FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

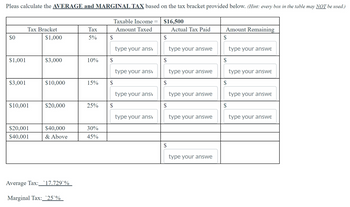

Transcribed Image Text:Pleas calculate the AVERAGE and MARGINAL TAX based on the tax bracket provided below. (Hint: every box in the table may NOT be used.)

$0

$1,001

$3,001

Tax Bracket

$10,001

$20,001

$40,001

$1,000

$3,000

$10,000

$20,000

$40,000

& Above

Average Tax:__`17.729%

Marginal Tax:__`25¹%

Tax

5%

10%

15%

25%

30%

45%

$

$

Taxable Income

Amount Taxed

type your ansv

type your ansv

type your ansv

=

type your ansv

$16,500

$

$

$

$

Actual Tax Paid

type your answe

type your answe

type your answe

type your answe

type your answe

Amount Remaining

$

$

$

$

type your answe

type your answe

type your answe

type your answe

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the marginal tax rate chart to answer the question. Tax Bracket Marginal Tax Rate $0–$10,275 10% $10,276–$41,175 12% $41,176–$89,075 22% $89,076–$170,050 24% $170,051–$215,950 32% $215,951–$539,900 35% > $539,901 37% Determine the effective tax rate for a taxable income of $95,600. Round the final answer to the nearest hundredtharrow_forwardFast please.arrow_forwardWith the following data, compute the NET FUTA Tax. Gross FUTA Tax DUE $ 6,750 Credit against FUTA (assume applicable) $3,100 Group of answer choices $3,100 $7,000 $3,650 $6,750arrow_forward

- Use the following tax table to determine how much income tax is paid on 732000 of taxable income. Taxable Income Bracket $0 to $9,325 Total Paid = $ Rate 10% 15% $9,325 to $37,950 25% $37,950 to $91,900 28% $91,900 to $191,650 33% $191,650 to $416,700 35% 39.60% $416,700 to $418,400 $418,400+ Single Taxable Income Tax Brackets and Rates, 2017arrow_forwardUse the table and find the income tax for an income of 279,000arrow_forwardI need step by step instructions for the problem e) what is the average income tax rate?** I know you have to divide total tax expense by the net income before taxes.So,For E) the income tax expense is $13,134Net Income before tax??Average Tax rate: ??Revenue : (sales) $144000(service) $28700All the taxes :depreciation tax $10400Interest expense $2400Income Tax expense. $13,134Supplies expense. $12,700F) if $18,500 of dividends had been declared and paid during year, what was the January 1 2016 balance of retained earnings?Retained Earnings Dec 31st : $59000Dividens declared: ???Retained Earnings January 1st: ???Please solve and explain thoroughly.arrow_forward

- K A tax rate schedule is given in the table. If x equals taxable income and y equals the tax due, construct a function y = f(x) for the tax schedule. f(x) = 0.11x +(x-D ☐+(×-D) If taxable income is over But not over 0 8,000 30,700 74,300 74,300 The tax is this amount 0.00 + 8,000 30,700 880.00 + 4,512.00 + 14,976.00 + if 0 74,300 Plus this % 11% 16% 24% 31% Of the excess over 0 8,000 30,700 74,300arrow_forwardMarginal tax rates Using the tax rate schedule attached Perform the following: a. Find the marginal tax rate for the following levels of sole proprietorship earnings before taxes: $16,800; $59,500; $89,600; $151,000; $245,000; $451,200; $1,000,000 b. Plot the marginal tax rates (measured on the y-axis) against the pretax income levels (measured on the x-axis).arrow_forwardUse the following tax table to determine how much income tax is paid on 915000 of taxable income. Total Paid = $ Rate 10% 15% 25% 28% 33% 35% 39.60% Taxable Income Bracket $0 to $9,325 $9,325 to $37,950 $37,950 to $91,900 $91,900 to $191,650 $191,650 to $416,700 $416,700 to $418,400 $418,400+ Single Taxable Income Tax Brackets and Rates, 2017arrow_forward

- Using the information below, calculate the individual income tax liability. (Use the following format $0,000.00) Tax Rate 10% $0 to $9,875 12% $9,876 to $40,125 22% $40,126 to $85,525 24% $85,526 to $163,300 32% $163,301 to $207,350 35% $207,351to $518,400 37%$518,401to For Single Individuals Taxable Income $85,000arrow_forwardWith the following data, compute the NET FUTA Tax. Gross FUTA Tax DUE $6,750 Credit against FUTA (assume applicable) $3,100 O $3,650 O $7,000 O $3,100 O $6,750arrow_forwardUsing the tax rate schedule given here LOADING..., perform the following: a. Find the marginal tax rate for the following levels of sole proprietorship earnings before taxes: $ 15 000; $ 60 000; $ 90 000; $ 150 000; $ 250 000; $ 450 000; and $1 million. b. Plot the marginal tax rates (measured on the y-axis) against the pretax income levels (measured on the x-axis) $0 to $9,875 $0 (10% amount over $0) 9,876 to 40, 125 988 + (12% amount over 9, 876) 40, 126 to 85, 525 4,618 + (22% amount over 40, 126) 85,526 to 163, 300 14, 606 + (24% amount over 85, 526) 163, 301 to 207, 350 33, 272 + (32% amount over 163, 301) 207, 351 to 518, 400 47,368 (35% amount over 207, 351) 518,401 to Unlimited 156, 235 (37% amount over 518, 401)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education