SWFT Corp Partner Estates Trusts

42nd Edition

ISBN: 9780357161548

Author: Raabe

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Need answer

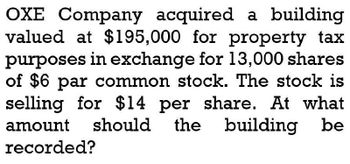

Transcribed Image Text:OXE Company acquired a building

valued at $195,000 for property tax

purposes in exchange for 13,000 shares.

of $6 par common stock. The stock is

selling for $14 per share. At what

amount should the building be

recorded?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Kansas Company acquired a building valued at $170,000 for property tax purposes in exchange for 12,000 shares of its $7 par common stock. The stock is widely traded and selling for $20 per share. At what amount should the building be recorded by Kansas Company?arrow_forwardSteak Company acquired a building valued at $176,400 for property tax purposes in exchange for 10,400 shares of its $8 par common stock. The stock is widely traded and selling for $16 per share. At what amount should the building be recorded by Steak Company? O a. $176,400 O b. $166,400 O C. S83,200 O d. $239,200arrow_forwardOn June 30, 2024, Ericson, Inc. purchased land. In payment for the land, Erickson, Inc. issued 10,000 shares of common stock with a $10 par value. The land had been appraised at a market value of $117,000. The journal entry to record this transaction would be: O Land 100,000 Common Stock-$10 Par Value O Land Common Stock-$10 Par Value Paid-In Capital in Excess of Par-Common O Land Common Stock-$10 Par Value Paid-In Capital in Excess of Par-Common Land Common Stock-$10 Par Value 117,000 137,000 117,000 100,000 100,000 17,000 100.000 37,000 117,000arrow_forward

- Determine the basis of the property contributed in the hands of the corporation in each instance. Assume that the 80% rule is met in all cases. Required: a. Contribution of property with a basis of $1,800 and an FMV of $2,200. b. Contribution of property with a basis of $4,600 and an FMV of $5,400. The stockholder also received $540 cash from the corporation as part of the stock transaction. c. Contribution of property with a basis of $9,000 and an FMV of $14,100. The stockholder also received property with an FMV of $2,500 from the corporation as part of the stock transaction. d. Contribution of a building with an FMV of $240,000, a mortgage (assumed by the corporation) of $140,000, and a basis of $205,000. e. Contribution of a building with an FMV of $1,780,000, a mortgage (assumed by the corporation) of $1,080,000, and a basis of $675,000. Amount a. Corporation's basis in property b. Corporation's basis in property c. Corporation's basis in property d. Corporation's basis in…arrow_forwardROK Company purchased land from XYZ company by issuing 6,000 shares of it's $5 par value stock. At the time of the purchase, ROK's stock was selling for $20 a share and the land was worth $100,000. The journal entry to record this purchase would include a: Debit to Land of $100,000 O Debit to land of $30,000 O Debit to Land of $120,000 Credit to Common Stock of $120,000arrow_forward3. During the year, Chinawish Co. distributed property dividends in the form of inventories. The carrying amount on the date of declaration was P2,000,000 and the fair values, which approximated the net realizable values, were P1,600,000 on the date of declaration and P2,200,000 on the date of distribution. Requirement: Provide the journal entries on the dates of declaration and distribution.arrow_forward

- How much is the cost of investment ?arrow_forwardCavite Company acquired land and building by issuing 60,00O, P100 par value, ordinary shares. On the date of acquisition, the shares had a fair value of P150 per share and the land and building had fair value of P2,000,000 and P6,000,000 respectively. During the year, Cavite also received land from a shareholder to facilitate the construction of a plant in the city. Cavite paid P100,000 for the land transfer. The land's fair value is P1,500,000. As a result of these acquisitions, Cavite Company's equity had a net increase ofarrow_forwardOn September 1, FAITH Inc issued 120,000 shares of its P50 par value ordinary share in exchange for land. On the date of the transaction, the fair value of the ordinary shares, evidenced by its quoted market price in the stock exchange, was P120 per share. The fair value of the land on the same date was valued at P10,000,000. The journal entry to record this transaction includes a debit to Land for how much?arrow_forward

- Smith Company exchanges assets to acquire a building. The market price of the Smith stock on the exchange date was $20 per share and the building’s book value on the books of the seller was $211,000.Which of the following journal entries is correct for Smith Company when Smith issues 11,100 shares of $10 par value common stock and pays $21,100 cash in exchange for the building? Please see picture attached.arrow_forwardOn Nov 15, Quazar Co. declared a property dividend of marketable securities to be distributed on Dec 15 to stockholders of record on Dec 1. The market value of the securities was as follows: November 15 $225,000 December 1 $220,000 December 15 $250,000 The mararketable securities originally cost Quazar $200,000. What is the net effect on Quazar's retained earnings as a result of declaring this property dividend ?arrow_forwardOn August 1, ABC Company acquired a real property for P 4,420,000. The shares were selling on the same date at P 125. The fair values are P 800,000 and P 3,200,000 for the land and building respectively. A mortgage of P 4,000,000 was assumed by ABC on the purchase. Moreover, the company paid P 180,000 of real property taxes in the prior years. ABC paid legal fees including title search for P 15,000. ABC also paid the local government special assessment for city improvement amounting to P 120,000. In order to make the building suitable for the use of ABC, remodeling costs had to be incurred in the amount of P 900,000. This however, necessitated the demolition of a portion of the building, which resulted in recovery of salvage material sold for P 30,000. Parking lot cost the company, P 320,000 while repairs in the main hall were incurred at P45,000 prior to its use. What is the correct cost of the land? P1,720,000 P2,535,000 P1,855,000 P1,799,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning