 O $11.84 O $12.29 O $12.56arrow_forward

- Complete the following table: Selling price $231,000, Down payment $46,200, Amount mortgage $184,800, Rate 7.00%, Years 15, Monthly payment $1,661.35. What is the interest and principal on first payment? What is the balance at end of month?arrow_forwardA company has profit before interest and tax of £66000Interest payable is £6000Tax is payable at 25% What is the profit after Tax? £arrow_forwardSales Cost of goods sold Accounts receivable Numerator: 2021 $ 446,762 225,881 21,623 Numerator: Compute trend percents for the above accounts, using 2017 as the base year. For each of the three accounts, state whether the situation as revealed by the trend percents appears to be favorable or unfavorable. Numerator: 1 1 1 1 1 1 1 2021: 2020: 2019: 2018: 2017: Is the trend percent for Net Sales favorable or unfavorable? 2020 $ 290,105 146,803 16,913 Trend Percent for Net Sales: 2019 $ 232,084 119,092 15,828 2021: 2020: 2019: 2018: 2017: Is the trend percent for Cost of Goods Sold favorable or unfavorable? Trend Percent for Cost of Goods Sold: 1 Denominator: 7 1 1 1 1 1 I 1 Denominator: Trend Percent for Accounts Receivable: Denominator: 1 1 1 1 2021: 2020: 2019: 2018: 2017: Is the trend percent for Accounts Receivable favorable or unfavorable? 2018 $ 167,570 84,885 9,820 = = = = = = = = = = 2017 $ 128,900 64,450 8,804 = Trend percent Trend percent Trend percent % % % % % % % % % % % % %…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education