FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

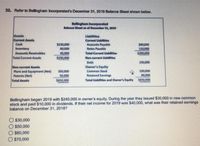

Transcribed Image Text:32. Refer to Bellingham Incorporated's December 31, 2019 Balanoe Sheet shown below.

Bellingham Incorporated

Balance Sheet as of December a1, 2019

Assets

Current Assets

Cash

Llabilities

Current Uabitles

S130,000

80,000

Accounts Payable

Notes Payable

S0,000

110,000

$200,000

Inventory

Accounts Recelvables

40,000

Total Current Liabilitles

Total Current Assets

$250,000

Non-current Llabilities

Debt

150,000

Owner's Equity

Non-current Assets

Plant and Equipment (Net)

Patents (Net)

350,000

50,000

220,000

80,000

Common Stock

Retained Earnings

Total Assets

$650.000

Total Liahilities and Owner's Equity 5650,000

Bellingham began 2019 with $240,000 in owner's equity. During the year they issued $30,000 in new common

stock and paid $10,000 in dividends. If their net income for 2019 was $40,000, what was their retained earnings

balance on December 31, 20187

O $30,000

$50,000

O S60,000

O $70,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Following are the current asset and current liability sections of the balance sheets for Freedom Inc. at January 31, 2020 and 2019 (in millions): Current Assets Cash Accounts receivable Inventories Total current assets Current Liabilities Note payable Accounts payable Other accrued liabilities Total current liabilities January 31, 2020 Working capital Current ratio 6 EL EL $ 21 $ 15 January 31, 2019 01/31/2020 01/31/2019 9 18 $ 25 Required: a. Calculate the working capital and current ratio at each balance sheet date. (Enter "Working capital" in millions of dollars (1.e.. 10,000,000 should be entered as 10). Round your "Current ratio" to 2 decimal places.) $12 b. Evaluate the firm's liquidity at each balance sheet date. Based on the working capital and current ratio measures, the firm has become more liquid over the 2-year period. O Based on the working capital and current ratio measures, the firm has become less liquid over the 2-year period. c. Assume that the firm operated at a loss…arrow_forwardFinancing Deficit Stevens Textile Corporation's 2019 financial statements are shown below: Balance Sheet as of December 31, 2019 (Thousands of Dollars) Cash $ 1,080 Accounts payable $ 4,320 Receivables 6,480 Accruals 2,880 Inventories 9,000 Line of credit 0 Total current assets $16,560 Notes payable 2,100 Net fixed assets 12,600 Total current liabilities $ 9,300 Mortgage bonds 3,500 Common stock 3,500 Retained earnings 12,860 Total assets $29,160 Total liabilities and equity $29,160 Income Statement for December 31, 2019 (Thousands of Dollars) Sales $36,000 Operating costs 34,000 Earnings before interest and taxes $ 2,000 Interest 160 Pre-tax earnings $ 1,840 Taxes (25%) 460 Net income $ 1,380 Dividends (40%) $ 552 Addition to retained earnings $ 828 Stevens grew rapidly in 2019 and financed the growth with notes payable and long-term bonds. Stevens expects sales to grow by 15% in the next…arrow_forwardJust Dew It Corporation reports the following balance sheet information for 2020 and 2021. Assets Current assets Cash Accounts receivable Inventory Total 2020 Total assets JUST DEW IT CORPORATION 2020 and 2021 Balance Sheets 2021 Liabilities and Owners' Equity Current liabilities $11,000 $14,250 27,000 36,750 75,000 96,250 $113,000 $147,250 Net plant and equipment $287,000 $352,750 $ $ 400,000 500,000 Accounts payable Notes payable Total Total Total liabilities and owners' equity 2020 Prepare the 2020 and 2021 common-size balance sheets for Just Dew It. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Long-term debt Owners' equity Common stock and paid-in surplus $ 55,000 $ 55,000 Retained earnings 226,200 320,750 2021 $54,000 $63,750 14,800 20,500 $68,800 $84,250 $50,000 $40,000 $281,200 $ 375,750 $ $ 400,000 500,000arrow_forward

- Just Dew It Corporation reports the following balance sheet information for 2020 and 2021. JUST DEW IT CORPORATION 2020 and 2021 Balance Sheets Assets 2020 2021 Liabilities and Owners' Equity 2020 2021 Current assets Current liabilities Cash $ 10, 620 $ 13, 275 Accounts payable $ 52, 560 $ 60, 750 Accounts receivable 21,420 29, 925 Notes payable 19, 260 24,075 Inventory 67, 860 82, 575 Total $ 99,900 $ 125, 775 Total $ 71,820 $ 84, 825 Long-term debt $ 36,000 $ 27,000 Owners' equity Common stock and paid - in surplus $ 45,000 $ 45,000 Retained earnings 207, 180 293, 175 Net plant and equipment $ 260, 100 $ 324, 225 Total $ 252, 180 $ 338, 175 Total assets $ 360,000 $ 450,000 Total liabilities and owners' equity $ 360,000 $ 450,000 For each account on this company's balance sheet, show the change in the account during 2021 and note whether this change was a source or use of cash. (If there is no action select "None" from the dropdown options. Leave no cells blank - be certain to enter…arrow_forwardwhat is the net fixed assets for zooey corporation on 2020 what is the total assets for zooey corpoartions in 2020 what is the long term debt for zooey corpoartion in 2020 help me answer this thank youarrow_forwardBridgeport Inc., a greeting card company, had the following statements prepared as of December 31, 2020. BRIDGEPORT INC.COMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 12/31/20 12/31/19 Cash $6,100 $7,100 Accounts receivable 61,500 51,000 Short-term debt investments (available-for-sale) 34,800 17,900 Inventory 39,800 59,900 Prepaid rent 5,000 4,000 Equipment 155,200 129,900 Accumulated depreciation—equipment (35,200 ) (24,800 ) Copyrights 45,800 49,800 Total assets $313,000 $294,800 Accounts payable $45,800 $39,800 Income taxes payable 4,100 6,000 Salaries and wages payable 7,900 3,900 Short-term loans payable 8,000 9,900 Long-term loans payable 60,100 68,900 Common stock, $10 par 100,000 100,000…arrow_forward

