FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

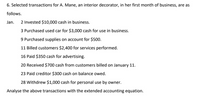

Transcribed Image Text:6. Selected transactions for A. Mane, an interior decorator, in her first month of business, are as

follows.

Jan.

2 Invested $10,000 cash in business.

3 Purchased used car for $3,000 cash for use in business.

9 Purchased supplies on account for $500.

11 Billed customers $2,400 for services performed.

16 Paid $350 cash for advertising.

20 Received $700 cash from customers billed on January 11.

23 Paid creditor $300 cash on balance owed.

28 Withdrew $1,000 cash for personal use by owner.

Analyse the above transactions with the extended accounting equation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 1. Adriana Diaz invested $50,000 cash to start an appliance repair business. 2. Hired an employee to be paid $400 per week, starting tomorrow. 3. Paid two years’ rent in advance, $7,200. 4. Paid the worker’s weekly wage. 5. Recorded revenue earned and received for the week, $1,500arrow_forwardOn April 1, Donna Clark established Clark’s Travel Agency. The following transactions were completed during the month. 1. Invested $13,000 cash to start the agency. 2. Paid $500 cash for April office rent. 3. Purchased equipment for $3,800 cash. 4. Incurred $600 of advertising costs in the Chicago Tribune, on account. 5. Paid $600 cash for office supplies. 6. Performed services worth $10,000: $3,500 cash is received from customers, and the balance of $6,500 is billed to customers on account. 7. Withdrew $600 cash for personal use. 8. Paid Chicago Tribune $400 of the amount due in transaction (4). 9. Paid employees' salaries $2,800. 10. Received $3,500 in cash from customers who have previously been billed in transaction (6). Complete the tabular analysis of the transactions. (If a transaction results in a decrease in Assets, Liabilities or Owner's Equity, place a negative sign (or parentheses) in front of the amount entered for the particular…arrow_forwardMoore General Store purchased office supplies on account during the month of March for $5,000. Payment for the supplies will be made in April. On March 1, the balance in the supplies account was $350. On March 31, supplies on hand amounted to $310. What was the amount of supplies used during March? Select one: a. $40 b. $310 c. $4,690 d. $5,040 e. $5,350arrow_forward

- DATE TRANSACTIONS October 1 Shonna Pumphrey invested $90,000 cash in the business October 2 Paid October office rent of $6,000; issued Check 1001. October 5 Purchased desks and other office furniture for $22,800 from Hudson's Furniture; received Invoice 4067 payable in 60 days. October 6 Issued Check 1002 for $8,200 to purchase art equipment. October 7 Purchased supplies for $3,340; paid with Check 1003. October 10 Issued Check 1004 for $1,250 for office cleaning service. October 12 Performed services for $8,400 in cash and $2,200 on credit. (Use a compound entry.) October 15 Returned damaged supplies for a cash refund of $750. October 18 Purchased a computer for $4,490 from Tolliver's Office Supply, Invoice 8017; issued Check 1005 for a $1,490 down payment, with the balance payable in 30 days. (Use one compound entry.) October 20 Issued Check 1006 for $12,800 to Hudson's Furniture as payment on account for Invoice 4067. October 26 Performed services for $9,600 on credit. October 27…arrow_forwardHandy Dandy Repair Shop had the following transactions during the first month of business as a proprietorship. Aug. 2 Invested $11,440 cash and $2,350 of equipment in the business. 7 Purchased supplies on account for $490. (Debit asset account.) 12 Performed services for clients, for which $1,380 was collected in cash and $640 was billed to the clients. 15 Paid August rent $555. 19 Counted supplies and determined that only $245 of the supplies purchased on August 7 are still on hand. Journalize the transactions.arrow_forwardApril 1- investigated $ 23,000 cash in her business. April 1- hired a secretary-receptionist at a salary of $ 900 per week payable monthly. April 2- paid office rent for the month $ 1,000. April 3- purchased dental supplies on account from Dazzle Company $ 4,500. April 10- performed dental services and billed insurance companies $ 4,700. April 11- received $ 1,100 cash advance from Leah Mataruka for an implant. April 20- received $ 1,900 cash for services performed from Michael Santos. April 30- paid secretary receptionist for the month $ 3,600. April 30- paid $ 2,900 to Dazzle for accounts payable due. Prepare a trial balance for April 30, 2020arrow_forward

- Sun Devil Hair Design has the following transactions during the month of February. February 2 Pay $700 for radio advertising for February.February 7 Purchase beauty supplies of $1,300 on account.February 14 Provide beauty services of $2,900 to customers and receive cash.February 15 Pay employee salaries for the current month of $900.February 25 Provide beauty services of $1,000 to customers on account.February 28 Pay utility bill for the current month of $300.Required:Record each transaction. Sun Devil uses the following accounts: Cash, Accounts Receivable, Supplies, Accounts Payable, Service Revenue, Advertising Expense, Salaries Expense, and Utilities Expense.arrow_forwardDec. 2 Paid $1,060 cash to Northview Mall for Security First’ share of mall advertising costs. Dec. 3 Paid $520 cash for minor repairs to the company’s computer. Dec. 4 Received $6,900 cash from Brady Engineering Co. for the receivable from November. Dec. 10 Paid cash to Zahara Hughes for six days of work at the rate of $160 per day. Dec. 14 Notified by Brady Engineering Co. that Security First’ bid of $7,100 on a proposed project has been accepted. Brady paid a $1,550 cash advance to Security First. Dec. 15 Purchased $2,250 of computer supplies on credit from Arnold Office Products. Dec. 16 Sent a reminder to Jackson Co. to pay the fee for services recorded on November 8. Dec. 20 Completed a project for Masters Corporation and received $7,900 cash. Dec. 22-26 Took the week off for the holidays. Dec. 28 Received $4,400 cash from Jackson Co. on its receivable. Dec. 29 Reimbursed K. Hughes for business automobile mileage…arrow_forwardA dentist opens a dental practice by depositing $10,000 into a bank account in the business name The dental business borrows $100,000 from the bank The dentist pays for malpractice insurance for the month, $2,000 Purchases for cash dental equipment, including X-ray machine, chair, etc. $60,000 The dentist pays for a billboard to advertise his services for one month, $500 The dentist performs dental services for the first half of the month and receives $8,000 for services January 1 January 2 January 3 January 4 January 20 January 21 rendered January 29 January 31 Pays the dental hygienist $2500 Bills patients for services rendered that have not been paid $5,000 Date Account Debit Credit 1/1/16 Cash 10000 Сapital 10000 Chart of Accounts: 1/2/16 Cash Accounts Receivable 1/3/16 Equipment Notes Payable 1/4/06 Сapital Fees Earned 1/20/16 Insurance Expense Advertising Expense 1/21/16 Salaries Expense 1/29/16 1/31/16 1. What is the net income for January? 2. How much do patients owe the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education