FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

![Use the following information for the Exercises 3-7 below. (Algo)

[The following information applies to the questions displayed below.]

Laker Company reported the following January purchases and sales data for its only product. The Company uses a

perpetual inventory system. For specific identification, ending inventory consists of 385 units from the January 30

purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory.

Date

January 1

January 10

January 20

January 25

January 30

Activities

Beginning inventory

Sales

Purchase

Sales

Purchase

Totals

Units Acquired at Cost

225 units @ $ 15.00-

180 units @ $14.00-

385 units @ $ 12.00 =

790 units

$ 3,375

2,520

4,620

$ 10,515

Units sold at Retail

175 units

210 units

385 units

Exercise 5-5 (Algo) Perpetual: Gross profit effects of inventory methods LO A1

1. Compute gross profit for the month of January for Laker Company for the four inventory methods.

2. Which method yields the highest gross profit?

3. Does gross profit using weighted average fall between that using FIFO and LIFO?

4. If costs were rising instead of falling, which method would yield the highest gross profit?

@

@

$ 24.00

$ 24.00

Che](https://content.bartleby.com/qna-images/question/331280cd-6ffc-4ab8-9a6d-fc1b9a250bf2/e3accb58-a394-4326-8fae-1ad6cc17b038/3fdzxo_thumbnail.png)

Transcribed Image Text:Use the following information for the Exercises 3-7 below. (Algo)

[The following information applies to the questions displayed below.]

Laker Company reported the following January purchases and sales data for its only product. The Company uses a

perpetual inventory system. For specific identification, ending inventory consists of 385 units from the January 30

purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory.

Date

January 1

January 10

January 20

January 25

January 30

Activities

Beginning inventory

Sales

Purchase

Sales

Purchase

Totals

Units Acquired at Cost

225 units @ $ 15.00-

180 units @ $14.00-

385 units @ $ 12.00 =

790 units

$ 3,375

2,520

4,620

$ 10,515

Units sold at Retail

175 units

210 units

385 units

Exercise 5-5 (Algo) Perpetual: Gross profit effects of inventory methods LO A1

1. Compute gross profit for the month of January for Laker Company for the four inventory methods.

2. Which method yields the highest gross profit?

3. Does gross profit using weighted average fall between that using FIFO and LIFO?

4. If costs were rising instead of falling, which method would yield the highest gross profit?

@

@

$ 24.00

$ 24.00

Che

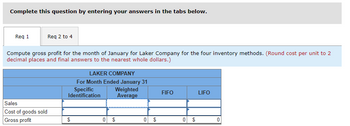

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Req 1

Req 2 to 4

Compute gross profit for the month of January for Laker Company for the four inventory methods. (Round cost per unit to 2

decimal places and final answers to the nearest whole dollars.)

Sales

Cost of goods sold

Gross profit

LAKER COMPANY

For Month Ended January 31

Specific

Identification

$

Weighted

Average

0 $

0

$

EA

FIFO

0 $

LIFO

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Warnerwoods Company uses a periodic inventory system. It entered into the following purchases and sales transactions for March. Date March 1 March 5 March 9 March 18 March 25 March 29 ) Periodic FIFO Beginning inventory Purchases. March 5 March 18 March 25 Activities Beginning inventory Purchase Sales Total Purchase Purchase Sales Totals b) Periodic LIFO For specific identification, units sold include 50 units from beginning inventory, 385 units from the March 5 purchase, 55 units from the March 18 purchase, and 135 units from the March 25 purchase. # of units oblem 6-2AA (Algo) Part 3 Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. ote: Round your "average cost per unit" to 2 decimal places. Cost of Goods Available for Sale Cost of Goods Available for Sale $ 5,750 115 $ Cost per unit 680 415 $ 55.00 150 $ 60.00 Units Acquired at Cost 115 units $50 per unit @$55 per unit 415 units 50.00 # of units 150 units…arrow_forwardA company reports the following beginning inventory and two purchases for the month of January. On January 26, the company sells 330 units. Ending inventory at January 31 totals 140 units. Units Unit Cost Beginning inventory on January 1 300 $ 2.80 Purchase on January 9 70 3.00 Purchase on January 25 100 3.14 Required: Assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the FIFO method.arrow_forwardThe following information applies to the questions displayed below.]Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Date Activities Units Acquired at Cost Units Sold at Retail Mar. 1 Beginning inventory 190 units @ $52.80 per unit Mar. 5 Purchase 270 units @ $57.80 per unit Mar. 9 Sales 350 units @ $87.80 per unit Mar. 18 Purchase 130 units @ $62.80 per unit Mar. 25 Purchase 240 units @ $64.80 per unit Mar. 29 Sales 220 units @ $97.80 per unit Totals 830 units 570 units Compute cost of goods available for sale and the number of units available for sale.arrow_forward

- Required information Use the following information for the Exercises 3-7 below. (Algo) [The following information applies to the questions displayed below.] Laker Company reported the following January purchases and sales data for its only product. The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 240 units from the January 30 purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory. Date January 1 January 10 January 20 January 25 January 30 Activities Beginning inventory Sales Purchase Sales Purchase Totals Units Acquired at Cost 160 units @ $ 8.50 = 100 units $ 7.50 = @ 240 units @ 500 units $ 7.00 = Exercise 5-3 (Algo) Perpetual: Inventory costing methods LO P1 $ 1,360 750 1,680 $ 3,790 Units sold at Retail 120 units 120 units 240 units @ @ $ 17.50 $ 17.50 Required: 1. Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification. 2.…arrow_forwardRequired information [The following information applies to the questions displayed below.] A company reports the following beginning inventory and two purchases for the month of January. On January 26, the company sells 350 units. Ending inventory at January 31 totals 150 units. Beginning inventory on January 1 Purchase on January 9 Purchase on January 25 Date Assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based or the LIFO method. January 1 January 9 Total January 9 January 25 Total January 25 January 26 Total January 26 Goods purchased # of units Units 320 80 100 Cost per # of units unit sold Unit Cost $ 4.10 4.30 4.44 Perpetual LIFO; Cost of Goods Sold Cost per unit Cost of Goods Sold # of units Inventory Balance Cost per unit Inventory Balance H N $ 0arrow_forwardA company reports the following beginning inventory and two purchases for the month of January. On January 26, the company sells 310 units. Ending inventory at January 31 totals 130 units. Units Unit Cost Beginning inventory on January 1 280 $ 2.60 Purchase on January 9 60 2.80 Purchase on January 25 100 2.94 Required:Assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on LIFO.arrow_forward

- [The following information applies to the questions displayed below.] Laker Company reported the following January purchases and sales data for its only product. The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 355 units from the January 30 purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory. Date January 1 January 10 January 20 January 25 January 30 Activities Beginning inventory Sales Purchase Sales Purchase Totals Units Acquired at Cost @ $ 14.00 = @ $ 13.00 = 215 units 160 units 355 units 730 units $ 11.00 = $ 3,010 2,080 3,905 $ 8,995 Units sold at Retail 165 units 190 units 355 units @ @ $23.00 $23.00 The Company uses a periodic inventory system. For specific identification, ending inventory consists of 355 units from the January 30 purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory. Determine the cost assigned to ending inventory and to cost of goods sold…arrow_forwardLaker Company reported the following January purchases and sales data for its only product. For specific identification, ending inventory consists of 260 units from the January 30 purchase, 5 units from the January 20 purchase, and 25 units from beginning inventory. Date January 1 Activities Beginning inventory Units Acquired at Cost 170 units @ $ 9.50 = $1,615 Units sold at Retail January 10 Sales 130 units @ $ 18.50 January 20 January 25 January 30 Purchase Sales Purchase Totals 120 units @ 260 units @ 550 units $8.50 = 1,020 130 units @ $ 18.50 $ 8.00 = 2,080 $ 4,715 260 units Record journal entries for Laker Company's sales and purchases transactions. Assume for this assignment that the company uses a perpetual inventory system and FIFO. All sales and purchases are made on account, and no discounts are offered. View transaction list Journal entry worksheet Record the sale of goods. Note: Enter debits before credits. Date January 10 General Journal Debit Creditarrow_forward[The following information applies to the questions displayed below.] Laker Company reported the following January purchases and sales data for its only product. The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 355 units from the January 30 purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory. Date January 1 January 10 January 20 January 25 January 30 Activities Beginning inventory Sales Purchase Sales Purchase Totals Units Acquired at Cost @ $ 14.00 = 215 units 160 units 355 units 730 units @ @ $ 13.00 = $ 11.00 = $ 3,010 2,080 3,905 $ 8,995 Units sold at Retail 165 units 190 units 355 units @ @ $23.00 $ 23.00 Required: 1. Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification. 2. Determine the cost assigned to ending inventory and to cost of goods sold using weighted average. 3. Determine the cost assigned to ending inventory and…arrow_forward

- ! Required information [The following information applies to the questions displayed below.] Laker Company reported the following January purchases and sales data for its only product. For specific identification, ending inventory consists of 200 units from the January 30 purchase, 5 units from the January 20 purchase, and 25 units from beginning inventory. Date January 1 January 10 January 20 January 25 January 30 Assume the perpetual inventory system is used. Required: Activities Beginning inventory Sales Purchase Sales Purchase Totals Specific Identification Purchase Date January 1 January 20 January 30 FIFO Units Acquired at Cost @ $ 7.50 = Complete this question by entering your answers in the tabs below. LIFO Available for Sale Activity Beginning inventory Purchase Purchase 150 units 80 units @ 3. Determine the cost assigned to ending inventory and to cost of goods sold using FIFO. 4. Determine the cost assigned to ending inventory and to cost of goods sold using LIFO. # of units…arrow_forwardLaker Company reported the following January purchases and sales data for its only product. The Company uses a perpetual inventory system. For specific identification, ending inventory consists of 270 units from the January 30 purchase, 5 units from the January 20 purchase, and 15 units from beginning inventory. 28 Date January 1 January 10 January 20 January 25 January 30 Required: S ual Activities Beginning inventory Sales Purchase Sales Purchase Totals Units Acquired at Cost 180 units @ $ 10.50 = 110 units @ Units sold at Retail $ 1,890 140 units @ $ 19.50 $9.50- 1,045 130 units @ $ 19.50 270 units @ 560 units $ 9.00 = 2,430 $ 5,365 270 units 1. Compute gross profit for the month of January for Laker Company for the four inventory methods. 2. Which method yields the highest gross profit? 3. Does gross profit using weighted average fall between that using FIFO and LIFO? 4. If costs were rising instead of falling, which method would yield the highest gross profit? งarrow_forwardThe following information applies to the questions displayed below.]Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Date Activities Units Acquired at Cost Units Sold at Retail March 1 Beginning inventory 120 units @ $51.40 per unit March 5 Purchase 235 units @ $56.40 per unit March 9 Sales 280 units @ $86.40 per unit March 18 Purchase 95 units @ $61.40 per unit March 25 Purchase 170 units @ $63.40 per unit March 29 Sales 150 units @ $96.40 per unit Totals 620 units 430 units 4. Compute gross profit earned by the company for each of the four costing methods. For specific identification, units sold include 75 units from beginning inventory, 205 units from the March 5 purchase, 55 units from the March 18 purchase, and 95 units from the March 25 purchase. (Round weighted average cost per unit to two decimals and final answers to nearest…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education