FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

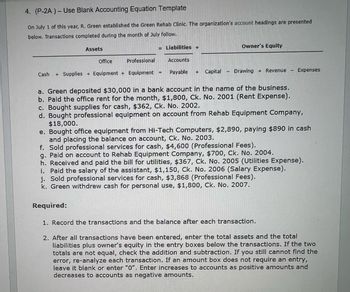

Transcribed Image Text:4. (P-2A)- Use Blank Accounting Equation Template

On July 1 of this year, R. Green established the Green Rehab Clinic. The organization's account headings are presented

below. Transactions completed during the month of July follow.

Assets

= Liabilities +

Owner's Equity

Office

Professional

Accounts

Cash + Supplies + Equipment + Equipment -

Payable + Capital

Drawing +Revenue

Expenses

a. Green deposited $30,000 in a bank account in the name of the business.

b. Paid the office rent for the month, $1,800, Ck. No. 2001 (Rent Expense).

c. Bought supplies for cash, $362, Ck. No. 2002.

d. Bought professional equipment on account from Rehab Equipment Company,

$18,000.

e. Bought office equipment from Hi-Tech Computers, $2,890, paying $890 in cash

and placing the balance on account, Ck. No. 2003.

f. Sold professional services for cash, $4,600 (Professional Fees).

g. Paid on account to Rehab Equipment Company, $700, Ck. No. 2004.

h. Received and paid the bill for utilities, $367, Ck. No. 2005 (Utilities Expense).

i. Paid the salary of the assistant, $1,150, Ck. No. 2006 (Salary Expense).

j. Sold professional services for cash, $3,868 (Professional Fees).

k. Green withdrew cash for personal use, $1,800, Ck. No. 2007.

Required:

1. Record the transactions and the balance after each transaction.

2. After all transactions have been entered, enter the total assets and the total

liabilities plus owner's equity in the entry boxes below the transactions. If the two

totals are not equal, check the addition and subtraction. If you still cannot find the

error, re-analyze each transaction. If an amount box does not require an entry,

leave it blank or enter "O". Enter increases to accounts as positive amounts and

decreases to accounts as negative amounts.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Prepare general journal entries for the following transactions of a new company called Pose-for-Pics. Use the following (partial) chart of accounts: Cash; Office Supplies; Prepaid Insurance; Photography Equipment; M. Harris, Capital; Photography Fees Earned; and Utilities Expense. Aug. 1 Madison Harris, the owner, invested $6,500 cash and $33,500 of photography equipment in the company. 2 The company paid $2,100 cash for an insurance policy covering the next 24 months. 5 The company purchased office supplies for $880 cash. 20 The company received $3,331 cash in photography fees earned. 31 The company paid $675 cash for August utilitiesarrow_forwardOn January 1, 20Y5, Fahad Ali established Mountain Top Realty, which completed the following transactions during the month: Jan. 1 Fahad Ali transferred cash from a personal bank account to an account to be used for the business, $31,000. 2 Paid rent on office and equipment for the month, $3,050. 3 Purchased supplies on account, $2,250. 4 Paid creditor on account, $850. 5 Earned fees, receiving cash, $14,660. 6 Paid automobile expenses (including rental charge) for month, $1,540, and miscellaneous expenses, $670. 7 Paid office salaries, $2,600. 8 Determined that the cost of supplies used was $1,050. 9 Withdrew cash for personal use, $2,200. Required: 1. Journalize entries for transactions Jan. 1 through 9. Refer to the chart of accounts for the exact wording of the account titles. . Every line on a journal page is used for debit or credit entries. 2. Post the journal entries to the T accounts, selecting the appropriate date to the left…arrow_forwardDetermine the unit contribution margin and contribution margin ratio. Last month, Laredo Company sold 450 units for $25 each. During the month, fixed costs were $2,520 and variable costs were $9 per unit.arrow_forward

