Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

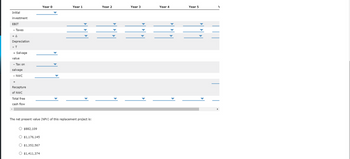

Transcribed Image Text:Initial

investment

EBIT

- Taxes

+ A

Depreciation

x T

+ Salvage

value

- Tax on

salvage

- NWC

+

Recapture

of NWC

Total free

cash flow

A

O $882,109

The net present value (NPV) of this replacement project is:

O $1,176,145

Year 0

O $1.352,567

O $1,411,374

Year 1

Year 2

Year 3

Year 4

Year 5

Transcribed Image Text:8. Analysis of a replacement project

At times firms will need to decide if they want to continue to use their current equipment or replace the equipment with newer equipment.

The company will need to do replacement analysis to determine which option is the best financial decision for the company.

Price Co. is considering replacing an existing piece of equipment. The project involves the following:

• The new equipment will have a cost of $600,000, and it will be depreciated on a straight-line basis over a period of six years (years

1-6).

• The old machine is also being depreciated on a straight-line basis. It has a book value of $200,000 (at year 0) and four more years of

depreciation left ($50,000 per year).

• The new equipment will have a salvage value of $0 at the end of the project's life (year 6). The old machine has a current salvage

value (at year 0) of $300,000.

• Replacing the old machine will require an investment in net working capital (NWC) of $45,000 that will be recovered at the end of the

project's life (year 6).

• The new machine is more efficient, so the firm's incremental earnings before interest and taxes (EBIT) will increase by a total of

$600,000 in each of the next six years (years 1-6). Hint: This value represents the difference between the revenues and operating

costs (including depreciation expense) generated using the new equipment and that earned using the old equipment.

• The project's cost of capital is 13%.

• The company's annual tax rate is 40%.

Complete the following table and compute the incremental cash flows associated with the replacement of the old equipment with the new equipment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- At times firms will need to decide if they want to continue to use their current equipment or replace the equipment with newer equipment. The company will need to do replacement analysis to determine which option is the best financial decision for the company. Price Co. is considering replacing an existing piece of equipment. The project involves the following: • The new equipment will have a cost of $2,400,000, and it is eligible for 100% bonus depreciation so it will be fully depreciated at t = 0. • The old machine was purchased before the new tax law, so it is being depreciated on a straight-line basis. It has a book value of $200,000 (at year 0) and four more years of depreciation left ($50,000 per year). • The new equipment will have a salvage value of $0 at the end of the project's life (year 6). The old machine has a current salvage value (at year 0) of $300,000. • Replacing the old machine will require an investment in net operating working capital (NOWC) of…arrow_forwardi need the answer quicklyarrow_forwardRust Industrial Systems is trying to decide between two different conveyor belt systems. System A costs $276,000, has a four-year life, and requires $84,000 in pretax annual operating costs. System B costs $390,000, has a six-year life, and requires $78,000 in pretax annual operating costs. Both systems are to be depreciated straight-line to zero over their lives and will have zero salvage value. Suppose the company always needs a conveyor belt system; when one wears out, it must be replaced. Assume the tax rate is 24 percent and the discount rate is 8 percent. Calculate the EAC for both conveyor belt systems. Note: Your answers should be negative values and indicated by minus signs. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. System A System B Which conveyor belt system should the firm choose? System A System Barrow_forward

- I need help with this problem Section b is a simple yes or noarrow_forward7) costs for the current machine. The current machine is based on older technology and has negligible market value. The purchase price of the new equipment is $500,000 and it is expected to last for 10 years. Its terminal salvage value is $50,000. Operating and maintenance (O&M) costs are estimated to be $20,000 for the first year. Thereafter, these O&M costs are expected to increase by $2,000 each year over the previous year's costs. MARR is 10% per year compounded annually. a) b) purchase this new equipment? Explain. EmKay, Inc. has decided to purchase new equipment because of the increasing maintenance Compute the present worth for this new equipment purchase. If the annual O&M costs for the current machine are $75,000, would you support the decision toarrow_forwardSaharrow_forward

- (Ignore income taxes in this problem.) Your Company has a telephone system that is in poor condition. The system must be either overhauled or replaced with a new system. The following data have been gathered concerning these two alternatives: Present System Proposed New System Purchase cost when new $100,000 $110,000 Accumulated depreciation 90,000 Overhaul cost needed now 80,000 Working capital required 50,000 Annual cash operating costs 30,000 20,000 Salvage value now of old system 10,000 Salvage value in 8 years 2,000 15,000 Your Company uses a 12% discount rate and the total cost approach to capital budgeting analysis. Both alternatives are expected to have a useful life of eight years. What is the net present value of the new system alternative? Enter your answer without dollar signs. If the NPV is negative enter with a minus sign in front.arrow_forwardNonearrow_forwardRust Industrial Systems Company is trying to decide between two different conveyor belt systems. System A costs $350,000, has a 4-year life, and requires $141,000 in pretax annual operating costs. System B costs $430,000, has a 6-year life, and requires $135,000 in pretax annual operating costs. Both systems are to be depreciated straight- line to zero over their lives and will have zero salvage value. Whichever project is chosen, it will not be replaced when it wears out. The tax rate is 22 percent and the discount rate is 8 percent. Calculate the NPV for both conveyor belt systems. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) System A System B Which conveyor belt system should the firm choose? ○ System B O System Aarrow_forward

- The company DstriBut.inc decides to take a technological shift by replacing its old distribution center with a new one that is more oriented towards technology and less dependent on manpower. The entire installation is estimated at $6,000,000 amortized at the rate of 30% decreasing. An immediate expense of $30,000 (taxable and non-depreciable) is planned to ensure the training of the personnel who will operate on the new installations. This investment creates a working capital requirement of $400,000, fully recoverable. The company estimates to increase its operating cash flow by $1,500,000 before tax. On the other hand, the company must assume an expense for the maintenance and replacement of consumable components of new installations in the amount of $50,000 every 2 years. This investment will have a residual value of $2,500,000 at the end of the investment horizon, which is set at 5 years by senior management. The tax rate is 40% and the rate of return required by senior management…arrow_forwardThe Aubey Coffee Company is evaluating the within-plant distribution system for its new roasting, grinding, and packing plant. The two alternatives are (1) a conveyor system with a high initial cost but low annual operating costs and (2) several forklift trucks, which cost less but have considerably higher operating costs. The decision to construct the plant has already been made, and the choice here will have no effect on the overall revenues of the project. The cost of capital for the plant is 12%, and the projects' expected net costs are listed in the following table: a. What is the IRR of each alternative? The IRR of alternative 1 is -Select- Year 0 1 2 3 4 5 -Select- Expected Net Cost Forklift -$200,000 -160,000 -160,000 -160,000 -160,000 -160,000 Conveyor -$500,000 -120,000 -120,000 -120,000 -120,000 -20,000 The IRR of alternative 2 is-Select- b. What is the present value of costs of each alternative? Do not round Intermediate calculations. Round your answers to the nearest…arrow_forwardi need the answer quicklyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education