ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

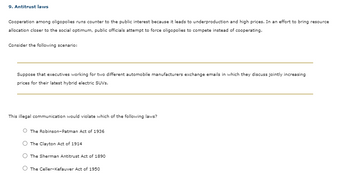

Transcribed Image Text:9. Antitrust laws

Cooperation among oligopolies runs counter to the public interest because it leads to underproduction and high prices. In an effort to bring resource

allocation closer to the social optimum, public officials attempt to force oligopolies to compete instead of cooperating.

Consider the following scenario:

Suppose that executives working for two different automobile manufacturers exchange emails in which they discuss jointly increasing

prices for their latest hybrid electric SUVs.

This illegal communication would violate which of the following laws?

The Robinson-Patman Act of 1936

The Clayton Act of 1914

The Sherman Antitrust Act of 1890

The Celler-Kefauver Act of 1950

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Two duopolists are sharing a market in which they are contemplating whether to compete or to cooperate. If they cooperate and behave like a monopolist they will share the monopolist profit of $1800. If they compete each will get a profit of $800 but if one them cooperates while the other chooses to compete the one who cooperates gets $700 while the one who competes will end up with $1000. Set-up the game, explain the process and show the Nash-equilibrium reached when the game is played.arrow_forward4) Which of the following companies is least likely to operate in an oligopoly? Burger King, which sells fast food Frontier, which provides Internet services AHF pharmacy Verizon, which provides cell phone coveragearrow_forward8. Two firms, the only firms in the market, sell the same product and have the same marginal cost. They realise they would be better off if they didn't compete with each other. They enter an alternating offers bargaining game to decide how they will divide the monopoly profit, n. They have three periods to come to an agreement. If no agreement is reached after three periods, the firms will compete simultaneously in prices. The firms toss a coin to decide who makes the first offer in the bargaining game. Firm 1 wins and decides to go first. Each firm has a discount factor o. a) Draw the game tree. b) What is the subgame perfect equilibrium when 8 = 0.5? c) What is the equilibrium payoff for each firm? d) Was Firm 1 wise to opt to make the first offer? Explain your answer. %3Darrow_forward

- QUESTION 13 Consider a market where two firms (1 and 2) produce differentiated goods and compete in prices. The demand for firm 1 is given by D₁(P₁, P2) = 140 - 2p1 + P2 and demand for firm 2's product is D2 (P1, P2) 140 - 2p2 + P1 Both firms have a constant marginal cost of 20. What is the Nash equilibrium price of firm 1? (Only give a full number; if necessary, round to the lower integer; no dollar sign.)arrow_forward2. Consider the following game: Soapy Inc. and Suddies Inc. are the only producers of soap powder. They collude and agree to share the market equally. If neither firm cheats on the agreement, each makes $1 million profit. If either firm cheats, the cheat makes a profit of $1.5 million, while the complier incurs a loss of $0.5 million. If both cheat, they break even. Neither firm can monitor the other's actions. a) Construct the payoff matrix. b) What is the dominant strategy? c) What is the nash equilibrium for this game?arrow_forward8. Two firms, the only firms in the market, sell the same product and have the same marginal cost. They realise they would be better off if they didn't compete with each other. They enter an alternating offers bargaining game to decide how they will divide the monopoly profit, n. They have three periods to come to an agreement. If no agreement is reached after three periods, the firms will compete simultaneously in prices. The firms toss a coin to decide who makes the first offer in the bargaining game. Firm 1 wins and decides to go first. Each firm has a discount factor o. a) Draw the game tree. b) What is the subgame perfect equilibrium when o = 0.5? c) What is the equilibrium payoff for each firm? d) Was Firm 1 wise to opt to make the first offer? Explain your answer.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education