Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

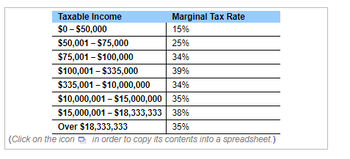

Transcribed Image Text:Taxable Income

$0-$50,000

Marginal Tax Rate

15%

$50,001 - $75,000

25%

$75,001 - $100,000

34%

$100,001 - $335,000

39%

$335,001-$10,000,000

34%

$10,000,001 - $15,000,000

35%

$15,000,001 - $18,333,333

38%

Over $18,333,333

35%

(Click on the icon in order to copy its contents into a spreadsheet.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Status Single DATA TABLE Total Tax Payments $ 8,342 Taxable Income $ 55,060.00 20,000 30,000 Total Tax $ 7,972 40,000 Refund Amount Amount Owed Create a one-way data table that will show the Total Tax (cell C7) for the three values of Taxable Income shown in cells F5 to F7. Answer these questions about the process of creating the data table. Before creating the table, what formulas must be put into the cells around the table? What must be entered in cell F4 before selecting Data Table from What-If Analysis?arrow_forwardPlease show work and explainarrow_forwardPleas calculate the AVERAGE and MARGINAL TAX based on the tax bracket provided below. (Hint: every box in the table may NOT be used.) $0 $1,001 $3,001 Tax Bracket $10,001 $20,001 $40,001 $1,000 $3,000 $10,000 $20,000 $40,000 & Above Average Tax:__`17.729% Marginal Tax:__`25¹% Tax 5% 10% 15% 25% 30% 45% $ $ Taxable Income Amount Taxed type your ansv type your ansv type your ansv = type your ansv $16,500 $ $ $ $ Actual Tax Paid type your answe type your answe type your answe type your answe type your answe Amount Remaining $ $ $ $ type your answe type your answe type your answe type your answearrow_forward

- Use the 2016 marginal tax rates to compute the tax owed by the following person. A married woman filing separately with a taxable income of $198,000. i Click the icon to view the 2016 marginal tax rates. THE The tax owed is $ (Type an integer or a decimal. Round to the nearest cent as needed.)arrow_forwardSTEN Rate 10% 12% 22% 24% 32% 35% 37% Single Single Tax Rates $0-$9,875 $9,875 - $40,125 $40,125-$85,525 $85,525-$163,300 $163,300 $207,350 $207,350-$518,400 $518,400 or more Standard Deductions $12,400 Married Filing Jointly $0-$19,750 $19,750-$80,250 $80,250-$171,050 $171,050-$326,600 $326,600-$414,700 $414,700-$622,050 $622,050 or more Married Filing Jointly Find Martin's taxable income. Round to the nearest cent. $1674.50 Martín is a 30-year-old, full-time college student sharing rent with a roommate who is filing separately from Martin. Martin made $15,600 at his part-time job in 2020. He does not have any adjustments or itemized deductions. $24,800 Martín qualifies for a $17 earned income tax credit. Compute Martín's tax owed. Round to the nearest cent. $ Suppose Martin's W-2 says that he paid $390 in taxes in 2020. Does Martín owe taxes, or is he due a refund? O Has to pay O Refund Calculate Martin's taxes owed or refund. Round your answer the nearest cent. Sarrow_forwardIndividual Taxpayers Income Tax Bracket ($) 0 - 9,700 9,701 - 39,475 39,476- 84,200 84,201 - 160,725 160,726 - 204,100 204,101 - 510,300 510,301 - 10% within bracket $970+ 12% within bracket $4,543 + 22% within bracket |$14,382.50 +24% within bracket $32,738.50 +32% within bracket $46,628.50 +35% within bracket Taxes Owed $153,798.50 +37% within bracket TABLE 2: 2019 tax brackets Exercise 3: Your income is $2,500,000 (2.5 million dollars) a) Compute your federal income tax b) Compute your effective tax ratearrow_forward

- Subject: accountingarrow_forwardQ9. Pertinent information for two alternatives A and B is shown below. If i=10%/year and the effective income tax rate is 35%, answer the following true/false questions. Alt. A Alt.B Basis, $ 150,000 225,,000 Gross Income (GI), $ 100,000 100,000 Operating Expense (OE), $ 30,000 10,000 Salvage Value, $ 15,000 22,500 MARCS Depreciation Method ADS-6: Years Recovery Period GDS: 5-Years Recovery Period The TI (taxable income) of Alt. B at the end of year 1 is $45,000. Group of answer choices True Falsearrow_forwardStatus Single DATA TABLE Total Tax Payments $ 8,342 Taxable Income $ 55,060.00 20,000 30,000 Total Tax $ 7,972 40,000 Refund Amount Amount Owed Use Goal Seek to find the Taxable Income (C5) that results in the Total Tax (C7) shown. Answer to the nearest 0.01. Do not include any punctuation ($ or ,) in your answer! Example of accepted answer: 12345.67Examples of incorrect answers: $12,345.67, 12,345.67, $12345.67 Taxable Income Total Tax Answer $2,600 Answer $4,200 Answer $8,500 Answer $10,500 Answer $22,000 Be sure to answer to the neared 0.01.arrow_forward

- Taxable Income (income tax brackets) Tax rates 15% on the first $50,197 of taxable income, plus20.5% on the next $50,195 of taxable income (on the portion of taxable income over 50,197 up to $100,392), plus 26% on the next $55,233 of taxable income (on the portion of taxable income over $100,392 up to $155,625), plus 29% on the next $66,083 of taxable income (on the portion of taxable income over 155,625 up to $221,708), plus 33% of taxable income over $221,708 a) Danny had a taxable income of $126,500. How much federal income tax should he report? (assuming tax rates remain the same) b) Danny expects his taxable income to increase by 25%. How much federal tax should he expect to pay the following year (assuming tax rates remain the same).arrow_forwardFill in Xs'arrow_forwardYears Revenue Cash Expense Book Depreciation Book Income Pre-Tax Book Tax at 32% After Tax Book Income Financial Measures Profit Margin % Net Assets ROA % Cashflow Revenue Cash Expense Tax Depreciation Pretax Income Tax at 32% After Tax Income After Tax Cashflow Cumulative Cashflow Payback Period Present Worth 10 PW12 PW15 IRR PV Index(15) Facility Cost Income Tax Rate 0 C. -9.5 d. -12.4 $ 100,000.00 2.2 Years 91740.92679 0.395702526 1 0.684350818 $ 100,000.00 32% $30,000.00 $100,000.00 $120,000.00 $140,000.00 $150,000.00 $150,000.00 $50,000.00 $60,000.00 $70,000.00 $75,000.00 $75,000.00 2 $20,000.00 $20,000.00 $20,000.00 $20,000.00 $20,000.00 $0.20 $20,400.00 $27,200.00 $0.26 $9,600.00 $12,800.00 $16,000.00 $17,600.00 $17,600.00 $20,400.00 ($100,000.00) $40,400.00 $51,040.00 ($100,000.00) -$59,600.00 -$8,560.00 $40,000.00 $50,000.00 $55,000.00 $55,000.00 $0.23 3 $0.45 $36,727.27 $80,000.00 $60,000.00 $40,000.00 $20,000.00 $0.85 $1.87 4 $19,040.00 5 $34,000.00 $37,400.00 $0.24…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education