FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

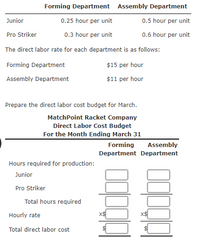

7. MatchPoint Racket Company manufactures two types of tennis rackets, the Junior and Pro Striker models. The production budget for March for the two rackets is as follows:

| Junior | Pro Striker | |

| Production budget | 6,600 units | 19,500 units |

Both rackets are produced in two departments, Forming and Assembly. The direct labor hours required for each racket are estimated as follows:

Transcribed Image Text:**MatchPoint Racket Company Direct Labor Cost Budget Explanation**

**Forming and Assembly Departments**

**Time per Unit:**

- **Junior Racket:**

- Forming Department: 0.25 hour per unit

- Assembly Department: 0.5 hour per unit

- **Pro Striker Racket:**

- Forming Department: 0.3 hour per unit

- Assembly Department: 0.6 hour per unit

**Direct Labor Rate:**

- Forming Department: $15 per hour

- Assembly Department: $11 per hour

**Task:**

Prepare the direct labor cost budget for March.

---

**Budget Table:**

**1. Hours Required for Production:**

- **Junior Racket:**

- Forming Department: __

- Assembly Department: __

- **Pro Striker Racket:**

- Forming Department: __

- Assembly Department: __

**2. Total Hours Required:**

- Forming Department: __

- Assembly Department: __

**3. Hourly Rate (given):**

- Forming Department: $15

- Assembly Department: $11

**4. Total Direct Labor Cost:**

- Forming Department: __

- Assembly Department: __

This budget planning involves calculating the total hours required for production based on the number of units produced and multiplying these hours by the respective hourly rate to find the total labor cost for each department. The goal is to determine the labor costs for the month ending March 31.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Becker Bikes manufactures tricycles. The company expects to sell 380 units in May and 510 units in June. Beginning and ending finished goods for May are expected to be 110 and 75 units, respectively. June's ending finished goods are expected to be 85 units. The company's variable overhead is $4.00 per unit produced and its fixed overhead is $4,500 per month. Compute Becker's manufacturing overhead budget for May and June. Note: Do not round intermediate calculations. Round your final answers to 2 decimal places. Budgeted manufacturing overhead May Junearrow_forwardMiami Solar manufactures solar panels for industrial use. The company budgets production of 5,300 units (solar panels) in July and 5,600 units in August.arrow_forwardYammy Company currently produces ultimate discs in an automated process. Expected production per month is 80,000 units. The required direct materials costs $0.20 per unit and labor costs $0.10 per unit. Manufacturing fixed overhead costs are $5,000 per month. Manufacturing overhead is allocated based on units of production. What is the flexible budget total product costs for 80,000 and 40,000 units, respectively?arrow_forward

- Packaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for each department. The planning budget and flexible budget for the Production Department are based on the following formulas, where q is the number of labor-hours worked in a month: Direct labor Indirect labor Utilities Supplies Equipment depreciation Factory rent Property taxes Factory administration Direct labor Indirect labor Utilities Supplies Equipment depreciation Cost Formulas The Production Department planned to work 4,300 labor-hours in March; however, it actually worked 4,100 labor-hours during the month. Its actual costs incurred in March are listed below: Factory rent Property taxes Factory administration $16.509 $4,400 $2.00q $5,000 + $0.50q $1,300+ $0.109 $18,500 + $2.60q $8,200 $2,400 $13,500+ $0.50q Actual Cost Incurred in March $ 69,270 $ 12,180 $ 7,540 $ 1,940 $ 29,160 $ 8,600 $ 2,400 $ 14,880 Required: 1. Prepare the Production…arrow_forwardPackaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for each department. The planning budget and flexible budget for the Production Department are based on the following formulas, where q is the number of labor-hours worked in a month: Direct labor Indirect labor Utilities Supplies Equipment depreciation Factory rent Property taxes. Factory administration The Production Department planned to work 4,200 labor-hours in March; however, it actually worked 4,000 labor-hours during the month. Its actual costs incurred in March are listed below: Direct labor Indirect labor Utilities Supplies Equipment depreciation Factory rent Property taxes Factory administration Cost Formulas $16.20g $4,200+ $1.50g $5,700+ $0.60g $1,500+ $0.10g $18,300+ $2.60g $8,600 $2,500 $13,300+ $0.90g Actual Cost Incurred in March $ 66,360 $ 9,680 $ 8,610 $ 2,130 $ 28,700 $ 9,000 $ 2,500 $ 16,310 Required: 1. Prepare the Production…arrow_forwardBlack Company expects to produce 2,100 finished goods units in January and 2,010 finished goods units in February. Black budgets 7 direct labor hours per finished good unit. Direct labor costs averages $11 per hour. Black's budgeted cost of Direct Labor for February is O $124,300 O $142,630 O $154,770 O $139,200 O $161,420arrow_forward

- The production budget for Manner Company shows units to produce as follows: July, 700; August, 760; and September, 620. Each unit produced requires one hour of direct labor. The direct labor rate is budgeted at $17 per hour in July and August, but is budgeted to be $17.75 per hour in September. Prepare a direct labor budget for the months July, August, and September. Units to produce Direct labor hours needed Cost of direct labor MANNER COMPANY Direct Labor Budget July 700 August 760 September 620 unitsarrow_forwardApple manufacturing company produces a single standard product. The standard overhead cost budgets are K 100,000 for this month is 20,000 direct labour hours based on the production budget. The standard cost card for the product is as follows: Materials Direct Labour Factory overhead K 100.00 5 pieces @ K 10.00 = K 50.00 5 hours @ K 5.00 = K 25.00 5 hour @ K 5.00 = K 25.00 The following transactions occurred during the month of March 2007. (a) Direct materials purchased 3,000 pieces @ K 9.00. (b) Direct maerials requisition 1,900 pieces. (c) Actual direct labour costs 2,100 hours @ K 5.25 (d) Production completed during March 420 units. Required: Calculate the materials and labour variances.arrow_forwardPackaging Solutions Corporation manufactures and sells a wide variety of packaging products. Its Production Department's planning budget and flexible budget are based on the following formulas, where q is the number of labor-hours worked in a month: Direct labor Indirect labor Utilities Supplies Equipment depreciation Factory rent Property taxes Factory administration Direct labor Indirect labor Utilities Supplies Equipment depreciation Cost Formulas $16.309 $4,200+ $1.809 $5,800+ $0.909 $1,800+ $0.109 The Production Department planned to work 4,200 labor-hours in March; however, it actually worked 4,000 labor-hours during the month. Its actual costs incurred in March are listed below: Factory rent Property taxes Factory administration $18,600 + $2.609 $8,100 $2,800 $13,300 + $0.709 Actual Cost Incurred in March $ 66,780 $ 10,940 $ 9,970 $ 2,430 $ 29,000 $ 8,500 $ 2,800 $ 15,470 Required: 1. Prepare the Production Department's planning budget for the month.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education