FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

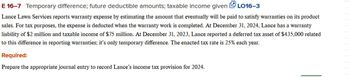

Transcribed Image Text:E 16-7 Temporary difference; future deductible amounts; taxable income given LO16-3

Lance Lawn Services reports warranty expense by estimating the amount that eventually will be paid to satisfy warranties on its product

sales. For tax purposes, the expense is deducted when the warranty work is completed. At December 31, 2024, Lance has a warranty

liability of $2 million and taxable income of $75 million. At December 31, 2023, Lance reported a deferred tax asset of $435,000 related

to this difference in reporting warranties; it's only temporary difference. The enacted tax rate is 25% each year.

Required:

Prepare the appropriate journal entry to record Lance's income tax provision for 2024.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- See Attached 5-29arrow_forward1. On January 1, 20X0 ABC Ltd. owed the government GST of $320. During 20X1, the company was subject to a GST rate of 7% and had sales before considering GST of $320,000. The company can deduct any GST it pays on taxable purchases at 7%. These purchases in 20X1 were $200,000 before considering GST. At the end of 20X0, the company had owed the government GST of $420. What is the net GST amount that the company paid to the government in 20X1? 2. XYZ Ltd., which uses IFRS, operates a coffee shop and began a promotion to increase the sales of its dark roast coffee in December 20X0. Every time that a customer buys a cup of this type of coffee for $4.00 each in December, the customer gets a coupon for 1 free mini cookie that usually sells for $.40 each and costs the company $.20 to produce. Customers cannot use or redeem the coupons until January 20X1. In December 20X1, the company sold 4,800 cups of dark roast coffee. Management expects customers will redeem 75% of the coupons based on many…arrow_forward4:34 PMJ-Matt, Inc., had pretax accounting income of $291,000 and taxable income of $300,000 in 2021. The only dif-ference between accounting and taxable income is estimated product warranty costs of $9,000 for sales in 2021. Warranty payments are expected to be in equal amounts over the next three years (2022-2024) and will be tax deductible at that time. Recent tax legislation will change the tax rate from the current 25% to 20% in 2023. Deter-mine the amounts necessary to record J-Matt's income taxes for 2021 and prepare the appropriate journal entry.arrow_forward

- Sh9arrow_forward15. On January 1, 200A, ABC rendered services to XYZ at a price of P450,000. ABC received P500,000 5-year promissory note from XYZ to be paid in full on December 200E. Assume the use of straight line method to amortized any premium or discount on note receivable, the total amount of income ABC realized from this transaction for 200A would bearrow_forwardSh6arrow_forward

- 33arrow_forwardcarala vista company has the following two temporary difference between its income tax expense and income taxes payable 2025 2026 2027 pretax financial income 854,000. 949,000. 962,000 excess deprecaition expense on tax return (29,800. (41,800) (9900) excess warranty expense in financial income 19800 10500 8100 taxable income 844000 917700 960200 the income tax rate for all years is 20% indicate how deferred taxes will be reported on the 2027 balance sheet carla vistas product warranty is or 12 monthsarrow_forwardTaxable income and pretax financial income would be identical for Blue Co. except for its treatments of gross profit on installment sales and estimated costs of warranties. The following income computations have been prepared. Taxable income 2024 2025 2026 Excess of revenues over expenses (excluding two temporary differences) $154,000 $191.000 $88,100 Installment gross profit collected 8,500 8,500 8,500 Expenditures for warranties Taxable income (4,500) $158,000 (4,500) $195,000 (4,500) $92,100 Pretax financial income 2024 2025 2026 Excess of revenues over expenses (excluding two temporary differences) Installment gross profit recognized $154,000 $191,000 $88,100 25,500 -0- -0- Estimated cost of warranties Income before taxes (13,500) $166,000 -0- -0- $191,000 $88,100 The tax rates in effect are 2024, 20%; 2025 and 2026, 25%. All tax rates were enacted into law on January 1, 2024. No deferred income taxes existed at the beginning of 2024. Taxable income is expected in all future years.…arrow_forward

- 5arrow_forwardLance Lawn Services reports warranty expense by estimating the amount that eventually will be paid to satisfy warranties on its product sales. For tax purposes, the expense is deducted when the warranty work is completed. At December 31, 2021, Lance has a warranty liability of $2 million and taxable income of $75 million. At December 31, 2020, Lance reported a deferred tax asset of $471,000 related to this difference in reporting warranties, its only temporary difference. The enacted tax rate is 25% each year. Required: Prepare the appropriate journal entry to record Lance's income tax provision for 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in whole dollars.) View transaction list Journal entry worksheet > Record 2021 income taxes. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Record entry Clear entry View general journalarrow_forwardE18.19 (LO 1, 2, 4) (Two Temporary Differences, Multiple Rates, Future Taxable Income) Nadal Inc. has two temporary differences at the end of 2024. The first difference stems from installment sales, and the second one results from the accrual of a loss contingency. Nadal's accounting department has developed a schedule of future taxable and deductible amounts related to these temporary differences as follows. Taxable amounts 2025 2026 2027 2028 $40,000 $50,000 $60,000 $80,000 (15,000) (19,000) Deductible amounts $40,000 $35,000 $41,000 $80,000 As of the beginning of 2024, the enacted tax rate is 34% for 2024 and 2025, and 20% for 2026-2029. At the beginning of 2024, the company had no deferred income taxes on its balance sheet. Taxable income for 2024 is $500,000. Taxable income is expected in all future years. Instructions a. Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2024. b. Indicate how deferred income taxes would be…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education