- Yard Professionals Incorporated experienced the following events in Year 1, its first year of operation: 1. Performed services for $26,000 cash. 2. Purchased $4,800 of supplies on account. 3. A physical count on December 31, Year 1, found that there was $1,040 of supplies on hand. Required: Based on this information alone: a. Record the events under an accounting equation. b. Prepare an income statement, balance sheet, and statement of cash flows for the Year 1 accounting per c. What is the balance in the Supplies account as of January 1, Year 2? d. What is the balance in the Supplies Expense account as of January 1, Year 2? Complete this question by entering your answers in the tabs below. Req A Req B1 Income statement Event Req B2 Balance sheet 1. Provided service 2. Purchased supplies 3. Used supplies Totals Record the events under an accounting equation. Note: Not all cells require input. Enter any decreases to account balances with a minus sign. Req B3 Statement of cash flows Cash…arrow_forwardThe Trial Balance of Song Hae Kyo Service Center on July 1 2009, list the entity assets, liabilities and owners equity on that date. Balance Account Title Debit Credit Cash .. $ 35,000 Account Receivable.... 4,500 Account Payable . Song Hae Kyo, Capital.. $ 2,000 37,500 Total... ... $ 39,500 $ 39,500 ..... ... During July, the business engaged in the following transactions: a. Borrowed $35,000 from bank and sing note payable in the name of business b. Paid cash $ 25,000 to real estate company to acquire the land c. Performed customer service and received cash $ 3,500 d. Purchase supplies $ 580 on account e. Performed customer service and earned revenue on account $ 7,800 f. Paid $ 1,500 on account g. Paid interest $ 750 h. Paid the following expenses; salaries $ 3,500 ; rent $ 1,500; utilities $ 500 i. Received $ 3,800 on account j. Withdrawal $2,600 for personal use Required : 1. Open the following accounts with the balances indicated, in the ledger of Song Hae Kyo Computer Service…arrow_forwardRequired Informatlon [The following Information applies to the questions displayed below.] On October 1, Ebony Ernst organized Ernst Consulting; on October 3, the owner contributed $83,010 in assets to launch the business. On October 31, the company's records show the following items and amounts. Cash withdrawals by owner Consulting revenue Cash $14,8980 930 Accounts receivable 12,820 12,820 Office supplies 2,290 Rent expense 2,530 Land 45,960 Salaries expense 5,780 Office equipment Accounts payable Telephone expense Miscellaneous expenses 16,900 790 7,678 610 Owner investments 83,010 Using the above Information prepare an October Income statement for the business. ERN ST CON SULTING Income Statementarrow_forward

- For each of the following activities, identify the effect on each component of the income statement and balance sheet. (Enter ell amounts as positive values. If the effect is both Increase and decrease, enter the amount. Do not enter 0.) 1. $14,000 of services were provided to clients on credit today. 2. $5,000 cash was collected for services performed on credit last month. 3. $25,000 cash was borrowed from the bank. 4. $500 of advertising was done in the local newspaper today on account. 5. $500 was pald regarding the advertising in (4) above. 6. The owner invested an additional $10,000 cash into the business. 7. The owner withdrew $5,000 of cash from the business. 8. The owner took $200 worth of office supples home for personal use. 9. A new computer was purchased for $2,000 cash. 10. A one-year Insurance policy costing $12,000 was purchased today. 11. Purchased $45 of fuel for the van; pald cash. 12. Collected $900 from a client for work performed today. es Income Statement Balance…arrow_forwardmework i Baird Company began operations on January 1, Year 1, by issuing common stock for $34,000 cash. During Year 1, Baird received $53,100 cash from revenue and incurred costs that required $38,100 of cash payments. Problem 10-26A (Algo) Part b Prepare a GAAP-based income statement and balance sheet for Baird Company for Year 1, under the following independent scenario: b. Baird is in the car rental business. The $38,100 was paid to purchase automobiles. The automobiles were purchased on January 1, Year 1, and have three-year useful lives, with no expected salvage value. Baird uses straight-line depreciation. The revenue was generated by leasing the automobiles. Complete this question by entering your answer in the tabs below. Income Statement 2 Prepare an Income Statement. W Balance Sheet S BAIRD COMPANY Income Statement for Year 1 7 3 E D 4 $ $ R D F 0 0 % 5 * 8 J 1 ( 9 K O 0 L P Help >arrow_forwardPost the transactions to t- account ( post entries in the order of information presented in the question cash, account receivable, equipment, account payable, common stock, service revenue, sales and wages expenses)arrow_forward

- On January 1, 20Y5, Fahad Ali established Mountain Top Realty, which completed the following transactions during the month: Jan. 1 Fahad Ali transferred cash from a personal bank account to an account to be used for the business, $53,000. 2 Paid rent on office and equipment for the month, $7,950. 3 Purchased supplies on account, $4,240. 4 Paid creditor on account, $2,320. 5 Earned fees, receiving cash, $24,180. 6 Paid automobile expenses (including rental charge) for month, $2,490, and miscellaneous expenses, $560. 7 Paid office salaries, $6,630. 8 Determined that the cost of supplies used was $1,860. 9 Withdrew cash for personal use, $2,600. Required: Journalize entries for transactions Jan. 1 through 9. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will…arrow_forwardSubmit correct and complete solutions. give propriate Explanation. Provide step-by-step detailed explanations.arrow_forwardLes Stanley established an insurance agency on July 1, 20Y5, and completed the following transactions during July: Opened a business bank account in the name of Stanley Insurance Inc., with a deposit of $48,000 in exchange for common stock. Borrowed $25,000 by issuing a note payable. Received cash from fees earned, $28,500. Paid rent on office and equipment for the month, $2,600. Paid automobile expense for the month, $1,800, and miscellaneous expense, $1,000. Paid office salaries, $4,200. Paid interest on the note payable, $90. Purchased land as a future building site, $60,000. Paid dividends, $4,300. Instructions: 1. Indicate the effect of each transaction and the balances after each transaction, using the integrated financial statement framework. If an amount box does not require an entry, leave it blank. Enter account decreases and net cash outflows as negative amounts. 2. Which of the following shows the correct effect on the accounting equation for a utility expense…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education