FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

Transcribed Image Text:Date

Account Titles and Explanation

Debit

Credit

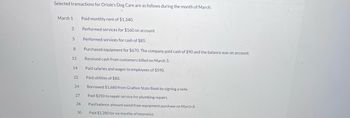

Transcribed Image Text:Selected transactions for Oriole's Dog Care are as follows during the month of March.

March 1

3

5

8

12

14

22

24

27

28

Paid monthly rent of $1,340.

Performed services for $160 on account.

Performed services for cash of $85.

Purchased equipment for $670. The company paid cash of $90 and the balance was on account.

Received cash from customers billed on March 3.

Paid salaries and wages to employees of $590.

Paid utilities of $80.

Borrowed $1,680 from Grafton State Bank by signing a note.

Paid $250 to repair service for plumbing repairs.

Paid balance amount owed from equipment purchase on March 8.

Paid $2,280 for six months of insurance.

30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 12, 2018 Julie prepaid $1,600 for pet care services to be provided each Friday for 8 weeks for her Yellow Lab, Honey. Mookie The Beagle Concierge recorded the entire $1,600 as Sales. At the end of the accounting period on January 31, 3 weeks (01/12, 01/19, 01/26) of the pet care services had been provided to Honey, so 5 weeks of services or $1,000 ($1,600/8 = $200 per week) had not been earned as of the end of January. Since $1,000 had not been earned, the $1,000 is a liability because Mookie The Beagle Concierge has an obligation to provide the pet care services or return the $1,000 to the customer. So an adjusting entry is needed to bring the accounts up to date at January 31. What is the journal entry needed?arrow_forwardAn international children’s charity collects donations, which are used to buy clothing and toysfor children in need. The charity records donations of cash and other items as Donations Revenuewhen received. Prepare journal entries for the following transactions, which occurred during arecent month, and determine the charity’s preliminary net income.a. Received $4,000 in cash and checks from a door-to-door campaign.b. Paid $2,000 cash for employee wages this month.c. Paid $1,000 cash on a short-term loan from the bank (ignore interest).d. Bought $3,000 worth of new toy supplies from a large toy manufacturer, paying $1,000 cashand signing a short-term note for $2,000.e. The manufacturer generously donated an additional $2,500 of toy suppliearrow_forwardGetting ready for the upcoming holiday season is traditionally a busy time for greeting card com-panies, and it was no exception for Kate. The following transactions occurred during the month of October: 1. Hired an assistant at an hourly rate of $10 per hour to help with some of the computer layouts and administrative chores. 2. Supplements her business by teaching a class to aspiring card designers. She charges and receives a total of $450. 3. Delivers greeting cards to several new customers. She bills them a total of $3,500. 4. Pays a utility bill in the amount of $250 that she determines is the business portion of her utility bill. 5. Receives an advance deposit of $500 for a new set of cards she is designing for a new customer. 6. Pays her assistant $200 for the work done this month. 7. Determines that the assistant has worked 10 additional hours this month that have not yet been paid. 8. Ordered and receives additional supplies in the amount of $1,000. These were paid for during…arrow_forward

- Bank 'n' Roll, Inc. pays its employees once a month and records the expense at the time of payment. On May 31, Bank 'n' Roll, Inc. paid its employees $10,000 for work performed in May. The entry to record the payment includes a (Check all that apply.) Check all that apply. debit to Cash for $10,000 credit to Wages Expense for $10,000 credit to Wages Payable for $10,000 debit to Wages Expense for $10,000 credit to Cash for $10,000arrow_forwardSun Devil Hair Design has the following transactions during the month of February. February 2 Pay $700 for radio advertising for February.February 7 Purchase beauty supplies of $1,300 on account.February 14 Provide beauty services of $2,900 to customers and receive cash.February 15 Pay employee salaries for the current month of $900.February 25 Provide beauty services of $1,000 to customers on account.February 28 Pay utility bill for the current month of $300.Required:Record each transaction. Sun Devil uses the following accounts: Cash, Accounts Receivable, Supplies, Accounts Payable, Service Revenue, Advertising Expense, Salaries Expense, and Utilities Expense.arrow_forwardan invoice for kitchen appliances is dated December 23 and is paid on January 14 of the following year. credit terms are 2/15,n/45 EOM. The total amount, $497.48 includes a charge for freight and insurance of $62.43. A. What amount should be paid? B.How much is credited to the buyer's account? C. Is any money still owed after the payment?arrow_forward

- Ainsley Emporium sells gift cards to customers. In December, customers purchased $10,000 of gift cards. During December, the gift card recipients used gift cards to purchase $3,000 of goods. Prepare Ainsley’s entry for (1) the sale of the gift cards and (2) the year-end adjusting entry. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit (To record cash received for goods to be provided at a later date) (To record the sale of merchandise using a gift card)arrow_forwardSafe Home provides house-sitting for people while they are away on vacation. Some of its customers pay immediately after the job is finished. Some customers ask that the business send them a bill. On December 31, Safe Home has collected $800 from cash-paying customers. Safe Home's remaining customers owe the business $1,800. Cash received Revenue Recorded Total Revenue Recorded December 31 December 31 Cash Basis 800 800 800 December 31 December 31 Accrual Basis 800 1800 2600arrow_forwardUse the unpaid balance method to find the finance charge on the credit card account for August. The starting balance from the previous month is $240. The transactions on the account for the month are given in the table to the right. Assume an annual interest rate of 21% on the account and that the billing date is August 1st.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education