FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

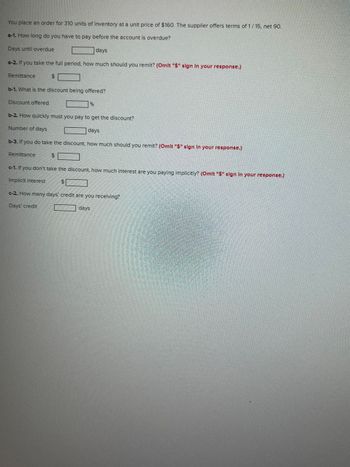

Transcribed Image Text:You place an order for 310 units of inventory at a unit price of $160. The supplier offers terms of 1/15, net 90.

a-1. How long do you have to pay before the account is overdue?

Days until overdue

days

a-2. If you take the full period, how much should you remit? (Omit "$" sign In your response.)

Remittance

$

b-1. What is the discount being offered?

Discount offered

Remittance

b-2. How quickly must you pay to get the discount?

Number of days

days

b-3. If you do take the discount, how much should you remit? (Omit "$" sign in your response.)

%6

$

c-1. If you don't take the discount, how much interest are you paying implicitly? (Omit "$" sign in your response.)

Implicit interest

$

c-2. How many days' credit are you receiving?

Days' credit

days

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please send correct answer Q2arrow_forwardA buyer who purchases merchandise under credit terms of 1/10, n/30 has 30 days after the invoice date to take advantage of the sales discount.arrow_forwardDirection: Complete the Table. Compute what is asked for. Give the exact amount. Use PESO SIGN. NO DECIMAL PLACES. ROUND-OFF Nearest peso. If your answer is NONE OR ZERO, PUT a 0 on the space. Name of Buyer Cost of Merchandise Trade Discount Cash Discount Date of Purchase Date Paid Returns made after 5 days purchase FOB Freight Charges Freight charges paid by Name of Buyer Trade discount, if any Invoice Price (before any reams) Purchase discount to be recorded upon payment Amount of Cash (payment) to be credited Company Aster 320,000 12% 1/10, n/eom 15-March-10 21-March-10 21,000 Shipping point 4,100 Buyer Company Aster A B C D Company Bougainvillea 65,000 5%,3%,2% 2/eom.n/45 15-Mar-10 25-Mar-10 3,100.00 Shipping point 1,200.00 Buyer Company Bougainvillea E F G T H Company Calabachi 105,000 1/15,2/10, n/eom 15-Mar-10 27-Mar-10 Destination 2,500.00 Seller Company Calabachi I J K L Company Daisy 25,300 P500 discount for every P5,000 purchased 15-Mar-10 16-Mar-10 Destination 1,100 Seller…arrow_forward

- Suppose a certain appliance store purchases the following items. Calculate the extended total after the trade discounts for each line, the invoice subtotal, and the invoice total. (Round your answers to the nearest cent.) Trade Extended Quantity Unit Merchandise Unit List Discounts Total 150 Blenders $49.95 20/15/15 2$ ea. 400 ea. Toasters $37.88 20/10/10 $ 18 doz. Coffee Mills $244.30 30/9/6 $ 12 doz. Juicers $440.00 25/10/5 $ Invoice subtotal Extra 5-% volume discount on total order 24 Invoice total $arrow_forwardA photographer buys some merchandise with a list price of $5,000. If the supplier offers trade discount rates of 20/15/5, find the trade discount (in $). (Find the single equivalent discount first.)arrow_forwardIf NetSolutions sells a customer some products on account (accounts receivable) and offers a discount for early payment of the customers accounts receivable within the credit period, the discount is called a _________________________________. Group of answer choices trade discount purchases discount sales discount sales allowancearrow_forward

- Suppose a certain appliance store purchases the following items. Calculate the extended total after the trade discounts for each line, the invoice subtotal, and the invoice total. (Round your answers to the nearest cent.) Trade Extended Quantity Unit Merchandise Unit List Discounts Total 150 Blenders $39.95 20/15/15 24 ea. 400 ea. Toasters $37.88 20/10/10 2$ 18 doz. Coffee Mills $244.30 30/9/7 2$ 12 doz. Juicers $440.00 25/10/5 2$ Invoice subtotal 2$ Extra 5% volume discount on total order $ Invoice total 2$arrow_forwardA computer lists for $ 600. 1. Find the trade discount if a discount rate of $ 10 is offered. 2. Find the net price. 3. Find the net price rate. 4. Use the net price rate to recalculate the net price.arrow_forwardSuppose a certain appliance store purchases the following items. Calculate the extended total after the trade discounts for each line, the invoice subtotal, and the invoice total. (Round your answers to the nearest cent.) Trade Extended Quantity Unit Merchandise Unit List Discounts Total 150 ea. Blenders $39.95 20/15/15 $ 300 ea. Toasters $38.88 20/10/10 18 doz. Coffee Mills $244.30 30/9/6 12 doz. Juicers $480.00 25/10/5 Invoice subtotal Extra 5- % volume discount on total order - Invoice total %24 %24 %24 24arrow_forward

- what is the total price of the first invoice that activates the chain discount?arrow_forwardA. Solve the following (round off 2 decimal places): 1. How much is the discount for an item with a list price of P13,500 subject to a 15% discount? What is the net price? 2. A cabinet listed at P14,000 is sold to a retailer at 14.7% discount. Find the amount of trade discount and the net price. al dinning sets at the s 3. Two suppliers offer identical dinning sets at the same list price. However, Company A gives trade discount series of 15%, 10 %, and 10% while Company B offers 20%, 10%, and 5%. Which is a better discount for the buyer? 4. Yuki bought a notebook set for P250. She spent P20 for transportation fee. She sold her notebook for P260. a. How much is the profit or loss? b. What is the profit/loss percent? VICI VEarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education