FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

how to answer this question.

Determine the balance for Lisa Assaad, Capital, April 1, 20X1.

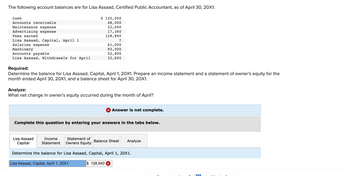

Transcribed Image Text:**Financial Accounting Exercise**

**Account Balances for Lisa Assaad, CPA (as of April 30, 20X1):**

- **Assets:**

- Cash: $120,000

- Accounts receivable: $48,000

- Machinery: $93,000

- **Expenses:**

- Maintenance expense: $22,000

- Advertising expense: $17,360

- Salaries expense: $61,000

- **Revenues:**

- Fees earned: $128,800

- **Liabilities:**

- Accounts payable: $52,800

- **Owner’s Equity:**

- Lisa Assaad, Capital, April 1: ?

- Lisa Assaad, Withdrawals for April: $32,600

**Required Tasks:**

1. **Determine the Balance for Lisa Assaad, Capital, April 1, 20X1.**

2. **Prepare:**

- An Income Statement for the Month Ended April 30, 20X1.

- A Statement of Owner’s Equity for the Month Ended April 30, 20X1.

- A Balance Sheet for April 30, 20X1.

**Analysis:**

- **Examine** the net change in owner’s equity during the month of April.

**Instructions:**

Complete the tasks using the provided tabs:

- **Lisa Assaad Capital**

- **Income Statement**

- **Statement of Owner's Equity**

- **Balance Sheet**

- **Analyze**

**Note:**

The answer is currently incomplete. Ensure to provide solutions in each tab for comprehensive results. The balance for "Lisa Assaad, Capital, April 1, 20X1" is given as $128,640.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Determine the retirement savings contributions credit in each of the following independent cases. Use Table 9-2. a. A married couple filing jointly with modified AGI of $37,500 and an IRA contribution of $1,800. b. A married couple filing jointly with modified AGI of $58,000 and an IRA contribution of $1,900. c. A head of household taxpayer with modified AGI of $33,000 and Roth IRA contribution of $1,990. d. A single taxpayer with modified AGI of $12,000 and an IRA contribution of $2,800. Retirement Savings Contributions Creditarrow_forward1. What is the total balance in the account after 40 years? 2. How much of the total did Pamela contribute herself? 3. How much money did Pamela make through compounded return in this investment account?arrow_forwardam. 123.arrow_forward

- I need help on question 21arrow_forwardWhat is the maximum amount of IRA contribution that may be made by a 60 year-old eligible taxpayer in \\( 2023 ? \\) A. \\( \\$ 2,000 \\) B. \\( \\$ 6,500 \\) C. \\( \\$ 7,500 \\) D. \\( \\$ 13,000 \\)arrow_forwardProblem 9-23 (Algorithmic) (LO. 4, 5) Chris and Heather are engaged and plan to get married. During 2023, Chris is a full-time student and earns $7,600 from a part-time job. With this income, student loans, savings, and nontaxable scholarships, he is self-supporting. For the year, Heather is employed and has wages of $79,200. Click here to access the standard deduction table to use. Click here to access the Tax Rate Schedules. If an amount is zero, enter, "0". Do not round your intermediate computations. Round your final answer to the nearest whole dollar. a. Compute the following: Gross income and AGI Standard deduction (single) Taxable income Income tax Q Search Filing Single S PRE ta Chris LA L Heather 1 Filing Single b. Assume that Chris and Heather get married in 2023 and file a joint return. What is their taxable income and income tax? Round your final answer to the nearest whole dollar. SA SA SA 7:29 2/8/2arrow_forward

- Muriel Evan write the following note on the back of an envelope: "I, Murierl Evans, promis to pay Karen Marvins or bearer $100 on demand. " Is this a negottiable instrument? Discuss why or why not.arrow_forward1. Label each item as Gross Income, (GI), Not Included, (NI) or Deductions for Adjusted Gross Income, (DAGI), and calculate adjusted gross income for Noelle Nelson. A gift from her mother Nia, $30,000 Noelle has a sole proprietorship, candy shop. The net income is $120,000 Salary $100,000. Bonus $40,000 Capital loss $20,000 Contribution to individual retirement account, $1,000 Child support received, $30,000 Alimony received $50,000. The divorce was signed on January 15, 2018. Noele won $20,000 in a national bowling tournament. Noelle received $20,000 from a legal settlement for a dog bite on her leg. Student loan interest paid $1,000. Noelle’s sister, Natasha, gave her $40,000, in repayment of a $35,000 loan from 2017. Workman’s compensation $30,000 Unemployment compensation $40,000 Interest from a City of Nashville Bond, $7,000 Treasury bill interest $10,000 Interest from CitiGroup Account $5,000 Penalty for early withdrawal from timed savings…arrow_forwardAn individual must complete Schedule B if the following situation occurs: Multiple Choice O Received interest income of $600. Received interest income of $1,500. Received interest income of $1,300. Received interest income of $1,750. shay < Prev 49 of 50arrow_forward

- What form is required?Explain why this is the correct form?arrow_forwardJigu3arrow_forwardDetermine the effects of the following on a cash basis taxpayer's gross income for 2023 and 2024. If an amount is zero, enter "0". Gross Income2023 Gross Income2024 a. On the morning of December 31, 2023, the taxpayer received a $1,500 check from a customer. The taxpayer did not cash the check until January 3, 2024. $fill in the blank 1 $fill in the blank 2 b. On the morning of December 31, 2023, the taxpayer received a $1,500 check from a customer. The customer asked the taxpayer not to cash the check until January 3, 2024, after the customer's salary check could be deposited. $fill in the blank 3 $fill in the blank 4 c. On December 31, 2023, the taxpayer received a $1,500 check from a customer. The check was not received until after the bank had closed on December 31, 2023. The taxpayer did not cash the check until January 3, 2024.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education