EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

None

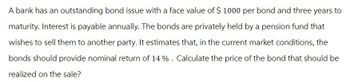

Transcribed Image Text:A bank has an outstanding bond issue with a face value of $ 1000 per bond and three years to

maturity. Interest is payable annually. The bonds are privately held by a pension fund that

wishes to sell them to another party. It estimates that, in the current market conditions, the

bonds should provide nominal return of 14%. Calculate the price of the bond that should be

realized on the sale?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A Bank offers both loans and deposits at a nominal interest rate of 4% that is continuously compounded A) What is the effective rate offered by the bank? B) The bank also offers a 3-year bond with face value £10000, redeemable at par, with 10% annual coupons. What is the final payment of that bond? C) Assuming there are no arbitrage opportunities, what is the price of the above bond?arrow_forwardAn insurance company is thinking about purchasing bonds A and B with zero coupons to cover some of its future liabilities. The redemption periods for these zero-coupon bonds are seven and twenty years, respectively.£11 million is due in 11 years, and £14 million is due in 16 years, according to the list of its liabilities.Determine bond B's value at an effective 5% annual interest rate so that Redington's theory of immunization's first two requirements are met. (correct answer=6.419) (using formulas, no tables)arrow_forwardPension funds pay lifetime annuities to recipients. If a firm will remain in business indefinitely, the pension obligation will resemble a perpetuity. Suppose, therefore, that you are managing a pension fund with obligations to make perpetual payments of $1.9 million per year to beneficiaries. The yield to maturity on all bonds is 19.0%. Required: a. If the duration of 5-year-maturity bonds with coupon rates of 11.8% (paid annually) is four years and the duration of 20-year-maturity bonds with coupon rates of 7% (paid annually) is 11 years, how much of each of these coupon bonds (in market value) will you want to hold to both fully fund and immunize your obligation? Note: Do not round intermediate calculations. Enter your answers in millions rounded to 2 decimal places. b. What will be the par value of your holdings in the 20-year coupon bond? Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places. a. 5 year bond a. 20 year bond b. Par…arrow_forward

- Pension funds pay lifetime annuities to recipients. If a firm will remain in business indefinitely, the pension obligation will resemble a perpetuity. Suppose, therefore, that you are managing a pension fund with obligations to make perpetual payments of $2.2 million per year to beneficiaries. The yield to maturity on all bonds is 14.4%. Required: a. If the duration of 5-year-maturity bonds with coupon rates of 10.5% (paid annually) is four years and the duration of 20-year-maturity bonds with coupon rates of 4% (paid annually) is 11 years, how much of each of these coupon bonds (in market value) will you want to hold to both fully fund and immunize your obligation? Note: Do not round intermediate calculations. Enter your answers in millions rounded to 2 decimal places. b. What will be the par value of your holdings in the 20-year coupon bond? Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places. Answer is complete but not entirely…arrow_forwardPension funds pay lifetime annuities to recipients. If a firm will remain in business indefinitely, the pension obligation will resemble a perpetuity. Suppose, therefore, that you are managing a pension fund with obligations to make perpetual payments of $1.3 million per year to beneficiaries. The yield to maturity on all bonds is 14.0%. Required: a. If the duration of 5-year-maturity bonds with coupon rates of 10.0 % (paid annually) is four years and the duration of 20-year-maturity bonds with coupon rates of 5% (paid annually) is 11 years, how much of each of these coupon bonds (in market value) will you want to hold to both fully fund and immunize your obligation? Note: Do not round intermediate calculations. Enter your answers in millions rounded to 2 decimal places. b. What will be the par value of your holdings in the 20-year coupon bond? Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places. a. 5 year bond a. 20 year bond b. Par…arrow_forwardA 10-year government bond has face value of OR 200 and a coupon rate of 6% paid semiannually. Assume that the interest rate is equal to 8% per year. What is the bond’s price? What is the reason for the difference in price on an annual and semiannually basis? Discuss the role of financial managers.arrow_forward

- Nikularrow_forwardA bank has assets of $500,000,000 and equity of $40,000,000. The assets have an average duration of 5.5 years, and the liabilities have an average duration of 2.5 years. An 8-year fixed-rate T-bond with the same coupon as the fixed-rate on the swap has a duration of 6 years, and the duration of a floating-rate bond that reprices annually is one year. The bank wishes to hedge its balance sheet with swap contracts that have notional contracts of $100,000. What is the optimal number of swap contracts into which the bank should enter? 2,500 contracts. 2,760 contracts. 13,800 contracts. 3,200 contracts. None of the above.arrow_forwardPension funds pay lifetime annuities to recipients. If a firm remains in business indefinitely, the pension obligation will resemble a perpetuity. Suppose, therefore, that you are managing a pension fund with obligations to make perpetual payments of $3.0 million per year to beneficiaries. The yield to maturity on all bonds is 20%. Required: a. If the duration of 5-year maturity bonds with coupon rates of 16% (paid annually) is 3.7 years and the duration of 20-year maturity bonds with coupon rates of 7% (paid annually) is 6.5 years, how much of each of these coupon bonds (in market value) will you want to hold to both fully fund and immunize your obligation? (Do not round intermediate calculations. Enter your answers in millions rounded to 5 decimal places.) > Answer is complete but not entirely correct. Holdings 5-year bond 20-year bond $ 1.60000 million $ 22.20000 million b. What will be the par value of your holdings in the 20-year coupon bond? (Enter your answer in dollars not in…arrow_forward

- Baghibenarrow_forwardpension funds pay lifetime annuities to recipients. if a firm will remain in business indefinitely, the pension obligation will resemble a perpetuity. suppose, therefore, that you are managing a pension fund with obligations to make perpetual payments of $2 million per year to beneficiaries. the yield to maturity on all bonds is 15%. a. if the duration of 5-year maturity bonds with coupon rates of 11% (paid annually) is 4 years and the duration of 20-year maturity bonds with coupon rates of 7% (paid annually) is 11 years, how much of each of these coupon bonds (in market value) will you want to hold to both fully fund and immunize your obligation?arrow_forwardPension funds pay lifetime annuities to recipients. If a firm will remain in business indefinitely, the pension obligation will resemble a perpetuity. Suppose, therefore, that you are managing a pension fund with obligations to make perpetual payments of $2 million per year to beneficiaries. The yield to maturity on all bonds is 16%.a. If the duration of 5-year maturity bonds with coupon rates of 12% (paid annually) is four years and the duration of 20-year maturity bonds with coupon rates of 6% (paid annually) is 11 years, how much of each of these coupon bonds (in market value) will you want to hold to both fully fund and immunize your obligation?b. What will be the par value of your holdings in the 20-year coupon bond?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT