Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN: 9781305506381

Author: James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please help me with this question

Transcribed Image Text:year's time?

e. What is the expected rate of real depreciation for the United States (versus the United

Kingdom)?

f. What is the expected rate of nominal depreciation for the United States (versus the United

Kingdom)?

g. What do you predict will be the dollar price of one pound a year from now?

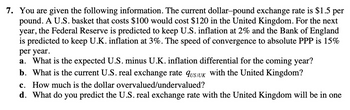

Transcribed Image Text:7. You are given the following information. The current dollar-pound exchange rate is $1.5 per

pound. A U.S. basket that costs $100 would cost $120 in the United Kingdom. For the next

year, the Federal Reserve is predicted to keep U.S. inflation at 2% and the Bank of England

is predicted to keep U.K. inflation at 3%. The speed of convergence to absolute PPP is 15%

per year.

a. What is the expected U.S. minus U.K. inflation differential for the coming year?

b. What is the current U.S. real exchange rate QUS/UK with the United Kingdom?

c. How much is the dollar overvalued/undervalued?

d. What do you predict the U.S. real exchange rate with the United Kingdom will be in one

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Is a country for which imports and exports comprise a large fraction of the GDP more likely to adopt a flexible exchange rate or a fixed (hard peg) exchange rate?arrow_forwardYou are given the following information. The current dollar/euro exchange rate is 1.25 dollars per euro. A U.S. basket that costs $100 would cost 64 euro in the euro area. For the next year, the Fed is predicted to keep U.S. inflation at 3% and the ECB is predicted to keep euro area inflation at 1%. The speed of convergence to absolute PPP is 15% per year. e. What is the expected U.S. minus euro area inflation differential for the coming year? f. What is the expected rate of nominal depreciation for the United States (versus the euro)?arrow_forward12. Use the Foreign Exchange market for British pounds to answer the following. Suppose that the British demand for US goods increases. The result is that: A) the demand for pounds increases. B) the demand for pounds decreases. C) the supply of pounds decreases. D) the supply of pounds increases. 13. Use the Foreign Exchange market for British pounds to answer the following. Suppose that the British demand for US goods decreases. The result under a flexible exchange rate regime is that: A) the demand for pounds increases. B) the demand for pounds decreases. C) the $/£ exchange rate decreases. D) the $/£ exchange rate increases.arrow_forward

- Suppose that on January 1, the dollar exchange rate with the yen is 1/120 $/Y. Over the year, the Japanese inflation rate is 5%, and the US inflation rate is 10%. If the exchange rate at the end of the year is 1$=130Y, does the yen appear to be overvalued, undervalued, or at the PPP level? Explain. What if Japanese inflation were 10% and the US inflation rate were 5% over the year, instead? Explain why your answer changes.arrow_forwardPlease see image for questionarrow_forwardAssume that Canada and the United States frequently trade with each other. Under the freely floating exchange rate system, low inflation in the U.S. will place ____ pressure on Canadian dollars (versus U.S. dollars), ____ the amount of Canadian dollars available for sale, and result in ____ inflation in Canada. a) upward; reduce; unchanged b) upward; increase; lower c) downward; reduce; lower d) downward; increase; unchanged e) None of the abovearrow_forward

- New Zealand dollar drops to lowest value against US dollar since 2020 (27/09/2022) The New Zealand dollar has dropped to its lowest value against its US equivalent since March 2020. The bad news for Kiwis is that it means it'll take longer for consumer price inflation to fall....a weak kiwi dollarmeans importing is more expensiveWhile we do expect inflation rates to slowly fall from here, the longer the New Zealand dollar remains low, the slower it will take for those inflation rates to fall, ASB senior economist Mark Smith said Six months ago the New Zealand dollar was US68.9c - now it's at US56.6c. a fall of 18 percent. Aotearoa's dollar is suffering because the US dollar is being pumped up by the US Federal Reserve lifting interest rates to tackle inflation. "Interest rates globally are going up, and when rates are going up, generally people tend to look to where their money will be safest, and at the moment it's certainly the US economy," saidSmithBut Finance Minister Grant…arrow_forwardNew Zealand dollar drops to lowest value against US dollar since 2020 (27/09/2022) The New Zealand dollar has dropped to its lowest value against its US equivalent since March 2020. The bad news for Kiwis is that it means it'll take longer for consumer price inflation to fall....a weak kiwi dollarmeans importing is more expensiveWhile we do expect inflation rates to slowly fall from here, the longer the New Zealand dollar remains low, the slower it will take for those inflation rates to fall, ASB senior economist Mark Smith said Six months ago the New Zealand dollar was US68.9c - now it's at US56.6c. a fall of 18 percent. Aotearoa's dollar is suffering because the US dollar is being pumped up by the US Federal Reserve lifting interest rates to tackle inflation. "Interest rates globally are going up, and when rates are going up, generally people tend to look to where their money will be safest, and at the moment it's certainly the US economy," saidSmithBut Finance Minister Grant…arrow_forwardPurchasing Power Parity Forecasts. Use the table Assuming purchasing power parity, and assuming that the forecasted change in consumer prices is a good proxy of predicted inflation, forecast the following exchange rates: a. Japanese yen/U.S. dollar in one year b. Japanese yen/Australian dollar in one year c. Australian dollar/U.S. dollar in one year |containing economic, financial, and business indicators to answer the following questions. Assuming purchasing power parity, and assuming that the forecasted change in consumer prices is a good proxy of predicted inflation, forecast the following exchange rates: a. Japanese yen/U.S. dollar in one year The forecast of the spot rate for Japanese yen/U.S. dollar in one year is Y/s. (Round to two decimal places.) b. Japanese yen/Australian dollar in one year The forecast of the cross rate for Japanese yen/Australian dollar in one year is ¥A$. (Round to two decimal places.) c. Australian dollar/U.S. dollar in one year The forecast of the spot…arrow_forward

- . In 2019, the exchange rate was ¥6.74=$1. Convert the China GDP of ¥99,086.5 billion yuan in 2019 with the U.S. GDP of $21,430 trillion for the same year.arrow_forwardThe U.S. dollar exchange rate increased from $0.96 Canadian in June 2011 to $1.03 Canadian in June 2012, and it decreased from 81 Japanese yen in June 2011 to 78 yen in June 2012. 1. Did the U.S. dollar appreciate or depreciate against the Canadian dollar? Did the U.S. dollar appreciate or depreciate against the yen? 2. What was the value of the Canadian dollar in terms of U.S. dollars in June 2011 and June 2012? Did the Canadian dollar appreciate or depreciate against the U.S. dollar over the year June 2011 to June 2012? 3. What was the value of 100 yen in terms of U.S. dollars in June 2011 and June 2012? Did the yen appreciate or depreciate against the U.S. dollar over the year June 2011 to June 2012?arrow_forwardSuppose that the United States decides to fix the dollar-euro exchange rate. If the U.S. central bank observes that the quantity supplied of euros exceeds the quantity demanded of euros at the fixed exchange rate, to maintain the exchange rate, the U.S. central bank will A.) realize a decrease in its reserves of euros. B.) need to appreciate the dollar. C.) realize an increase in its reserves of euros. D.) need to reduce the domestic supply of dollars.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning

Macroeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506756

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning