FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

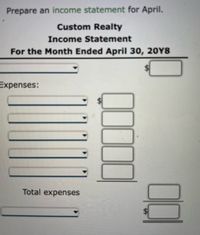

Prepare an income statement for April.

Transcribed Image Text:-Prepare an income statement for April.

Custom Realty

Income Statement

For the Month Ended April 30, 20Y8

Expenses:

Total expenses

Transcribed Image Text:Transactions; Financial Statements

On April 1, 20Y8, Maria Adams established Custom Realty. Maria completed the following transactions during the month of April:

a. Opened a business bank account with a deposit of $31,000 in exchange for common stock.

b. Purchased supplies on account, $3,110.

c. Paid creditor on account, $1,970.

d. Earned sales commissions, receiving cash, $31,710.

e. Paid rent on office and equipment for the month, $6,220.

f. Paid dividends, $10,000.

g. Paid automobile expenses for month, $2,980, and miscellaneous expenses, $1,430.

h. Paid office salaries, $3,740.

i. Determined that the cost of supplies on hand was $1,050; therefore, the cost of supplies used was $2,060.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The income statement for the first quarter of 2019 was as follows: Income Statement For the Quarter Ended March 31, 2019 Sales Cost of goods sold Gross profit Operating expenses ales salaries Rent expense Depreciation Utilities Miscellaneous Total operating expenses Net income $52,000 24,000 12,000 3,600 12,800 $720,000 396,000 324,000 104,400 $219,600 Prepare a budgeted quarterly income statement in tabular form for the first quarter of 2020.arrow_forwardPerez Pointers Corporation expects to begin operations on January 1, year 1; it will operate as a specialty sales company that sells laser pointers over the Internet. Perez expects sales in January year 1 to total $210,000 and to increase 20 percent per month in February and March. All sales are on account. Perez expects to collect 68 percent of accounts receivable in the month of sale, 24 percent in the month following the sale, and 8 percent in the second month following the sale. Required Prepare a sales budget for the first quarter of year 1. Determine the amount of sales revenue Perez will report on the year 1 first quarterly pro forma income statement. Prepare a cash receipts schedule for the first quarter of year 1. Determine the amount of accounts receivable as of March 31, year 1. Complete this question by entering your answers in the tabs below. Prepare a sales budget for the first quarter of year 1.arrow_forward5 please follow instructions and show workarrow_forward

- Unit Information with BWIP, FIFO Method Jackson Products produces a barbeque sauce using three departments: Cooking, Mixing, and Bottling. In the Cooking Department, all materials are added at the beginning of the process. Output is measured in ounces. The production data for July are as follows: Production: Units in process, July 1, 60% complete* Units completed and transferred out Units in process, July 31, 80% complete* * With respect to conversion costs. 11,000 88,000 15,100arrow_forwardThe budget director for Rundle Cleaning Services prepared the following list of expected selling and administrative expenses. All expenses requiring cash payments are paid for in the month incurred except salary expense and insurance. Salary is paid in the month following the month in which it is incurred. The insurance premium for six months is paid on October 1. October is the first month of operations, accordingly, there are no beginning account balances. Required a. Complete the schedule of cash payments for S&A expenses by filling in the missing amounts. b. Determine the amount of salaries payable the company will report on its pro forma balance sheet at the end of the fourth quarter. c. Determine the amount of prepaid insurance the company will report on its pro forma balance sheet at the end of the fourth quarter. Complete this question by entering your answers in the tabs below. Req A Complete the schedule of cash payments for S&A expenses by filling in the missing amounts.…arrow_forwardCan you show how you got the numbers for question 6? Can you show me how to prepare the following: Prepare a selling and administrative expenses budget for January Prepare a budgeted income statement for Januaryarrow_forward

- Determine if the following items can be found on a Balance Sheet, cash flow statement, or a budget. *Current value of your investment account. *Spending patterns for the past few months.arrow_forwardPrepare a production budget for the months of April, May, and June.arrow_forward1.Prepare a tuition revenue budget for the upcoming academic year. 2. Determine the number of faculty members needed to cover classes.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education