Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

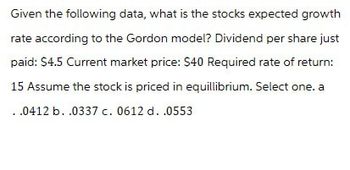

Transcribed Image Text:Given the following data, what is the stocks expected growth

rate according to the Gordon model? Dividend per share just

paid: $4.5 Current market price: $40 Required rate of return:

15 Assume the stock is priced in equillibrium. Select one. a

.0412 b. .0337 c. 0612 d. .0553

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A stock is trading at $80 per share. The stock is expected to have a yearend dividend of $4 per share (D1 = $4), and it is expected to grow at some constant rate, g, throughout time. The stock’s required rate of return is 14% (assume the market is in equilibrium with the required return equal to the expected return). What is your forecast of gL?arrow_forwardGiven the following data, what is the stock's expected growth rate according to the Gordon model? Dividend per share just paid: $3 Current market price: $35 Required rate of return: .10 Assume the stock is priced in equilibrium. Select one: O a. 2.45% O b. 4.32% O c. 3.56% Od. 1.32% c = X FILEarrow_forwardSuppose your expectations regarding the stock price are as follows: State of the Market Probability Ending Price HPR (including dividends) Boom 0.35 $140 44.5% Normal growth 0.30 110 14.0 Recession 0.35 80 -16.5 Use the following equations to compute the mean and standard deviation of the HPR on stocks:arrow_forward

- Stock X has the following data. Assuming the stock market is efficient and the stock is in equilibrium, which of the following statements is CORRECT? Expected dividend, D1 $3.00 Current Price, Po $50 Expected constant growth rate 6.0% O a. The stock's expected dividend yield is 5%. O b. The stock's expected dividend yield and growth rate are equal. O c. The stock's required return is 10%. O d. The stock's expected price 10 years from now is $100.00. O e. The stock's expected capital gains yield is 5%.arrow_forwardQuestions: Refer to the data of Omani common stock at below table, answer the following questions: Calculate the required rate of return (RRR) of stock. If beta coefficient decreases from 1.5 t0 0.5, what is the affect required rate of return. Build a theoretical framework depends on result of above questions. Beta Coefficient Stock Market Return Risk-free Return 1.5 10% 6%arrow_forwardSuppose your expectations regarding the stock price are as follows: State of the Market Boom Normal growth Recession Probability Ending Price 0.26 $ 140 0.25 110 0.49 80 Use the equations E (r) = Ep (s) r(s) and o² = Ep (s) [r(s) — E(r)]² to compute the mean and standard deviation of the HPR on - S S Mean Standard deviation HPR (including dividends) 55.0% 21.0 -16.0 stocks. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. % %arrow_forward

- Suppose your expectations regarding the stock price are as follows: State of the Market Probability Ending Price HPR (includingdividends) Boom 0.30 $ 140 53.5 % Normal growth 0.28 110 17.5 Recession 0.42 80 −12.0 Use the equations E(r)=Σsp(s)r(s)E(r)=Σsp(s)r(s) and σ2=Σsp(s) [r(s)−E(r)]2σ2=Σsp(s) [r(s)−E(r)]2 to compute the mean and standard deviation of the HPR on stocks. (Do not round intermediate calculations. Round your answers to 2 decimal places.)arrow_forwardSuppose your expectations regarding the stock price are as follows: State of the Market Boom Normal growth Recession Probability Ending Price 0.21 $ 140 0.30 110 0.49 80 Use the equations E (r) = Ep (s) r(s) and o² = Ep (s) [r(s) - E(r)]² to compute the mean and standard deviation of the HPR on S S HPR (including dividends) 50.5% 18.0 -12.5 stocks. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Mean Standard deviation Answer is complete but not entirely correct. 13.65 % 20.48 %arrow_forwardSuppose your expectations regarding the stock price are as follows: HPR (including dividends) 50.5% 20.5 -18.5 State of the Market Boom Normal growth Recession Probability 0.20 0.22 0.58 Mean Standard deviation - Use the equations E (r) = Ep (s) r(s) and o² = Ep (s) [r(s) — E(r)]² to compute the mean and standard deviation of the HPR on S S stocks. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Ending Price $ 140 110 80 % %arrow_forward

- what are the two type parts of most stocks expected total return? if D1=$2.00, g= 6% and po $40.00, what are the stocks expected dividend yield, capital gains yield, and total expected return for the coming year?arrow_forwardStocks X and Y have the following data. Assuming the stock market is efficient and the stocks are in equilibrium, which of the following statements is CORRECT? X Y Price $25 $25 Expected dividend yield 5% 3% Required return 12% 10% a. Stock X pays a higher dividend per share than Stock Y. b. One year from now, Stock X should have the higher price. c. Stock Y pays a higher dividend per share than Stock X. d. Stock Y has the higher expected capital gains yield. e. Stock Y has a lower expected growth rate than Stock X.arrow_forwardStocks X and Y have the following data. Assuming the stock market is efficient and the stocks are in equilibrium, which of the following statements is CORRECT? X Y Price $25 $25 Expected dividend yield 5% 3% Required return 12% 10% a. Stock Y pays a higher dividend per share than Stock X. b. Stock Y has the higher expected capital gains yield. c. One year from now, Stock X should have the higher price. d. Stock X pays a higher dividend per share than Stock Y.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT