FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

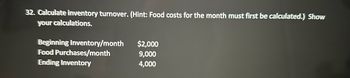

Transcribed Image Text:32. Calculate inventory turnover. (Hint: Food costs for the month must first be calculated.) Show

your calculations.

Beginning Inventory/month

Food Purchases/month

Ending Inventory

$2,000

9,000

4,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The units of Manganese Plus available for sale during the year were as follows: Mar. 1 Inventory 21 units @ $29 $609 June 16 Purchase 29 units @ $32 928 Nov. 28 Purchase 46 units @ $35 1,610 96 units $3,147 There are 10 units of the product in the physical inventory at November 30. The periodic inventory system is used. Round answers to the nearest whole dollar. a. Determine the inventory cost by the FIFO method.$ b. Determine the inventory cost by the LIFO method.$ c. Determine the inventory cost by the average cost methods.arrow_forwardThe following are the transactions for the month of July. Units Unit Cost Unit Selling Price July 1 Beginning Inventory 55 $ 10 July 13 Purchase 275 11 July 25 Sold (100 ) $ 14 July 31 Ending Inventory 230 Calculate cost of goods available for sale and ending inventory, then sales, cost of goods sold, and gross profit, under FIFO. Assume a periodic inventory system is used. How would i creat a FIFO periodic table?arrow_forward2. Calculate January's ending inventory and cost of goods sold for the month using LIFO, periodic system.arrow_forward

- Solve for the missing information designated by "?" in the following table. (Use 365 days in a year. Round the inventory turnover ratio to one decimal place before computing days to sell. Round days to sell to one decimal place.) Case Beginning Inventory Purchases Cost of Goods Sold Ending Inventory Inventory Turnover Ratio Days to Sell a. $ 130 $ 730 $ 690 b $ 230 $ 1,320 C $ 1,120 $ 135 6.6 32.6arrow_forwardBeginning Inventory at FIFO: 15 Units @ $16 = $240 Beginning Inventory at LIFO: 15 Units @ $12 = $1801. Compute the inventory turnover ratio for the month of January under the FIFO and LIFO inventory costing methods. 2. Which costing method is the more accurate indicator of the efficiency of inventory management?arrow_forwardUse the following information for the Exercises 3-7 below. (Algo) [The following information applies to the questions displayed below.] Laker Company reported the following January purchases and sales data for its only product. The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 385 units from the January 30 purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory. Date January 1 January 10 January 20 January 25 January 30 Activities Beginning inventory Sales Purchase Sales Purchase Totals Units Acquired at Cost 225 units @ $ 15.00- 180 units @ $14.00- 385 units @ $ 12.00 = 790 units $ 3,375 2,520 4,620 $ 10,515 Units sold at Retail 175 units 210 units 385 units Exercise 5-5 (Algo) Perpetual: Gross profit effects of inventory methods LO A1 1. Compute gross profit for the month of January for Laker Company for the four inventory methods. 2. Which method yields the highest gross profit? 3. Does gross profit…arrow_forward

- You have the following information for Bramble Inc. for the month ended June 30, 2022. Bramble uses a periodic inventory system. Date Description Quantity Unit Cost orSelling Price June 1 Beginning inventory 40 $31 June 4 Purchase 135 34 June 10 Sale 110 61 June 11 Sale return 15 61 June 18 Purchase 55 37 June 18 Purchase return 10 37 June 25 Sale 65 67 June 28 Purchase 35 41arrow_forwardRequired information [The following information applies to the questions displayed below.] A company began January with 8,000 units of its principal product. The cost of each unit is $7. Inventory transactions for the month of January are as follows: Date of Purchase January 10 January 18 Totals Sales Units Date of Sale January 5 January 12 January 20 Total 6,000 8,000 14,000 * Includes purchase price and cost of freight. Units Purchases Unit Cost* 4,000 2,000 5,000 11,000 $8 9 11,000 units were on hand at the end of the month. Total Cost $ 48,000 72,000 $ 120,000arrow_forwardCalculate Inventory Carrying Cost (ICC) using the information below. annual demand ordering cost per order inventory carrying cost percentage leadtime unit value #days in the period. EOQ 1000 $75 20% 3 days $30 360 158arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education