FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

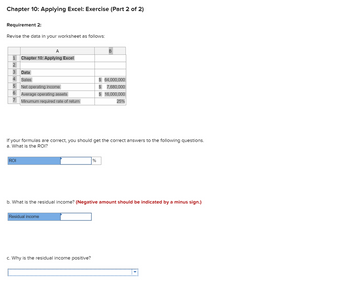

Transcribed Image Text:Chapter 10: Applying Excel: Exercise (Part 2 of 2)

Requirement 2:

Revise the data in your worksheet as follows:

A

1 Chapter 10: Applying Excel

2

3

Data

4 Sales

5

6

7

Net operating income

ROI

Average operating assets

Minumum required rate of return

If your formulas are correct, you should get the correct answers to the following questions.

a. What is the ROI?

Residual income

B

%

c. Why is the residual income positive?

$ 64,000,000

$ 7,680,000

$ 16,000,000

25%

b. What is the residual income? (Negative amount should be indicated by a minus sign.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required Supply the missing information in the following table for Vernon Company. (Do not round intermediate calculations. Round "ROI" answer to 2 decimal places. (i.e., 0.2345 should be entered as 23.45).) Sales $369,600 ROI % Operating assets Operating income Turnover 2.1 Residual income Operating profit margin 14 % Desired rate of return 17 %arrow_forwardReferring to the spreadsheet graphic provided below; the optimal formula is terms of flexibility to calculate the projected sales result in cell C2 would be: B 1 Regions Previous sales Projected sales 2 East 120000 3 West 150000 4 North 135000 5 South 175000 6 =B2*G1 =b2*(1+$g$1) =b2*(1+g1) =g1*$b$2 + b2 D E Growth factor F G 7%arrow_forwardRequired Supply the missing information in the following table for Rooney Company. (Do not round intermediate calculations. Round "ROI" answer to 2 decimal places. (i.e., 0.2345 should be entered as 23.45).)arrow_forward

- a Rance 0ortotal tSpendingjJariance The Walnut Division of Benton core hurdle rate isug9o. Calculate the return on investment Calculate the profit, nmargin ÇalculateThe invest ment turnover (alculate the residual incomearrow_forward= Required Supply the missing information in the following table for Zachary Company: Note: Do not round intermediate calculations. Round "ROI" answer to 2 decimal places. (i.e., 0.2345 shoule Sales ROI Operating assets Operating income Turnover Residual income Operating profit margin Desired rate of return $ 309,600 1.8 % 13 % 19%arrow_forwardA segment has the following data: Sales $790000 Variable expenses 345000 Fixed expenses 550000 What will be the incremental effect on net income if this segment is eliminated, assuming the fixed expenses will be allocated to profitable segments? $345000 increase $445000 decrease Cannot be determined from the data provided $5750 decreasearrow_forward

- Pa help po. Salamatarrow_forwardSegment Income (Loss) Sales Variable costs Contribution margin Fixed costs Income (loss) $ 255,000 178,500 76,500 107,000 (30,500) (a) Compute the income increase or decrease from eliminating this segment. (b) Should the segment be eliminated?arrow_forwardDetermining missing items in return on investment computation One item is omitted from each of the following computations of the return on investment: Return on Investment = Profit Margin x Investment Turnover 27 % = 10 % x (a) (b) = 16 % x 0.75 24 % = (c) x 1.5 14 % = 20 % x (d) (e) = 15 % x 1.8 Determine the missing items identified by the letters as shown above. If required, round your answers to two decimal places. (a) fill in the blank 1 (b) fill in the blank 2 % (c) fill in the blank 3 % (d) fill in the blank 4 (e) fill in the blank 5 %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education