Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

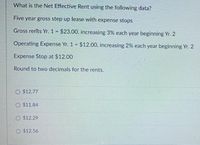

Transcribed Image Text:What is the Net Effective Rent using the following data?

Five year gross step up lease with expense stops

Gross rents Yr. 1 = $23.00, increasing 3% each year beginning Yr. 2

Operating Expense Yr. 1 $12.00, increasing 2% each year beginning Yr. 2

%3!

Expense Stop at $12.00

Round to two decimals for the rents.

O $12.77

O $11.84

O $12.29

O $12.56

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose you borrow $14,000. The interest rate is 11%, and it requires 4 equal end-of-year payments. Set up an amortization schedule that shows the annual payments, interest payments, principal repayments, and beginning and ending loan balances. Round your answers to the nearest cent. If your answer is zero, enter "0". Beginning Repayment Ending Year Balance Payment Interest of Principal Balance 1 $ fill in the blank 60 $ fill in the blank 61 $ fill in the blank 62 $ fill in the blank 63 $ fill in the blank 64 2 $ fill in the blank 65 $ fill in the blank 66 $ fill in the blank 67 $ fill in the blank 68 $ fill in the blank 69 3 $ fill in the blank 70 $ fill in the blank 71 $ fill in the blank 72 $ fill in the blank 73 $ fill in the blank 74 4 $ fill in the blank 75 $ fill in the blank 76 $ fill in the blank 77 $ fill in the blank 78 $ fill in the blank 79arrow_forwardences Rental Costs. Annual rent Insurance Security deposit Buying Costs Annual mortgage payments Property taxes Insurance, maintenance Down payment, closing costs Growth in equity Estimated annual appreciation $ 7,520 152 1,050 Rental cost Buying cost Total Cost $ 10,600 ($ 9,606 is interest) 2,170 Assume an after-tax savings interest rate of 5 percent and a tax rate of 28 percent. a. Calculate the total rental cost and total buying cost. 1,920 4,500 994 3,000arrow_forwardPlease calculate the rate used, present value factor used, present value of amount desired at end of period with the present value interest factor chart. Thank you! $6,000 3% 8years compounded semiannually 16 periodsarrow_forward

- Purchase Costs Down payment Loan payment Estimated value at end of loan Opportunity cost interest rate Leasing Costs $ 1,500 $ 690 for 36 months $ 4,300 6 percent Security deposit Lease payment End of lease charges $ 1,130 $ 1,080 $400 for 36 months Based on the costs listed in the table above, calculate the costs of buying and of leasing a motor vehicle. Note: Round your answers to the nearest whole number. Buying and Leasing Total purchase cost Total leasing costarrow_forwardPayment Calculator Property Location Fullerton Payments per year 12 Property Cost $750,000 Total Payments 360 Down Payment $75,000 Interest (APR) 4.00% Loan Amount $675,000 Payment (per month) Period (Years) 30 Pleasae use the formula PMT to determine the payment per month.arrow_forwardQuestion 7 A loan is offered with monthly payments and a 15.25 percent APR. What’s the loan’s effective annual rate (EAR)? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Effective annual rate %arrow_forward

- A8arrow_forwardQ2. Complete the amortization schedule for the last three payments on a $500,000, 15-year, monthly-pay, 4.2% APR home mortgage. End of Beginning Monthly Month Balance Payment Principal Interest Ending Balance 178 $11,167.99 $3,748.75 $39.09 $3,709.66 $7,458.32 179 $7,458.32 $3,748.75 $26.10 $3,722.65 $3,735.68 180 $3,735.68 $3,748.75 $13.07 $3,735.68 $0.00arrow_forwardThe effective annual rate (EAR) for a loan with a stated APR of 4% compounded quarterly is closest to: O A. 4.87% B. 5.28% C. 4.47% D. 4.06%arrow_forward

- The value of a 6 year lease that requires payments of $650 made at the beginning of every quarter is $13,000. What is the nominal interest rate compounded quarterly? 0.00 % Round to two decimal places SUBMIT QUESTION ← SAVE PROGRESS C D १२ 1 ICarrow_forwardDetermine the simple interest. p = $1137.94, r = 1-% per month, t = 6 months 4 3 The simple interest on $1137.94 at 1-% per month for 6 months is $ 4 (Round to the nearest cent.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education