Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

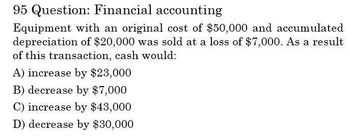

Transcribed Image Text:95 Question: Financial accounting

Equipment with an original cost of $50,000 and accumulated

depreciation of $20,000 was sold at a loss of $7,000. As a result

of this transaction, cash would:

A) increase by $23,000

B) decrease by $7,000

C) increase by $43,000

D) decrease by $30,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Answer this below Questionarrow_forwardThe asset turnover from the following is: (Round to the nearest tenth) Gross Sales $60,000 //// Sales discount $3,000 II Sales returns and allowances $7,000 //// Total Assets $38,000 O a. 1.4 O b. 1.6 Oc. 1.5 O d. 1.3 A Moving to another question will save this response. «< Question 12 of 23 Sh Informative Top...docx の)arrow_forwardprovide correct optionarrow_forward

- 95 Question:arrow_forwardCalculate the operating cash flows from the following data: Sales: $2,190,000 Cost: $815,000 Depreciation: $290,000 Tax rate: 21% Life: 3 years $857,150 O $1,147,150 O$1,085,000 O s1,375,00arrow_forwardUsing the Exhibit below, assume that the depreciation expense on the Income Statement for the year was $38,000. When preparing the Statement of Cash Flow using the indirect method for the current year, which of the following statements would describe the proper presentation of depreciation expense on the Cash flow from operating activities section? EXHIBIT Increase (Decrease) Net Income (loss) $XXX Adjustments to reconcile net income to net cash flow from operating activities: Depreciation of fixed assets XXX Losses on disposal of assets XXX Gains on disposal of assets (XXX) Changes in current operating assets and liabilities:…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning