FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Financial Accounting Question please solve

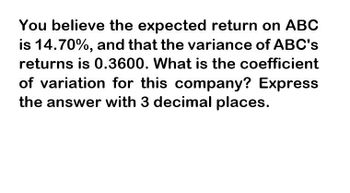

Transcribed Image Text:You believe the expected return on ABC

is 14.70%, and that the variance of ABC's

returns is 0.3600. What is the coefficient

of variation for this company? Express

the answer with 3 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Given the following information, calculate the expected value for Firm C's EPS. Data for Firms A and B are as follows: E(EPSA) = $5.10, and σA = $3.63; E(EPSB) = $4.20, and σB = $2.94. Do not round intermediate calculations. Round your answer to the nearest cent. Probability 0.1 0.2 0.4 0.2 0.1 Firm A: EPSA ($1.61) $1.80 $5.10 $8.40 $11.81 Firm B: EPSB (1.20) 1.30 4.20 7.10 9.60 Firm C: EPSC (2.59) 1.35 5.10 8.85 12.79 E(EPSC): $ You are given that σc = $4.12. Discuss the relative riskiness of the three firms' earnings using their respective coefficients of variation. Do not round intermediate calculations. Round your answers to two decimal places. CV A B C The most risky firm is .arrow_forwardprovide step by step explaination (no excel)arrow_forwardA probability distribution of possible returns from a share has a variance of 0.0064. What is the standard deviation of this probability distribution? a. 0.08 b. 0.64 c. 8% d. Both (a) and (c)arrow_forward

- Consider the following information: State Probability i of State i Actual Return of Johnson and Johnson Boom 78 % 21 % Bust 22% 1% What is the variance of Johnson and Johnson? (Round to 6 decimals) (Remember Variance is not in percentage terms!) Answer:arrow_forwardSuppose an investment is equally likely to have a 30% return or a -5% return. The variance on the return for this investment is closest to 0.175 0.2 0.03 0arrow_forwardA linear regression model is Units = 4,004 – 0.659×Week. For week 46, what is the forecast for the number of units? Round your answer to the nearest whole number. unitsarrow_forward

- Emmons Corporation has a 0.0 probability of a return of 0.49, a 0.4 probability of a rate of return of 0.07, and the remaining probability of a 0.0 rate of return. What is the variance in the expected rate of return of Emmons Corporation?arrow_forwardThis is a three-part question. Answer to part one is 2.4%; please help me solve for parts two and three. Thank you.arrow_forward1. Over the past 3 years an investment returned 0.18, -0.11, and 0.08. What is the variance of returns?arrow_forward

- Suppose that the returns on an investment are normally distributed with an expected return of 16% and standard deviation of 3%. What is the likelihood of receiving a return that is equal to or less than 19%? (Hint: the area under a curve for 1 std dev is 34.13%, 2 std dev is 47.73% and 3 std dev is 49.87%.).arrow_forwardF1arrow_forwardWhich one of the following is defined as the average compound return earned per year over a multiyear period? Multiple Choice A Geometric average return B Variance of returns C Standard deviation of returns D Arithmetic average return E. Normal distribution of returnsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education