FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:A

0

4

5

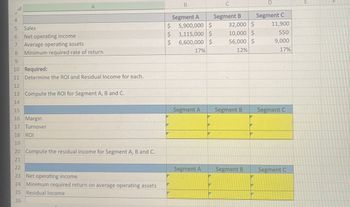

Sales

6

Net operating income

7

Average operating assets

8

Minimum required rate of return

9

10 Required:

11

Determine the ROI and Residual Income for each.

12

13 Compute the ROI for Segment A, B and C.

14

15

16

Margin

17

Turnover

18

ROI

19

20 Compute the residual income for Segment A, B and C.

21

22

23 Net operating income

24 Minimum required return on average operating assets

25 Residual Income

26

B

C

D

E

Segment A

Segment B

Segment C

$

5,900,000 $

32,000 $

11,900

$

1,115,000 $

10,000 $

550

$

6,600,000 $

56,000 $

9,000

17%

12%

17%

Segment A

Segment B

Segment C

Segment A

Segment B

Segment C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Munabhaiarrow_forwardEXERCISE 4-5 Companywide and Segment Break-Even Analysis L04-50 oldahBY S-A321onaxa Piedmont Company segments its business into two regions-North and South. The company pre- pared the contribution format segmented income statement as shown below: kruigmoo c Sales Variable expenses.. Contribution margin Traceable fixed expenses Segment margin Common fixed expenses. Net operating income... Total Company $600,000 360,000 240,000 120,000 120,000 50,000 $ 70,000 Required: 2. 1. Compute the companywide break-even point in dollar sales. Compute the break-even point in dollar sales for the North region. Compute the break-even point in dollar sales for the South region. 3. North South $400,000 $200,000 280,000 80,000 120,000 120,000 60,000 60,000 $ 60,000 $ 60,000 6MFarrow_forward5arrow_forward

- QS 24-11 Performance measures LO A1, A2 Investment center Department A Department B B Sales $ ? $12,200,000 Net Income $584,600 $ ? Average invested assets $1,580,000 $ ? Profit margin 10% ? % Investment turnover ? 1.3 Return on investment ? % 13% Use the information in the table above to compute each department's contribution to overhead (both in dollars and as a percent). (Round your final answers to 2 decimal places.) Investment center Choose Numerator/ Choose Denominator = Profit Margin Percent (A & B). Choose Numerator/Choose Denominator = Investment Turnover (A & B). Choose…arrow_forward'C QUESTION 8 Sales revenue (30,000 units) Variable costs Contribution margin Fixed costs Operating income At the breakeven point: Sales are equal to total fixed costs. Contribution margin in equal to sales. Contribution margin is equal to total fixed costs. O Sales are equal to total variable costs. Click Save and Submit to save and submit. Click Save All Answers to save all answers. * 구 $ G # % Total $750,000 450,000 300,000 150,000 $150,000 MacBook Pro ^ Per unit 25 15 ? &arrow_forward22.0 need helparrow_forward

- Kimmel, Accounting, 7e Help | System Announcements 16 PM/ Remaining: 23 min. CALCULATOR PRINTER VERSION 1 BACK NEXT Problem 21-01A National Corporation needs to set a target price for its newly designed product M14-M16. The following data relate to this new product. Per Total Unit Direct materials Direct labor $44 Variable manufacturing overhead $15 Fixed manufacturing overhead $1,377,000 Variable selling and administrative expenses $ 5 Fixed selling and administrative expenses $ 1,053,000 These costs are based on a budgeted volume of 81,000 units produced and sold each year. National uses cost-plus pricing methods to set its target selling price. The markup percentage on total unit cost is 40%. Compute the total variable cost per unit, total fixed cost per unit, and total cost per unit for M14-M16. GMXarrow_forward2arrow_forwardExercise 18-21 (Algo) Predicting unit and dollar sales using contribution margin LO C2 Nombre Company management predicts $1,632,000 of variable costs, $2,213,000 of fixed costs, and income of $235,000 in the next period. Management also predicts that the contribution margin per unit will be $51. (1) Compute the total expected dollar sales for next period. Contribution margin Income (2) Compute the number of units expected to be sold and produced next period. Numerator: 1 Denominator: = = Units Unitsarrow_forward

- Exercise 15-19 (Algo) Investment center analysis; ROI and residual income LO 15-9 The Northern Division of Allied Incorporated has operating income of $18,500 on sales revenue of $166,000. Divisional operating assets are $80,200, and management of Allied has determined that a minimum return of 13% should be expected from all investments. Required: a. Using the DuPont model, calculate the Northern Division's margin, turnover, and ROI. b. Calculate the Northern Division's residual income. Complete this question by entering your answers in the tabs below. Required A Required B Using the DuPont model, calculate the Northern Division's margin, turnover, and ROI. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Margin Turnover ROI Northern Division % turns %arrow_forwardIn the cost-volume- profit graph (above), what is represented by the point marked "A"? Question 1 options: Breakeven point Fixed expenses Operating income area Operating loss areaarrow_forwardQUESTION 28 Top management is trying to determine which would be the best choice of the following investment opportunities: Data of investment choices: 2 Sales $9,000,000 Operating income 300,000 Average operating assets 3,000,000 Required: Compute the Residual Income assuming a minimum required rate of return of 8%. $66,000 $60,000 $50,000 $55,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education