FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Os

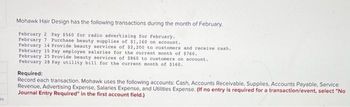

Mohawk Hair Design has the following transactions during the month of February.

February 2 Pay $560 for radio advertising for February.

February 7 Purchase beauty supplies of $1,160 on account.

February 14 Provide beauty services of $2,200 to customers and receive cash.

February 15 Pay employee salaries for the current month of $760.

February 25 Provide beauty services of 5860 to customers on account.

February 28 Pay utility bill for the current month of $160.

Required:

Record each transaction. Mohawk uses the following accounts: Cash, Accounts Receivable, Supplies, Accounts Payable, Service

Revenue, Advertising Expense, Salaries Expense, and Utilities Expense. (If no entry is required for a transaction/event, select "No

Journal Entry Required" in the first account field.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Billing charges for Microsoft 365 Commercial licensing. When a customer purchases a subscription and changes the amount during the subscription period, a full refund is credited then prorated for what was used. For example, if a customer purchased 2 subscriptions for the month of June at $15 each, the total charge for the month would be $30. If they decide to return one subscription 5 days later, the full $30 would be credited then a prorated charge for what was used would be applied. Credit $30 Charge $15 Charge $0.5 * 5 = $2.50 $15/30 $0.5 p/day = Total Charge $17.50 Total Credit $12.50 If a customer purchases 10 Microsoft 365 Business Premium licenses at $22 each per month, for a full year then 6 months later decides they only need 5 licenses for the remainder of the year, what would be the total charge and credit for the year?arrow_forwarda local shoe outlet ordered 30 pairs of tennis shoes from nike corporation. The shoes were priced at $75 for eaxh pair with the following terms: 4/10, 2/30, n/60. The invoice was dated october 15. The store sent in a payment on October 28. What should have been the amount of the check?arrow_forwardFeb. 26 The company paid cash to Lyn Addie for eight days’ work at $125 per day. Mar. 25 The company sold merchandise with a $2,002 cost for $2,800 on credit to Wildcat Services, invoice dated March 25. Required 1. Assume that Lyn Addie is an unmarried employee. Her $1,000 of wages have deductions for FICA Social Security taxes, FICA Medicare taxes, and federal income taxes. Her federal income taxes for this pay period total $159. Compute her net pay for the eight days’ work paid on February 26. Round amounts to the nearest cent. 2. Record the journal entry to reflect the payroll payment to Lyn Addie as computed in part 1. 3. Record the journal entry to reflect the (employer) payroll tax expenses for the February 26 payroll payment. Assume Lyn Addie has not met earnings limits for FUTA and SUTA (the FUTA rate is 0.6% and the SUTA rate is 5.4% for the company). Round amounts to the nearest cent. 4. Record the entry(ies) for the merchandise sold on March 25 if a 4% sales tax rate…arrow_forward

- From the following facts, Molly Roe has requested you to calculate the average daily balance. The customer believes the average daily balance should be $877.67. Respond to the customer’s concern. Note: Round your final answer to the nearest cent. 28-day billing cycle 3/18 Billing date $ 672 Previous balance 3/24 Payment $ 59 Credit 3/29 Charge: Sears 218 4/5 Payment 17 Credit 4/9 Charge: Macy’s 166 Average daily balance:arrow_forwardPlease read the questions carefully the First question is asking for journal entry.arrow_forwardLamplight Plus sells lamps to consumers. The company contracts with a supplier who provides them with lamp fixtures. There is an agreement that Lamplight Plus is not required to provide cash payment immediately and instead will provide payment within thirty days of the invoice date. Additional information: • Lamplight purchases 25 light fixtures for $25 each on August 1, invoice date August 1, with no discount terms. Lamplight returns 5 light fixtures (receiving a credit amount for the total purchase price per fixture of $25 each) on August 3. • Lamplight purchases an additional 15 light fixtures for $10 each on August 19, invoice date August 19, with no discount terms. • Lamplight pays $130 toward its account on August 22. What amount does Lamplight Plus still owe to the supplier on August 30? What account is used to recognize this outstanding amount?arrow_forward

- Triple Tier Bakery is a locally-owned business offering custom cakes, cupcakes, desserts and wedding cakes. At year end, Triple Tier's balance of Allowance for Uncollectible Accounts is $530 (credit before adjustment. The Accounts Receivable balance is $21,500, During the next year, Triple Tier estimates that 15% of accounts will be uncollectible. Record the adjustment required for Allowance for Uncollectible Accounts? (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the adjusting entry for Allowance for Uncollectible Accounts. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journalarrow_forwardBolton sold a customer service contract with a price of $37,000 to Sammy's Wholesale Company. Bolton offered terms of 1/10, n/30 and uses the gross method. Required: Hide Prepare the journal entry assuming the payment is made after 10 days (after the discount period). Account and Explanation Debit Credit Record collection of accounts receivablearrow_forwardA man received an invoice for washing machine for $455 dated April 17, with a sales term of 2/10 EOM. How much should he pay if he pay if he pays bill on April 28?arrow_forward

- Squeaky Shine provides car washing services in Jersey City, New Jersey. A three-month pass for automatic car wash sells for $60, which entitles the customer for an unlimited number of car washes during the contract period. Squeaky Shine estimates that pass holders wash their cars equally throughout the three-month period. On December 1st, customers purchased $2,160 of the three-month passes, with usage of the passes occurring evenly throughout the contract period. Required: 1. Prepare the journal entries that Squeaky Shine would record on December 1 and on December 31, 2024, with respect to this transaction. 2. State the account titles and amounts that will be included in Squeaky Shine's 2024 income statement and balance sheet. Complete this question by entering your answers in the tabs below. Required 1 Required 2 State the account titles and amounts that will be included in Squeaky Shine's 2024 income statement and balance sheet. Account Titles Amounts Income Statement and Balance…arrow_forwardIt is the last day of the month and fiscal year, your manager asks you to create an invoice for $10,000 (debiting Accounts Receivable and Crediting Sales) and send it to a specified customer. Normally invoices are sent to customers when products have been shipped or the service has been finished. You manager tells you that we will be shipping equipment and performing the setup services for this customer next month (as early as next week). How would the company’s financial statements (and the users of the financial statements) be affected if you record this entry?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education