- 25. Coronado Inc., a greeting card company, had the following statements prepared as of December 31, 2020. CORONADO INC.COMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 12/31/20 12/31/19 Cash $5,900 $7,000 Accounts receivable 61,400 51,500 Short-term debt investments (available-for-sale) 35,000 18,200 Inventory 40,000 60,500 Prepaid rent 5,000 4,100 Equipment 152,900 131,100 Accumulated depreciation—equipment (35,200 ) (25,100 ) Copyrights 45,800 50,000 Total assets $310,800 $297,300 Accounts payable $46,100 $40,100 Income taxes payable 3,900 5,900 Salaries and wages payable 8,000 4,000 Short-term loans payable 8,100 10,000 Long-term loans payable 60,400 69,300 Common stock, $10 par 100,000 100,000…arrow_forwardWildhorse Inc., had the following condensed balance sheet at the end of operations for 2019. Cash Current assets other than cash Equity invesments Plant assets (net) Land 1. During 2020, the following occurred. 2. 3. 4. 5. 6. 7. WILDHORSE INC. BALANCE SHEET DECEMBER 31, 2019 $8,400 28,800 8. 20,000 67,100 40,300 $164,600 Current liabilities Long-term notes payable Bonds payable Common stock Retained earnings A tract of land was purchased for $8,900. Bonds payable in the amount of $15,000 were redeemed at par. An additional $9,900 in common stock was issued at par. Dividends totaling $9,400 were paid to stockholders. Net income was $30,600 after allowing depreciation of $13,300. Land was purchased through the issuance of $22,800 in bonds. $15,200 25,500 25,000 75,000 23,900 $164,600 Wildhorse Inc. sold part of its investment portfolio for $12,900. This transaction resulted in a gain of $1,900 for the company. No unrealized gains or losses were recorded on these investments in 2020. Both…arrow_forwardWindsor Inc., a greeting card company, had the following statements prepared as of December 31, 2020. WINDSOR INC.COMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 12/31/20 12/31/19 Cash $6,100 $7,100 Accounts receivable 62,400 51,000 Short-term debt investments (available-for-sale) 34,700 18,100 Inventory 40,400 60,300 Prepaid rent 4,900 4,000 Equipment 154,100 130,600 Accumulated depreciation—equipment (34,900 ) (24,800 ) Copyrights 46,400 49,800 Total assets $314,100 $296,100 Accounts payable $46,500 $40,200 Income taxes payable 4,000 6,000 Salaries and wages payable 8,100 4,100 Short-term loans payable 7,900 10,100 Long-term loans payable 59,600 68,400 Common stock, $10 par 100,000 100,000 Contributed…arrow_forward

- Just Dew It Corporation reports the following balance sheet information for 2020 and 2021. JUST DEW IT CORPORATION 2020 and 2021 Balance Sheets Assets 2020 2021 Liabilities and Owners’ Equity 2020 2021 Current assets Current liabilities Cash $ 7,800 $ 12,250 Accounts payable $ 46,400 $ 52,750 Accounts receivable 15,800 31,000 Notes payable 20,600 26,500 Inventory 53,400 64,250 Total $ 77,000 $ 107,500 Total $ 67,000 $ 79,250 Long-term debt $ 46,000 $ 40,000 Owners’ equity Common stock and paid-in surplus $ 50,000 $ 50,000 Retained earnings 237,000 330,750 Net plant and equipment $ 323,000 $ 392,500 Total $ 287,000 $ 380,750 Total assets $ 400,000 $ 500,000 Total liabilities and owners’ equity $ 400,000 $ 500,000 For each account on this company’s balance sheet, show the change in the account during 2021 and note whether…arrow_forwardThe balance sheet and income statement for J. P. RObard Manufatcuring Company are as follows: Item Cash J.P. Robard Manufacturing Company Balance Sheet as at 31 December 2021 ($ in thousands) 500 Account receivable Inventory Total current assets Net fixed assets Total assets Accounts payable Accrued expenses Short-term notes payable Total curernt liabilities Long-term debt Total common equity Total liabilities and equity 2,000 1,000 3,500 4,500 8,000 1,100 600 300 2,000 2,000 4.000 8,000arrow_forwardBelow are the 2018 and 2019 year-end balance sheets for Walker Inc.:. Assets Cash Accounts receivable Inventories Total current assets Net fixed assets Total assets Liabilities and equity Accounts payable Notes payable Total current liabilities Long-term debt Common stock Retained earnings Total common equity Total liabilities and equity 2019 $200,000 864,000 2,000,000 $3,064,000 6,000,000 $9,064,000 $2,400,000 1,600,000 $3,000,000 2,400,000 2,000,000 664,000 $2,664,000 $9,064,000 2018 $170,000 700,000 1,400,000 $2,270,000 5,600,000 $7,870,000 $1,090,000 800,000 $1,890,000 2,400,000 3,000,000 580,000 $3,580,000 $7,870,000 Walker has never paid a dividend on its common share, and it issued $2,400,000 of 10-year non- callable, long-term debt in 2018. As of the end of 2019, none of the principal on this debt had been repaid. Assume that the company's sales in 2018 and 2019 were the same. Which of the following statements must be correct? O a. Walker issued new common shares in 2019. O b.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education