FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

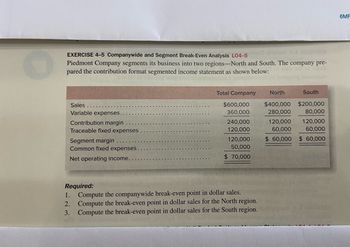

Transcribed Image Text:EXERCISE 4-5 Companywide and Segment Break-Even Analysis L04-50 oldahBY S-A321onaxa

Piedmont Company segments its business into two regions-North and South. The company pre-

pared the contribution format segmented income statement as shown below:

kruigmoo c

Sales

Variable expenses..

Contribution margin

Traceable fixed expenses

Segment margin

Common fixed expenses.

Net operating income...

Total Company

$600,000

360,000

240,000

120,000

120,000

50,000

$ 70,000

Required:

2.

1. Compute the companywide break-even point in dollar sales.

Compute the break-even point in dollar sales for the North region.

Compute the break-even point in dollar sales for the South region.

3.

North

South

$400,000 $200,000

280,000

80,000

120,000

120,000

60,000

60,000

$ 60,000 $ 60,000

6MF

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forwardnt 3 i Shannon Company segments its income statement in its North and South Division. The company's overall sales, contribution margin ratio, and net operating income are $480,000, 60%, and $48,000, respectively. The North Division's contribution margin and contribution margin ratio are $135,000 and 75%, respectively. The South Division's segment margin is $38,000. The company has $72,000 of common fixed expenses that cannot be traced to either division. Required: Prepare an income statement for Shannon Company that uses the contribution format and is segmented by divisions. (Round your percentage answers to 1 decimal place (i.e .1234 should be entered as 12.3)) Total Company Amount $ 0 0 0 % 0.0 Amount 0.0 $ 0.0 North 0 0 % Divisions 0.0 Amount 0.0 $ South 0 0 % 0.0 0.0arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Exercise 11-15A (Algo) Using contribution margin format income statement to measure the magnitude of operating leverage LO 11-3, 11-4 The following income statement was drawn from the records of Benson, a merchandising firm: BENSON COMPANY Income Statement For the Year Ended December 31 Sales revenue (4,500 units × $163) $ 733,500 Cost of goods sold (4,500 units × $82) (369,000 ) Gross margin 364,500 Sales commissions (5% of sales) (36,675 ) Administrative salaries expense (85,000 ) Advertising expense (34,000 ) Depreciation expense (48,000 ) Shipping and handling expenses (4,500 units × $3) (13,500 ) Net income $ 147,325 Required Reconstruct the income statement using the contribution margin format. Calculate the magnitude of operating leverage. Use the measure of operating leverage to determine the amount of net income Benson will earn if sales increase by 20 percent.arrow_forwardNonearrow_forwardrmn.3arrow_forward

- Required information Exercise 23-9 (Algo) Segment elimination LO P4 [The following information applies to the questions displayed below] Suresh Company reports the following segment (department) income results for the year. Sales Expenses Avoidable Unavoidable Total expenses Income (loss) Department O Department P Department T Department M Department N $ 42,000 $ 80,000 Decision 16,300 57,000 73,300 $ 6,700 44,200 20,400 64,600 $ (22,600) Department o $ 76,000 Total $ 300,000 150,800 152,000 302,800 $ (2,800)arrow_forwarddreams demstime dremstph %24 The co ired rate of is 15%. Requlred Information The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: $ 2,300,000 Sales Variable expenses Contribution margin Fixed expensesi 1,630,000 1,170,000 24 460,000 $ 1,437,500 Net operating income Average operating assets At the beginning of this year, the company has a $287,500 investment opportunity with the following cost and revenue characteristics: $ 460,000 Contribution margin ratio Fixed expenses 50% of sales $ 161,000 The company's minimum required rate of return is 15%. 9. If the company pursues the investment opportunity and otherwise performs the same as last year, what ROI will it earn this year? (Do not round Intermedlate calculations. Round your percentage answer to 1 declmal place (I.e., 0.1234 should be considered as 12.3).)arrow_forwardExercise 18 -8 (Static) Computing missing amounts in contribution margin income statements LO A1 Compute the missing amounts in the contribution income statement shown below: (Round "Per Unit" answers to 2 decimal places.) \table[[Number of units sold, Company A, Company B], [,,,, 1,975, ], [,, otal,,unit, Total, Per unit], [Sales, $, 208, 000, $, 65.00,, ], [Variable costs,, 150, 400,,, 39, 500, ], [Contribution margin,,,,, 43, 450, ], [Fixed costs,,,,,19, 750, ], [ Income, $, 46, 400,,,,]]arrow_forward

- sarrow_forwardKeep-or-Drop Decision Petoskey Company produces three products: Alanson, Boyne, and Conway. A segmented income statement, with amounts given in thousands, follows: Boyne Conway $270 Sales revenue Less: Variable expenses Contribution margin Less direct fixed expenses: Depreciation Salaries Alanson $1,280 $185 1,115 $165 50 95 $20 45 $140 15 85 $40 216 $54 12 100 $(58) Total $1,735 1,376 $359 77 280 $2 Segment margin Direct fixed expenses consist of depreciation and plant supervisory salaries. All depreciation on the equipment is dedicated to the product lines. None of the equipment can be sold. Assume that each of the three products has a different supervisor whose position would be eliminated if the associated product were dropped. Required: Conceptual Connection: Estimate the impact on profit that would result from dropping Conway. Enter amount in full, rather than in thousands. For example, "15000" rather than "15".arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education