FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

How do we get 70, 280, and 50? Please show me the work and explanation. Thanks!

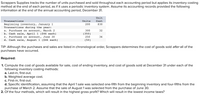

Transcribed Image Text:Scrappers Supplies tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing

method at the end of each period, as if it uses a periodic inventory system. Assume its accounting records provided the following

information at the end of the annual accounting period, December 31.

Unit

Transactions

Units

Cost

Beginning inventory, January 1

Transactions during the year:

a. Purchase on account, March 2

b. Cash sale, April 1 ($46 each)

c. Purchase on account, June 30

d. Cash sale, August 1 ($46 each)

200

$30

300

32

(350)

250

36

(50)

TIP: Although the purchases and sales are listed in chronological order, Scrappers determines the cost of goods sold after all of the

purchases have occurred.

Required:

1. Compute the cost of goods available for sale, cost of ending inventory, and cost of goods sold at December 31 under each of the

following inventory costing methods:

a. Last-in, first-out.

b. Weighted average cost.

c. First-in, first-out.

d. Specific identification, assuming that the April 1 sale was selected one-fifth from the beginning inventory and four-fifths from the

purchase of March 2. Assume that the sale of August 1 was selected from the purchase of June 30.

2. Of the four methods, which will result in the highest gross profit? Which will result in the lowest income taxes?

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Req 1A

Req 1B

Req 10

Req 1D

Req 2A

Req 2B

d. Compute the cost of goods available for sale, cost of ending inventory, and cost of goods sold at December 31 using the

Specific identification method. Assume that the April 1 sale was selected one-fifth from the beginning inventory and four-fifths

from the purchase of March 2. Assume that the sale of August 1 was selected from the purchase of June 30. (Round "Cost per

Unit" anwers to 2 decimal places.)

Show less A

Cost

Specific Identification (Periodic)

Units

Total

per

Unit

Beginning Inventory

$ 30.00

$ 6,000

200

Purchases

$ 32.00

$ 36.00

March 2

300

June 30

250

Total Purchases

550

18,600

Goods Available for Sale

Cost of Goods Sold

750

24,600

$ 30.00

$ 32.00

$ 36.00

Units from Beginning Inventory

70

Units from March 2 Purchase

280

Units from June 30 Purchase

50

Total Cost of Goods Sold

400

12,860

Ending Inventory

$11,7400

350

< Req 1C

Req 2A >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prepare the financial section of a business case for the Cloud-Computing Case that is listed above this assignment in Canvas. Assume that this project will take eight months to complete (in Year 0) and will cost $600,000. The costs to implement some of the technologies will be $300,000 for year one and $200,000 for years two and three. Estimated benefits will start in year 1 at $400,000 and will be $600,000 for years 2 and 3. There is no benefit in year 0. Use the business case spreadsheet template (business_case_financials.xls) template provided below this assignment in Canvas to calculate the NPV, ROI, and the year in which payback occurs. Assume a 7 percent discount rate for the template. notes* Payback occurs in the first year that there is a positive value for cumulative benefits - costs. (*Negative values are presented in parenthesis) What I have so far is attached I need to make it so Pay back occurs in year 3 where there is positive cumulative benefits - costs.arrow_forwardPlease answer ASAP if you can please. Thank you! Please Please write expression or formula used Set up expression initially with functional notation (e.g.,(P/F,I,n))arrow_forwardCan you please solve questions 5-15 of the problem above. Thank you.arrow_forward

- Please answer ASAP if you can please. Thank you! Please Please write expression or formula used Set up expression initially with functional notation (e.g.,(P/F,I,n))arrow_forwardSHOW COMPLETE SOLUTIONS AND MAKE IT EASY TO READ FOR UPVOTEarrow_forwardHow do you Estimate and report the Fama-French 5-factor estimated equation in the program called e-views?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education