FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

9

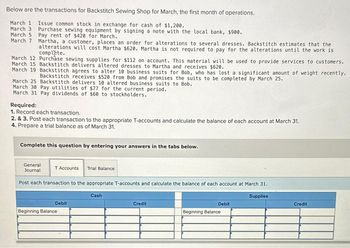

Transcribed Image Text:Below are the transactions for Backstitch Sewing Shop for March, the first month of operations.

March 1 Issue common stock in exchange for cash of $1,200.

March 3 Purchase sewing equipment by signing a note with the local bank, $900.

March 5 Pay rent of $420 for March.

March 7 Martha, a customer, places an order for alterations to several dresses. Backstitch estimates that the

alterations will cost Martha $620. Martha is not required to pay for the alterations until the work is

complete.

March 12 Purchase sewing supplies for $112 on account. This material will be used to provide services to customers.

March 15 Backstitch delivers altered dresses to Martha and receives $620.

March 19 Backstitch agrees to alter 10 business suits for Bob, who has lost a significant amount of weight recently.

Backstitch receives $520 from Bob and promises the suits to be completed by March 25.

March 25 Backstitch delivers 10 altered business suits to Bob.

March 30 Pay utilities of $77 for the current period.

March 31 Pay dividends of $60 to stockholders.

Required:

1. Record each transaction.

2. & 3. Post each transaction to the appropriate T-accounts and calculate the balance of each account at March 31.

4. Prepare a trial balance as of March 31.

Complete this question by entering your answers in the tabs below.

General

Journal

T Accounts Trial Balance

Post each transaction to the appropriate T-accounts and calculate the balance of each account at March 31.

Debit

Beginning Balance

Cash

Credit

Debit

Beginning Balance

Supplies

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education